“Look to the future, because that is where you will spend the rest of your life”

- George Burns

“I never think of the future. It comes soon enough.”

- Albert Einstein

These two quotes, seemingly complete contradictions both in terms of content and authorship, are remarkably apropos of this latest quarter and the very conflicting (if not schizophrenic) data it provided.

The ink was barely dry on our last quarterly update when a front-page article in the Wall Street Journal ominously proclaimed, “Slump in Housing Market Deepens,” focused upon the 6.4% drop in December (year-over-year) home sales and what such a sharp decline might signify when viewed in light of the government shutdown, recent increases in interest rates, and significant volatility in equity markets that characterized the end of 2018. At that point, it was not a question of whether a recession was coming, but whether it would happen in the last half of 2018 or sometime in early 2019.

And then, like an economic slingshot, the housing and equity markets bounced right back, sharply, such that all of the major stock market indices are presently within a stone’s throw of their all-time highs. Following a very tepid February employment report (33,000 jobs added), March saw 196,000 new jobs created, well exceeding analyst expectations, with the unemployment rate holding steady at 3.8%. Homebuilder stocks experienced their best quarter in seven years, rising 17%, after declining 29% in 2018, including 15% in Q4 alone. Mortgage rates dropped sharply, boosting demand for single-family acquisitions and refinancing activity.

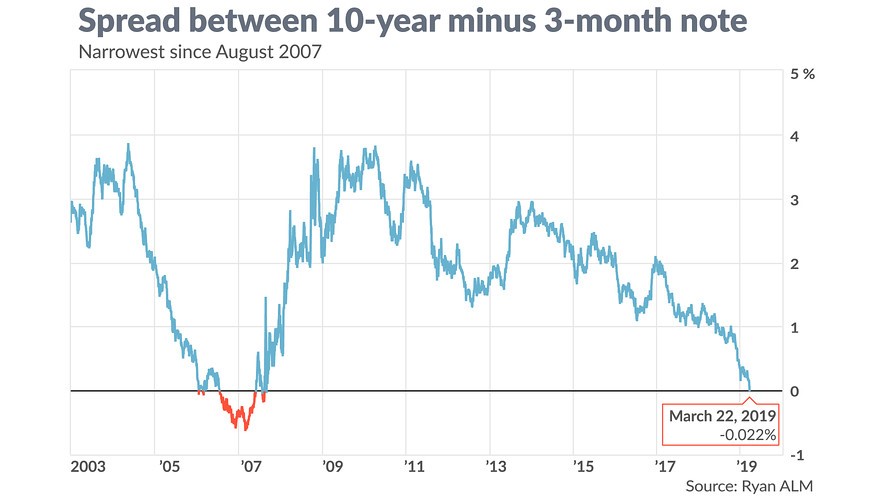

Perhaps one particular day, March 22nd, captures the essence of the first entire quarter. On that day, Robert Mueller finally delivered his long-awaited report, the S&P 500 declined 2.5%, longer-term bond yields tanked (with rates on ten-year Treasuries dropping below those on 90-day Treasury Bills for the first time since 2007), and the National Association of Realtors announced that sales of existing U.S. homes increased nearly 12 percent in February (from January), the largest monthly gain since 2015.

Very fittingly and reflective of the quarter’s confounding data, several noted economists concluded, again on that same day, that the inversion of the yield curve likely foretold of recession in the fairly near term. After all, the last time the yield curve inverted was before the global financial crisis. At nearly the same time, former Fed Chair, Janet Yellen stated that the inversion did not indicate that a recession was imminent. If the supposed experts and those whose careers depend on analyzing and interpreting economic data and making forecasts cannot draw conclusions while looking at the same data, where does that leave the rest of us? Why can’t economists be like dentists, who almost universally (nine out of 10!) recommend Trident for their patients who chew gum?

