“Inflation is taxation without representation”

- Milton Friedman

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” - Ronald Reagan

By Eric Sussman

August 13, 2021

As a long-standing Executive Member of Costco, I have always marveled at two things. One, how have they been able to sell a mammoth-sized hot dog and bottomless soda for $1.50 year after year after year after year? And two, how can they only charge $4.99 for an entire ready-to-eat roasted chicken while the uncooked parts, mere steps away, cost far more? Even today, in the face of higher prices everywhere one looks – food, gas, housing, used cars – I find great comfort knowing that the prices of Costco hot dogs and roast chicken remain stubbornly predictable, while I wax nostalgic about the good ol’ days when a two-pack of Reese’s Peanut Butter Cup cost a mere quarter.

Which brings me to the question de jour and what so many want to know, not whether Costco will eventually give into economic reality, its shrinking or even negative margins on hot dogs and roast chicken, and raise the prices for both, but what impact persistently higher inflation might have on real estate values. In fact, the most common question I am asked these days, other than if we are in a real estate “bubble,” is whether higher inflation might be the pin that pops it.

So, what impact might persistently higher inflation have on real estate prices? Well, as terribly unsatisfying an answer as it might be…it depends. Is the real estate improved or not? Leased? For how long? If leased for some period of time, are the rents periodically adjusted? How? Are rental adjustments tied to inflation? Finally, what is driving the higher inflation? Economic expansion and greater than anticipated growth in GDP? Are increases in wages contributing to the inflation?

Those most concerned that higher inflation will translate to lower real estate prices are principally focused on interest rates. The thought process is simple. Higher inflation means higher mortgage rates, meaning reduced purchasing power, higher cap rates in the case of commercial properties, and lower real estate prices. From another perspective, higher inflation means higher construction costs, higher prices, reduced demand, and lower real estate values.

However, such perspectives are overly simplistic and woefully incomplete.

One, to the extent that rents and rental adjustments are tied explicitly to changes in local or regional consumer prices (i.e., CPI-U), common in commercial leases, property values can be hedged against inflation.

Two, to the extent that lease terms are short and routinely renegotiated with either new or existing tenants at prevailing market prices (think hotel rates and apartment rents), increases in inflation should not translate to declines in property values. Moreover, if employee wages are also rising along with inflation, apartment renters and/or prospective homeowners will be able to afford the higher rents or mortgage payments that inflation might bring.

On the other hand, commercial properties subject to long-term leases with no or minimal rent adjustments – think single-tenant properties leased to the likes of Walgreens, Kroger, and Walmart – will be most negatively impacted by higher inflation, as there is no rental hedge to offset the expansion in cap rates that will accompany higher inflation and interest rates. Finally, changes in the value of unimproved land or the portion of improved property attributed to the underlying dirt should be highly correlated with changes in inflation.

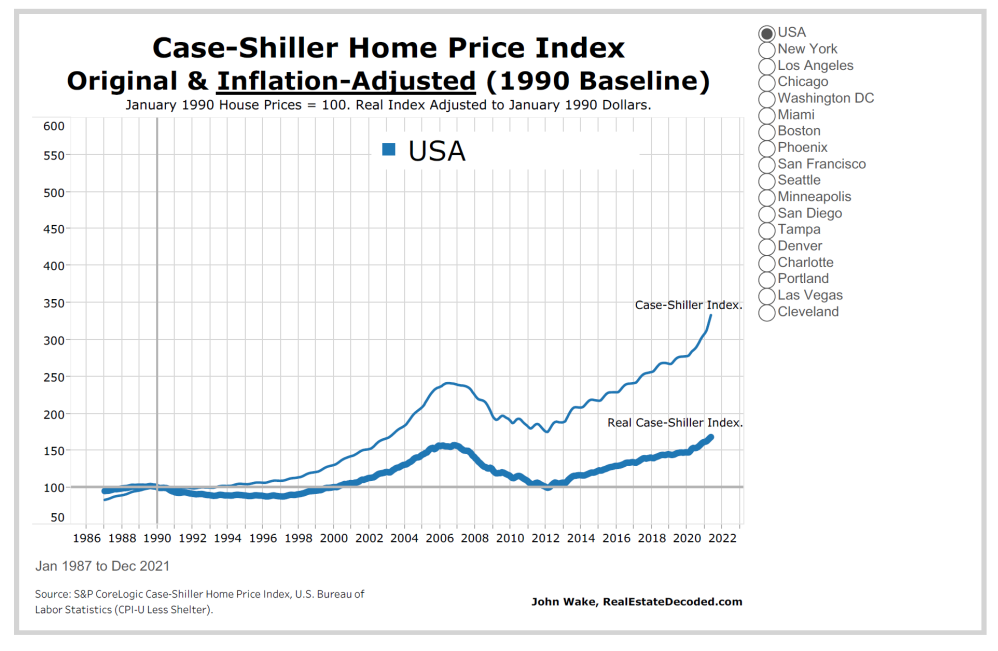

Although the data across property types and time is sparse, real housing prices, the values of homes net of inflation – as measured by the inflation-adjusted Case-Shiller Index – have mostly been positive, at least since 1990.

Therefore, while recent inflation figures have been eye-catching, most real estate investors should fear not. Commercial properties with rental adjustments tied to local or regional price changes, hotels, vacation rentals, multifamily projects, and single-family homes will more than likely keep up with the inflationary Joneses.