If you’re going through hell, keep going. —Winston Churchill

You may encounter many defeats, but you must not be defeated. In fact, it may be necessary to encounter the defeats, so you can know who you are, what you can rise from, how you can still come out of it. —Maya Angelou

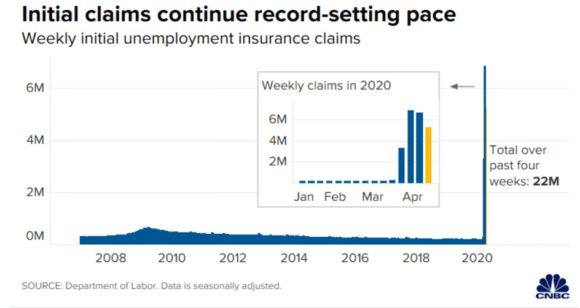

Before you read beyond the first sentence of this newsletter, I might advise you to take three deep breaths. Maybe four. It has never been my nature to sugarcoat reality or mince words (just ask my students), and I am not about to change long-formed habits. There is simply no way to paint a rosy picture from the more than 39,000 Americans that have died thus far from Coronavirus, adding to the over 162,000 deaths globally, not to speak of the more than 2.3 million people worldwide who have been infected by this scourge. Or the 22 million Americans that have filed unemployment claims in just the last three weeks, including 5.2 million claims just this past week, increasing our unemployment rate to somewhere in the high teens, I gather. Or the significant financial losses and head-spinning volatility that investors in just about everything have experienced in what seems like the blink of an eye. Or the routine virtual meet-ups and happy hours posing as modest substitutes for the real deals. It has all been surreal and painful.

But if you have come to read a memo that echoes the view of many that the world is coming to an end, as perhaps the media and others might have you believe, read no further. Because while this missive won’t sugarcoat, underestimate, or ignore the heart- and mind-wrenching realities of what we have experienced and are living, and the significant impact this will have over the near- to medium-term, I know that this shall pass, and be but a painful memory in time, fully recognizing that not all pain is created equal. As I mentioned in my recent podcast, the 20th and 21st Centuries (to date) have witnessed two World Wars, the (misnomered) Spanish Flu, the Great Depression, the Cold War, Vietnam, Korea, 9/11, the dot-com implosion, the Savings & Loan crisis, the Great Recession, and more natural disasters than be counted. Oh, and I should not neglect to mention the ‘62 Mets, Heaven’s Gate (Google it), Joe Exotic (Google that as well, if needed), and my Bar Mitzvah.

Yet I imagine that none of you gave any of these things much thought (especially my Bar Mitzvah) when you made investment decisions over the last decade of bull market and general economic, if uneven, prosperity. We are wired to move forward and, yes, forget. Thus, the markets and economy will rebound, the job market will improve, and traffic will eventually return to the 405 Freeway. However, I fully recognize that even if a vaccine were to miraculously appear tomorrow, it will take some time to get the economy back to any semblance of normalcy, and behaviors from greeting customs, to social gatherings, to the acceptance of wearing a mask even as you enter a bank with nothing but good intentions, will be different, at least for a while.

However, the combination of time, unprecedented federal stimulus, record-levels of cash on the sidelines, and human ingenuity will ultimately ensure an economic recovery. For one single objective anecdote, I read that the Vanguard Group just closed its Treasury Money Market Fund to new investors, as a record $7.3 billion flowed into the Fund during the last month (a 20% increase in assets), as investors sold risky assets and sought refuge from volatile and uncertain markets. Meanwhile, government money market funds collectively added over $900 billion in assets in just the past six weeks. All of these risk-averse actions will eventually unwind and these assets will find their way back to riskier assets and markets in time.