In any event, though there are no signs that a recession is imminent, the global economy is slowing, and it is becoming increasingly likely that the remainder of 2019 will be characterized by modest, but uninspiring growth, both here and abroad. Perhaps the recent earnings announcements from FedEx are especially probative, given the nature of the firm’s operations. The company recently reduced 2019 earnings expectations for the second time in as many quarters, citing a significant slowdown in the EU, the impact of tariffs and trade disputes, the waning stimulus from 2017’s corporate tax cuts, and overall slowing international growth. Meantime, yields on ten-year U.S. Treasuries have dropped sharply, ending the first quarter at 2.41%, versus 2.69% at the end of 2018 and 2.59% today, while yields on German and Japanese bonds remain negative, at least for two- and five-year maturities. All of this data clearly point to slowing economic growth.

The key takeaway is that investors need to act cautiously in such an environment, and not be tempted to assume greater risk in the chase for higher yields and returns. And this certainly includes investors in commercial real estate. I have been telling investors for years that they ought to recalibrate return expectations, certainly as to what they should anticipate from investments in most multifamily assets, like those evaluated and acquired by Clear Capital. Historically, I have told investors that they ought to expect mid-teen IRRs from investments in multifamily assets, over three- to five-year investment horizons.

Not any longer. I don’t think such lofty expectations can be reconciled with so much equity and debt capital available and on the sidelines awaiting investment opportunities, low Treasury yields, and similarly low cap rates. I now believe investors ought to expect IRRs of ten to twelve percent on investments in multifamily assets, achieved over longer investment horizons, say five to seven years. That is not to say that the occasional higher-yielding opportunity is not out there and won’t cross our desks, but I anticipate those will be exceptions as opposed to norms. To be clear, we remain very bullish on the multifamily market, as all of the long-term, structural trends underpinning demand for rental housing remain firmly intact. It is simply a matter of tempering expectations to reflect economic and financial realities.

In such an environment, it is critical to remain disciplined and maintain underwriting standards and investment objectives, and we will certainly do so.

Despite all the economic uncertainty, investors in residential or commercial real estate anticipating broad or sharp declines in asset values and related buying opportunities will most likely end up disappointed

While housing prices in 2018 grew at their slowest pace in four years, they still rose 4.7% during the year, well above inflation. In February, U.S. housing starts declined 8.7% from January to a seasonally adjusted 1.16 million units, the largest decline since last June, as construction of single-family homes dropped to a more than 18-month low. For some broader historical perspective, monthly U.S. housing starts averaged some 1.43 million units between 1959 and 2018. Meanwhile, in Fannie Mae’s December homebuyer sentiment survey, only 52% of respondents nationwide said that they believed it was a “good time to buy,” a low for a survey that started in 2010. Fourteen percent of respondents believed home prices would drop in 2019, the highest figure since 2012. From my perspective, declining construction coupled with relatively pessimistic consumer or investor sentiment, are contrarian indicators. Combined with low interest rates, strong employment data, equity indices near all-time highs, and a number of initial public offerings coming to the markets providing additional liquidity to several key markets, I cannot foresee meaningful drops in home prices.

In fact, I just read that from the proceeds of Lyft’s recent initial public offering, the company’s current and former employees could purchase all of the homes presently listed for sale in San Francisco, and still have funds left over. While perhaps not exactly the most probative or predictive data, the point is clear. Liquidity, coupled with low interest rates, provide substantial buffers, if not catalysts, to residential real estate markets. However, for every bullish data point, there are plenty of bearish ones…or maybe it is fallacious to talk about the residential housing market as a single, unified market, but the tale of several markets, defined by geography, segment (e.g., high-end versus entry-level), and whether we are talking about single-family homes for purchase, or multifamily residences for rent.