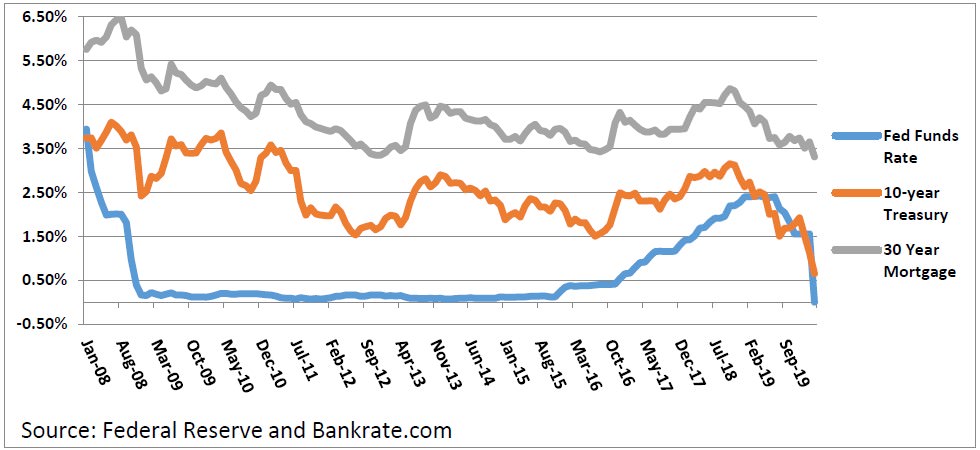

In addition, between unprecedented action and intervention by the Federal Reserve and recent, if clumsily rolled out, Congressional aid packages, some $6 trillion of federal stimulus has already been provided, and even more is likely on the way. Candidly, my biggest concern at this point is not whether the markets will recover, but that all this stimulus and quantitative easing will eventually result in future inflation and asset bubbles. While there is absolutely zero inflation risk in the near-term, between the demand shock we have experienced and the impetus to save rather than spend, the long-run is an entirely different ballgame.