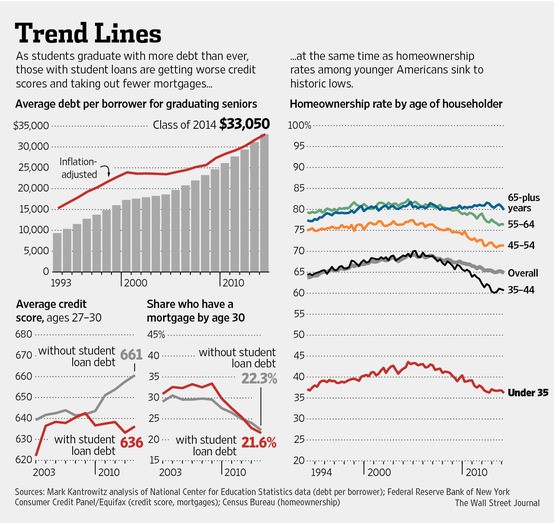

High-end luxury rentals in the urban cores continue to be popular, especially amongst those in their twenties and thirties. For example, high-income renters (those with incomes in excess of $100K per year) in markets like Austin and Dallas have increased exponentially, some 142% and 91%, respectively, during just the past five years. Dallas now ranks third nationally in per-capita spending on multifamily housing, just behind Denver and Seattle. The graph below says it all. Despite so many tailwinds (e.g., strong job market, equity markets, and low mortgage rates), homeownership rates for those under 35 remains below levels seen in 1994.

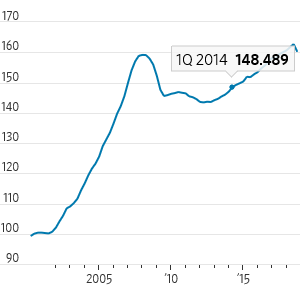

Affordability remains the principal challenge facing the single-family residential housing markets, and the problem is not merely a domestic one. You may have seen articles in the WS Journal or LA Times, which focused on markets like Berlin, which are facing significant housing crises and shortages of their own. In some 32 cities around the world, real home prices have surged 24% (on average) over just the last five years (see graph below), while household incomes have not nearly kept pace. In Berlin, at least one proposal calls for the nationalizing of all housing privatized following the fall of the Berlin Wall. While these radical proposals are likely to fail, the broader point is clear. Housing affordability is the single greatest challenge to the residential markets, both here and abroad, and the implications for prospective owners/renters, investors and policy makers are profound.

Global Real House Price Index

Closer to home, the private sector, perhaps recognizing that the government can only do so much to alleviate the affordability crisis, is stepping in. The “Chan-Zuckerberg Initiative,” a partnership between Facebook Chief Executive, Mark Zuckerberg, and several corporate foundations (e.g., Genentech, Ford, Hewlett-Packard), plans to raise $450 million to preserve or develop 8,000 affordable housing units in the Bay Area is one such example. It has already raised $280 million towards its fundraising goal. However, money is only part of the problem, and unless these well-intentioned partners can develop solutions to deal with land scarcity, political gridlock, transportation challenges, and other practical challenges and impediments, they will not make much of a dent in the affordability problem. To highlight just how serious an issue this is, Stanford University is suing Santa Clara County over a new law which would require the University to provide affordable housing as part of its long(er)-term expansion plans. Through these laws and regulations, or “economic sticks” as I like to call them, the public sector is acknowledging that it alone lacks the resources to tackle thorny housing issues, and is trying to compel the private sector to fill the void, even at the risk of inviting legal challenges to their efforts.

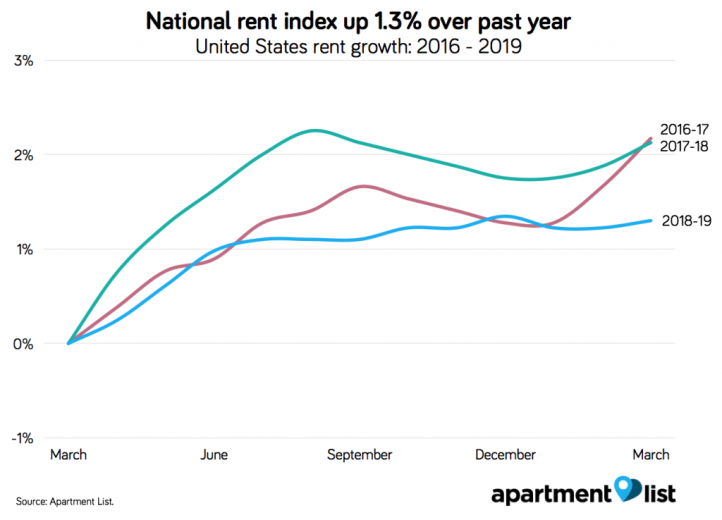

However, multifamily rental growth is slowing, providing modest relief to renters struggling with housing affordability