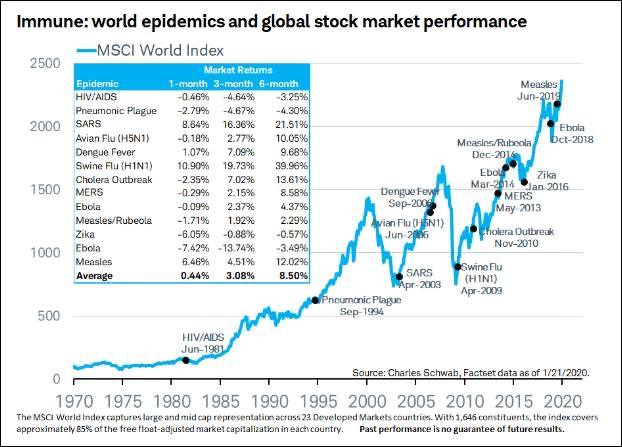

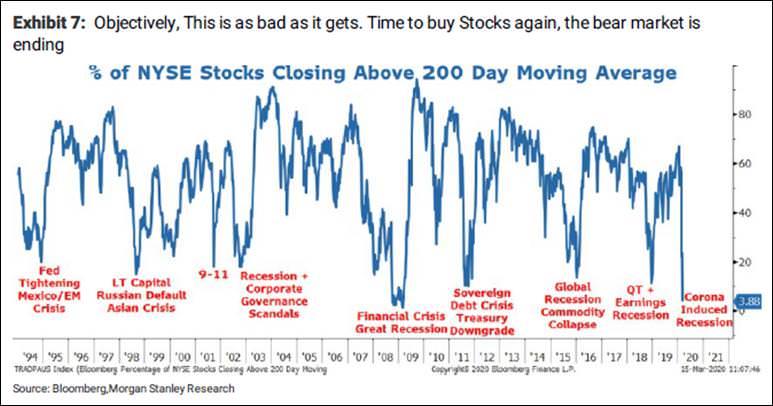

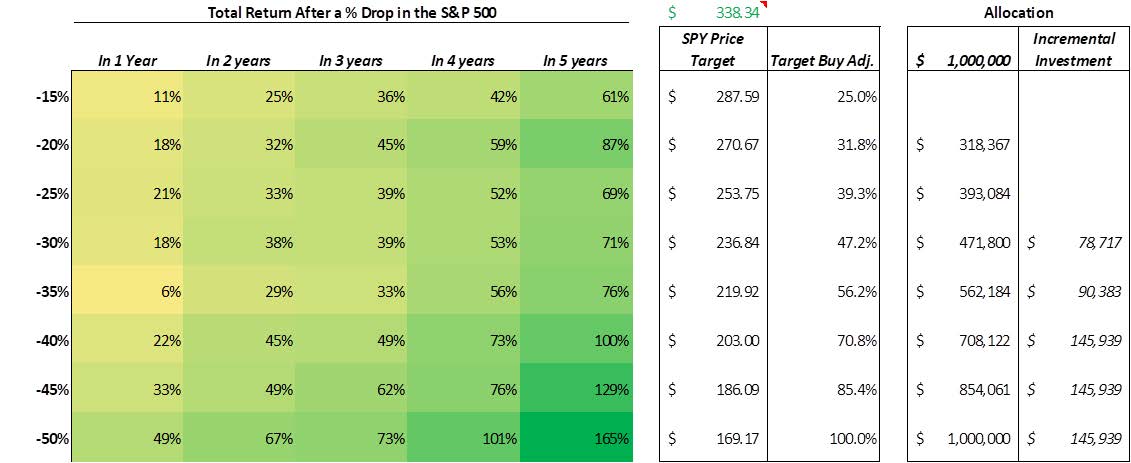

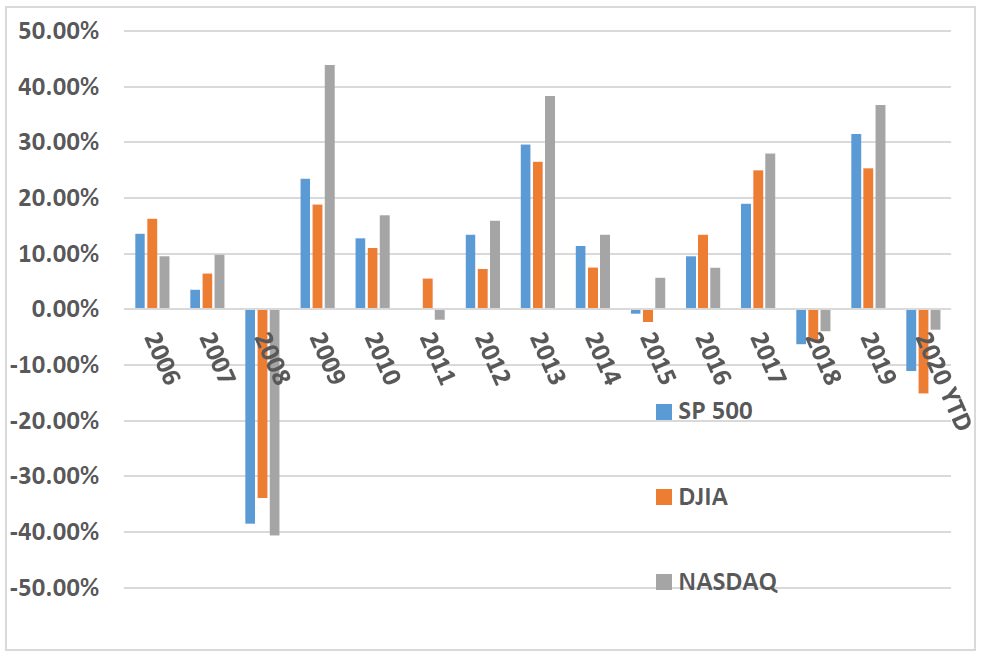

As you know, I am a huge fan of graphs and data, and I think these three tell a compelling story, consistent with the perspective set forth above, that markets will recover, and that now is probably a good time to actually invest spare cash, if you are able and are investing for the medium- to longer-term:

Finally, before I lay out what Clear Capital has been up to in these unprecedented times, and get too deep into the economic weeds, the markets, and our outlook, let me first express my best wishes to each of you and those in your close circles. I am not really sure how many people read these quarterly memos, or even how many get past the first page once they start, but I am sure that more than a few of you have been very directly and significantly impacted by this epidemic, and I, on behalf of everyone at Clear Capital, want to pass along our very best wishes.

I also wanted to acknowledge and thank the entire Clear Capital team, which has been working tirelessly with our residents, partners, vendors, and on-site management teams in every area of operations – communication, safety and security, leasing, revenue, expense and cash management, staffing, and resident/tenant support – as we seek to preserve capital, position our portfolio for future growth, and seek investment opportunities in dislocated markets, just as you would hope and expect from us.

So, how has Clear Capital responded to the Coronavirus pandemic?

Over the years, I have often told my students that crises, in whatever form they arrive, separate wheat from chaff. That is, in a bull market, the rising tide generally lifts all boats, new competition emerges, and returns compress. However, in times of crisis and bear markets, skills, abilities, and resources – human and financial – are severely tested, and the more capable players not only survive, but position themselves to ultimately thrive in post-crisis environments.

I recognize that all of our inboxes have been inundated with emails from everyone we have ever done business with, as firms lay out how they have responded to this crisis. I have thus far resisted the temptation to circulate such an email, under the assumption that it would soon be relegated to your email’s “deleted items” folder, lost in a sea of similar emails. But I would be remiss if I did not let you know what Clear Capital has been up to and what actions we have been taking, so let me quickly summarize how we have responded to the crisis, so that we indeed not just survive it, but are optimally positioned once it ends.

Oversight and Communication

• Implemented daily reporting protocols for each property (e.g., cash collections, leasing activity, notices)

• Initiated daily leadership teleconferences to share information and coordinate action across our portfolio of assets

• Instituted weekly property-level forecasts, in order to prepare for different economic scenarios

Safety and Security of Residents and Staff

• Modified standard operating procedures to conform with CDC guidelines

• Discontinued routine maintenance in occupied apartments

• Closed common areas (e.g., pools, gyms)

• Discontinued resident functions

• Closed leasing and management offices to foot traffic

• Encouraged team members to work remotely when and if possible

• Require staff to wear protective equipment when appropriate

• Practice social distancing

Leasing

• Pivoted to virtual leasing, by creating video tours of vacant apartments to share with prospective residents, and use of FaceTime and/or other similar software applications

• Contacted all residents scheduled to move out to encourage them to stay and extend their leases

• Reduced rental rates on expiring leases to entice renewal

• Transitioned tenant application process, lease application, and lease renewals online

Expense Reductions

• Discontinued all discretionary capital expenditure projects, including unit upgrades

• Reassigned certain tasks and services from third-party contractors to in-house maintenance personnel (e.g., janitorial, groundskeeping, painting)

• Reduced, halted, and/or discontinued all non-essential regular service contracts

• Withdrew spending authority from property managers. All purchases and expenditures require express approval

• Limited variable expenses to essential materials and services only

Staffing

• Reduced staffing levels through reductions in work hours and furloughs, but have not terminated a single employee

• Refocused staff to essential services only (e.g., leasing, resident support, and asset preservation)

• Supported key personnel by ensuring their full-time status, by sharing their available hours with other portfolio properties

Resident Support

• Assembled a team to research and become familiar with all resources available to residents (e.g., unemployment insurance and other state and local programs, SBA grants, loans and other federal programs, loans and grant programs offered by non-profit and charitable organizations)

• Created reference guides and instructions to assist residents to determine eligibility and process applications for each resource

• Created and implemented COVID-19 claims process, documentation, forms, and tracking protocols

• Proactively reached out to residents to inquire about their well-being and to offer assistance where needed

• Waived late fees and withheld eviction proceedings against delinquent residents affected by COVID-19

• Negotiated repayment agreements with delinquent residents affected by COVID-19

In short, we have been very busy, not necessarily doing things we would like to do, but things that we must do. I am confident that these endeavors will pay dividends both during and subsequent to the crisis, and again, I send my sincere thanks and appreciation to our team.