During the first quarter of 2019, national apartment rents increased by a modest 1.3%, as compared to the first quarter of last year. While these results are essentially consistent with overall inflation rates, multifamily rental growth has certainly slowed as compared to the last two years (see graph below) due principally to increases in supply and low mortgage rates, which have spurred single-family acquisition activity.

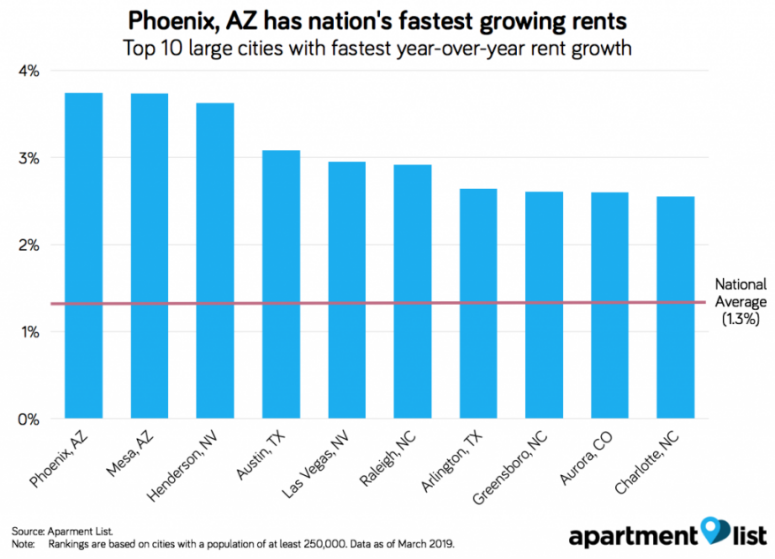

Obviously slowing rental growth is welcome news to financially strapped renters, especially in the supply-constrained, primary markets. It is also worth noting that relative growth in employee wages, as discussed in more detail below, is finally outpacing rental growth rates. We view this as positive news overall. Meantime, we have to be careful not to generalize because there is no single real estate “market,” of course, and geography matters. Rents continue to grow more quickly in secondary and tertiary markets, which is not altogether surprising. Markets in Arizona, Nevada, and Texas continue to see the strongest rental growth.

Meanwhile, overall the multifamily vacancy rate remained flat at approximately 4.8%, reflecting the overall strong fundamentals in the market.

Global interest rates and the U.S. yield curve are painting a fairly sobering outlook for domestic and global growth, and low rates are likely to persist for the foreseeable future, as we have previously predicted

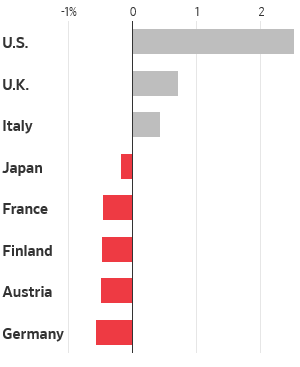

If pictures tell a thousand words, I think the three graphs that follow are very informative. The first depicts global two-year government bond yields at the end of the first quarter:

Source: Bloomberg

While the absolute levels of negative yields remain below what we witnessed in 2017, the trend has spread to countries like Austria, Finland, and France. The message is clear. Growth expectations both in the U.S. and elsewhere are low and the inflation outlook, tepid. Here in the U.S. the yield on 10-year Treasuries fell sharply during the quarter as described above, and I don’t see anything that would compel significantly higher yields over the next year or two. Perhaps my only concerns are twofold, one increasing budget deficits requiring increased borrowings and the narrowing, if not negative, spreads between short- and longer-term rates:

Perhaps the best thing about the U.S. economy remains the job market

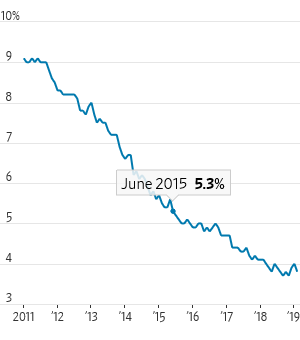

Not only did March employment figures paint a distinctly rosy picture with those 196,000 jobs added, but the net positive figure represents the 102nd straight month of increased employment levels, another record. Meanwhile, wages increased 3.2%, the seventh straight month in which wages have grown by at least 3.0%, the most robust growth rate since the financial crisis.

These results may not seem impressive, but they must be viewed in a longer-term context, in which real wages had essentially been flat over the prior two decades. And, as we have stated repeatedly, we are rooting for strong employment, coupled with modest but not excessive real wage growth, since multifamily rents and asset values should benefit from such a trend.

U.S. Unemployment Rate

The quarter continued to witness increased local and state government regulation in housing markets, continuing a trend that will continue into the foreseeable future

Gavin Newsom, California’s new Governor barely had time to loosen his inauguration tie before the State filed suit against the City of Huntington Beach for failing to meet regional housing needs and comply with a State law that requires cities to provide housing commensurate with job and population growth. Meantime, in New York, a State Senator, Julia Salazar, proposed a bill that prevents “wrongful” evictions, which would include circumstances when rents have been raised by an “unconscionable” amount, defined as 150% of the regional Consumer Price Index. In early March, Oregon became the first state to pass statewide rent control, setting a cap on annual rent increases equal to the inflation rate plus seven percent. On its face, such a cap seems more than reasonable, but I suspect that this is the first volley in a longer-term battle, where this seven percent spread will be reduced over time. Other cities in Southern California (e.g., Inglewood, Beverly Hills) have or are poised to pass “emergency rent control measures.” I am not sure what the sudden “emergency” is, but that is how they have been described. Meantime, I mentioned the Stanford-Santa Clara County litigation and efforts to nationalize certain housing in Berlin.

These are not fads, blips, or cyclical trends or phenomena, so all investors in multifamily housing should be prepared for more of the same and strategize accordingly.

Finally, there are a number of additional financial, demographic, and market data points we are keeping an eye on, to assess how they might impact the economy, housing, and the markets in which we invest or might seek to invest

Retail store closures: The closure of brick-and-mortar retail locations goes on, continuing a brutal trend, with Amazon, Tesla and Bed, Bath, & Beyond joining an auspicious list, which includes The Gap, Amazon (their pop-up stores), and Payless Shoes, all of whom are shuttering locations. In fact, Payless, Gymboree, Charlotte Russe, and Shopko have all filed for bankruptcy in 2019, and will close a combined 3,720 stores. Even Family Dollar, Walgreens, and GNC are struggling and have announced plans to shrink their store footprints to better compete and strengthen their balance sheets.

Through early March, over 4,800 store closures had been announced or completed. As dreadful as this figure might be, the silver lining is that the number of store closures is actually declining, as some 5,524 and 8,139 retail locations were closed in 2018 and 2017, respectively. Of course, saying these results is an improvement over recent history is like saying that the Los Angeles Lakers and the New York Knicks had better seasons this year than last. Sure, they may have won more games, but they both still stunk. In any event, this trend is also not likely to abate significantly in coming quarters. In fact, I have a feeling that before 2019 is through, the total number of physical retail stores that will have closed will actually exceed results in 2018, but we shall see.

It remains unclear how the changing retail landscape will impact the residential housing market overall. Certainly, I see a significant amount of vacant ground-floor retail in New York and in many other mixed-use apartment projects, and I don’t see that changing anytime soon.