So, let’s start with an overview of recent events, as sobering as they might be

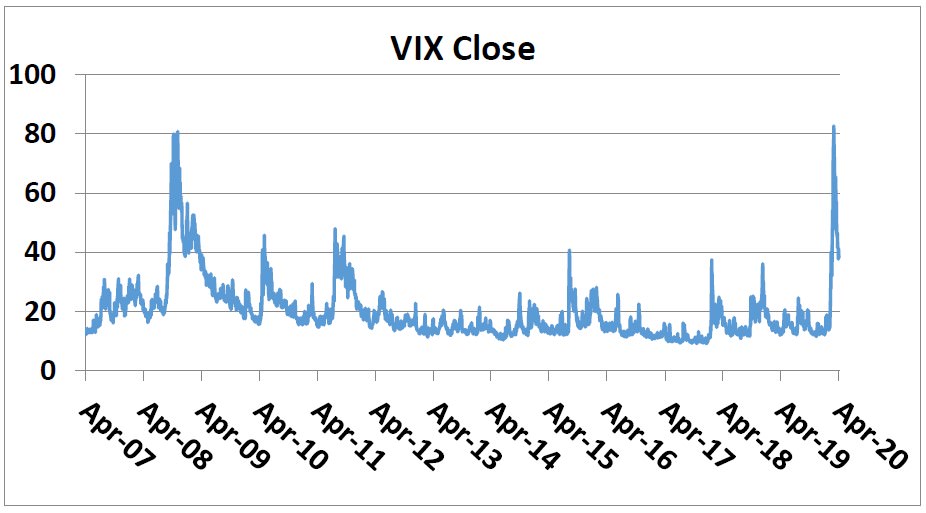

Unless you have been living under a rock and practicing social isolation as a way of life, you don’t need me to tell you that we have witnessed unprecedented economic and market contractions, and spikes in unemployment and market volatility never seen previously. In my last memo, I marveled at just how resilient the markets had been over the past decade, withstanding all the slings and arrows flung at them. But not this time. While the equity markets have recently rallied, substantially cutting year-to-date losses, all market indices are lower, and the spikes and declines in volatility, as measured by the VIX, have been unnerving.

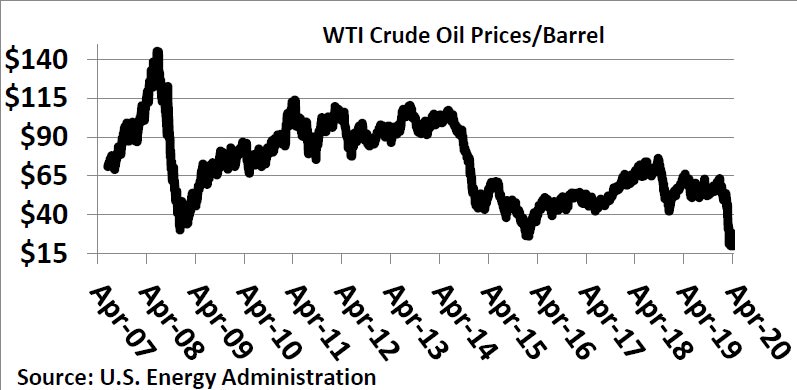

An enemy invisible to the naked eye and a contemporaneous collapse in oil prices (oil prices hit an 18-year low on Friday) have proved a toxic pairing, and the related job losses have simply been stunning. The 9.9% and 12.3% national and California unemployment rates that we witnessed in 2009 seem like distant memories, and will pale in comparison to what the Bureau of Labor and Statistics is likely to report in coming months. 57 economists surveyed by the Wall Street Journal project that 14.4 million jobs shall be lost in coming months, and the unemployment rate will rise to a record 13.5% in June, nearly four times February’s 3.5%. While I am always skeptical of consensus, I don’t think these folks are going out on a limb. After all, this data speaks an immutable truth.

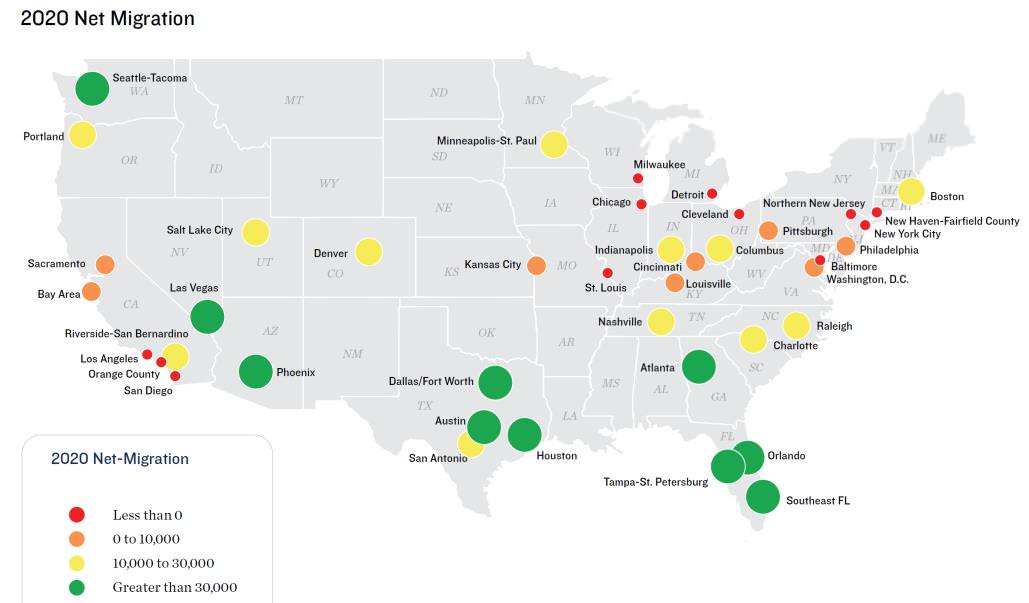

Obviously the travel, hospitality, tourist, and retail trades have been hardest hit, but white-collar job losses will not be far behind. Hopefully, some government intervention (e.g., the Paycheck Protection Program) will mitigate job losses to a degree. Meantime, Las Vegas, the Southwest Florida Coast, Orlando, and Houston, whose economies are dependent on hard-hit industries and lack industry diversification, have been and will be especially impacted.

And while a drop in consumer spending, travel, and overall economic output would provide headwinds for oil prices in any case, a Russian-Saudi Arabia standoff surrounding oil supplies could not have come at a worse time. Keep in mind that the U.S. is now an energy exporter, and the oil and gas industry is especially significant to Texas, the Gulf of Mexico, California, North Dakota, and Oklahoma. Such low energy prices would lead to significant job losses and bankruptcies in even the best of times.

Finally, keep in mind that consumer spending makes up 70% of the U.S. GDP, and the incomparable job losses we have sustained will leave a mark, no matter the largesse of our federal and state governments. I suppose we will have to wait until the government releases March and April data before we can know for sure just how badly the consumer has been impacted.1 It is simply too early to be sure, like predicting the end of a pro basketball game based on the halftime score. However, this reality – the power and impact of the U.S. consumer – is what is providing the greatest pressure from politicians to reopen the economy.