Impact of the 2017 Tax Bill: I realize this might be a sore subject, given we all either just filed our returns or extensions thereto (at least I hope so!), and many of us will likely feel the impact of the reduced deductibility of state and local property taxes and mortgage interest, which will impact over 1o million taxpayers, many in California, New York, and New Jersey. In fact, New York just announced a $2.3 billion shortfall, and Governor Andrew Cuomo blamed the tax law changes, as New Yorkers fled in ever increasing numbers to Florida, parts of which are already wholly-owned New York subsidiaries. One real estate agent quipped that New Yorkers are Florida’s new foreign buyers. In 2018, Manhattan co-op and condo sales were down 12% from 2017 to their lowest levels since 2009, while the median price for condos in Miami-Dade County were increased modestly (some two percent), which may not sound like much, but in the face of declining foreign buyers (the real ones) and increasing supply, the price increase is noteworthy.

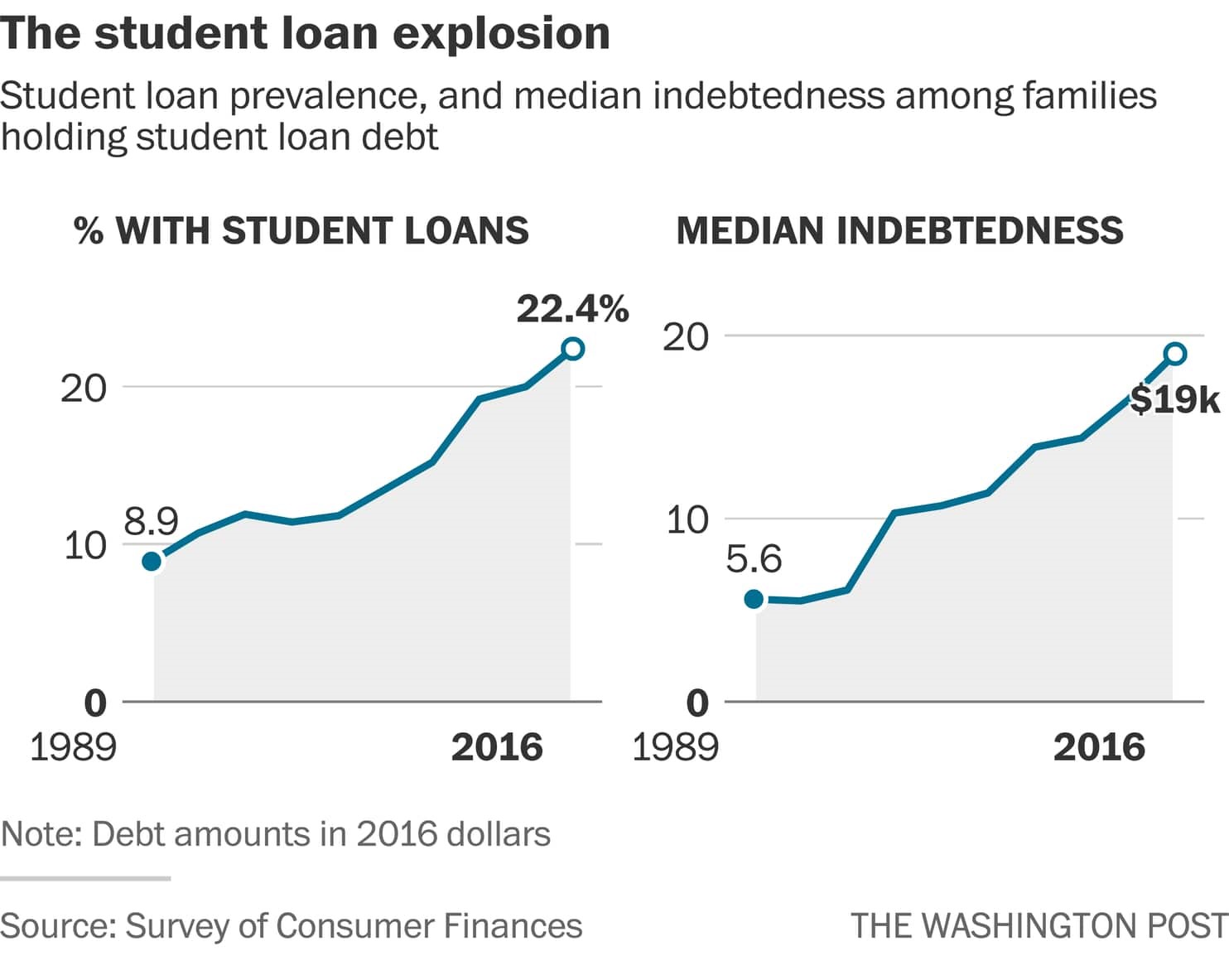

Rising Student Debt: One of the significant factors playing a significant role in housing, and something we have discussed previously, is the impact of student debt levels. According to a new report issued by the Federal Reserve, student debt prevented 400,000 young Americans (those in their 20’s to 30’s) from purchasing homes. The graph below provides some color on the ballooning student debt levels:

Again, it is hard to fathom what relief might come to these overextended individuals, and the impact on their ability to acquire single-family homes will remain pervasive and long-lasting.

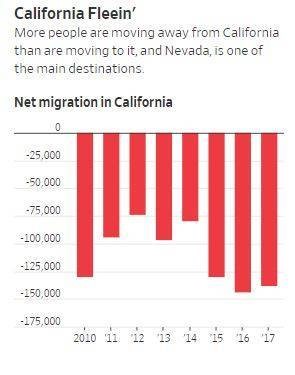

Net Migration from Blue States to Red: As we have also discussed in previous memos, more people have been leaving California, net, for at least the last five years, and in recent years, the trend has been growing, with Arizona, Nevada, and Texas principally benefitting from California’s population outflows.

In fact, more Californians move to Dallas-Fort Worth each year than residents of any other state, according to a new analysis of domestic migration. On average, some 8,300 Californians packed their bags and relocated to Dallas-Fort Worth each year between 2012 and 2016. Texas Governor, Greg Abbott, who successfully won reelection last November, actually incorporated the message “Don’t California my Texas,” as part of his campaign strategy. You can even sign up for Governor Abbot’s petition here, if you wish, although he already won: https://www.gregabbott.com/petition-poll/dont-california-texas/