Meanwhile, the federal government has brought out the heavy artillery to combat the economic fallout from COVID-19, and while these have stabilized financial markets in the short-run, the longer-term implications are worrisome

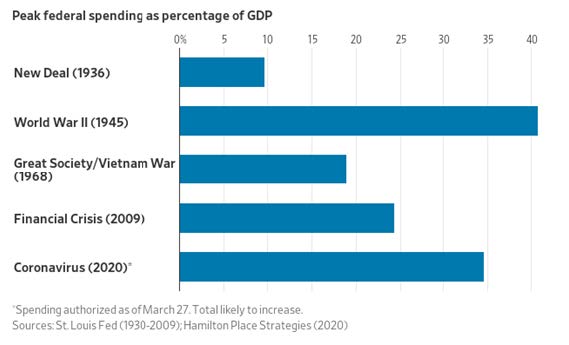

To say that the federal government has brought out the howitzers to offset the unprecedented economic dislocation we have witnessed would be an understatement, from CARES (Coronavirus Aid, Relief, and Economic Security Act), to PPP (Paycheck Protection Program), to $4 trillion of Fed stimulus and quantitative easing, under several different programs. In the short run, our federal government is going to print money like there is no tomorrow, with deflation the bigger near-term concern. But longer-term? What will be the efficacy of these unprecedented moves, and are we making some sort of Faustian deal in the longer-term?

In short, these questions are probably academic, as I don’t believe we have a choice, unless a second Great Depression is on the menu. I felt the same way in 2008 and 2009, while fully recognizing the same Faustian deal we arguably made back then and the moral hazards and unintended consequences bailouts and heavy-handed governmental intervention can bring. The last time our federal spending represented such a significant percentage of our GDP was during World War II.

1) Some argue (see https://www.nationalreview.com/exchequer/70-percent-myth-consumer-economy-kevin-d-williamson/, for example) that the actual percentage is less than 70%, perhaps “only” 40%, depending on how it is measured. It is sort of an academic argument, as it is extremely material in any case.

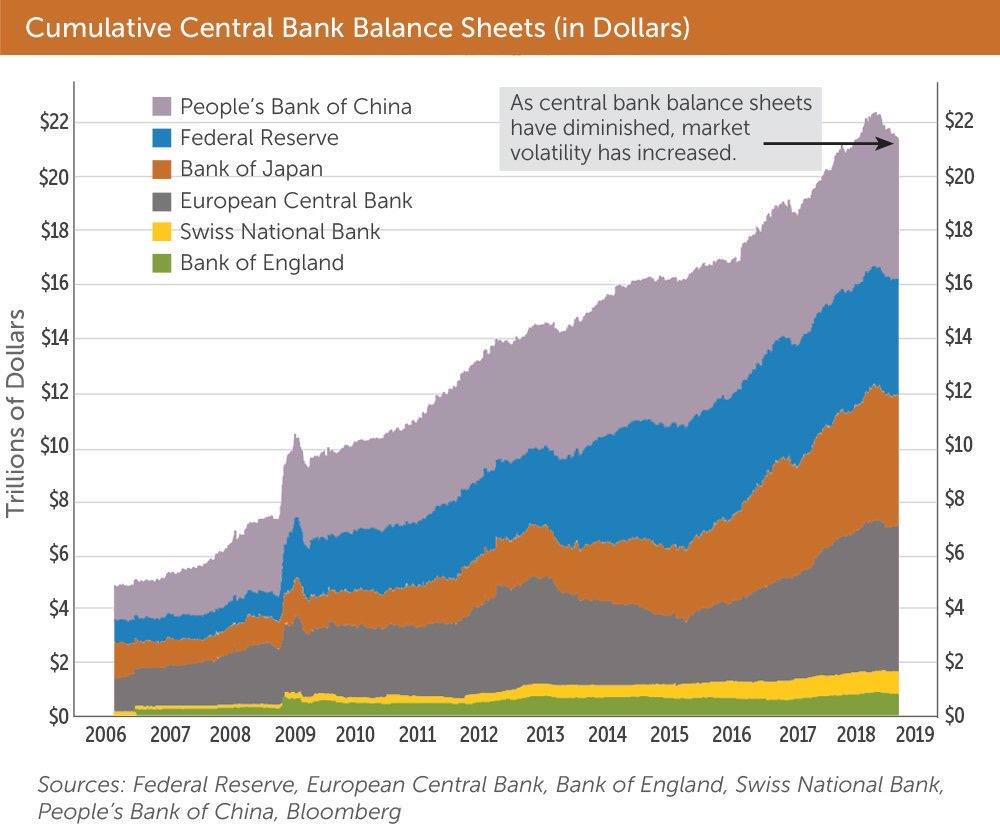

And keep in mind that Central Bank balance sheets were already bloated, sitting at record levels before this crisis hit.