A simple comparison between the cost of living in California and Texas highlights the issue. According to a report I just read, the overall cost of living in Austin, for example, is 45.6% lower than San Francisco, with the differential in housing costs being the principal differentiator between the two. Home prices and rental rates are 74% and 67% lower in Austin, respectively, simply staggering figures. In my opinion, this migration is also not a secular or cyclical trend, but something far more permanent and structural.

In closing, 2019 will be a fascinating and perhaps a transitional year, economically and politically, with potentially significant impacts on residential real estate markets

It is no secret that the last 20 years have been very good for investors in multifamily residential real estate, impacted by so many significant economic, financial, and demographic shifts. Broadly speaking, those trends will certainly persist as we look out over the next decade. However, after nearly ten years of economic growth, we are cognizant of cycles and the practical reality that a recession is perhaps overdue, and numerous signals are flashing some warning signals, with perhaps the inverted yield curve, sharp declines in global interest rates, and slowing domestic and global growth being the most concerning.

However, it certainly appears that no recession is imminent or even likely in 2019, though what we experienced in December, where equity markets fell sharply, volatility spiked, and real estate transaction volumes declined, should remind us all that things can change rapidly. And as the 2020 election cycle heats up and our nation’s capital, knee-deep in political rancor, continues to be in a state of legislative paralysis, we will be especially thoughtful and conservative in our underwriting and pursuit of investment opportunities. In fact we recently added Enrique Huerta to our underwriting team, and he has already hit the ground running, analyzing potential opportunities not only in the markets in which we already invest, but in other markets, like Arizona. which might provide compelling opportunities.

Thank you, as always, for your trust and confidence, and we look forward to communicating our thoughts and endeavors in the coming quarters. Meantime, please contact a member of the Clear Capital team should you have any comments, questions, or feedback regarding your investments, our strategy, or anything else you might need.

Best,

Eric Sussman

Managing Partner