The long-term implications of these extraordinary actions remain to be seen, and reasonable and educated pundits might disagree. Me? I see asset bubbles and inflation in our future, though I cannot say when that will occur. Depending on how quickly improved treatments and/or a vaccine for COVID-19 are created, the asset appreciation and related inflation which I anticipte may happen sooner rather than later.

What about real estate markets, now and looking forward?

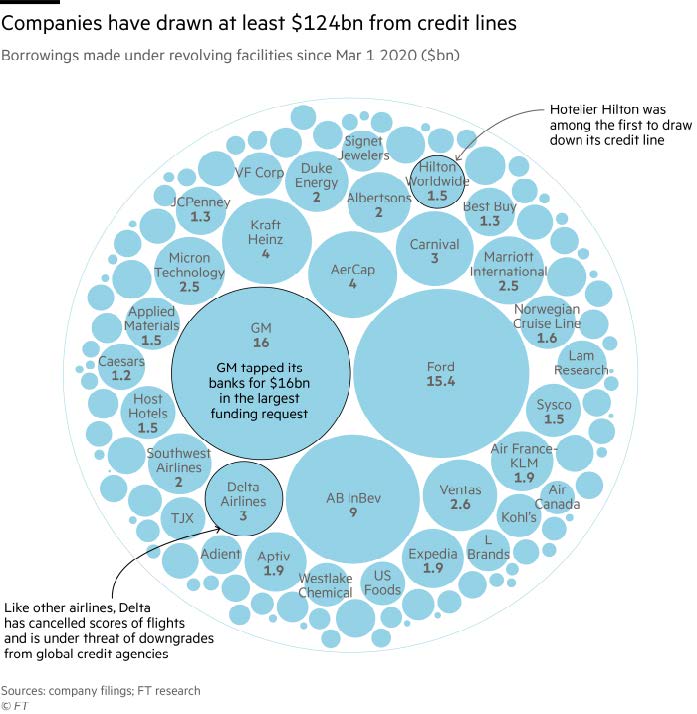

Not surprisingly, the real estate market has also taken it on the chin, with the hospitality, retail, and office sectors being especially hard hit. Many hotel owners and retail landlords, along with many of their tenants, will not survive this downturn. Neiman Marcus and JC Penny missed debt payments this past week, and many others will likely follow suit. The list of retailers not likely to survive this crisis include not just Neiman and Penny’s, but Macy’s. Others like Kohl’s and Nordstrom’s have been drawing down lines of credit, joining a long list of companies taking similar actions. I imagine most retailers, including Kohl’s and Nordstrom’s, have six months of cash on hand, maybe eight to ten. But nobody should feel guilty or alone in their efforts to increase liquidity. Firms seeking increased liquidity are part of a very large fraternity:

Prologis, the largest industrial landlord, indicated that 25% of its tenants have requested some sort of “rent relief,” though I suspect the industrial market will perform better than retail or office looking forward because of the continued growth in e-tailing and the likely future return of on-shore manufacturing of certain essential health care products and equipment that had previously been outsourced to China. I assume the mask, ventilator, and protective equipment markets will be quite robust for the foreseeable future, and domestic supply chains for these products strengthened.

Meanwhile, the National Association of Homebuilders/Wells Fargo Housing Market Index, based on a monthly survey of homebuilders and designed to take the pulse of the single-family housing market, plunged 42 points in April, to 30 (a 42% drop), the largest monthly decline ever. At 42, the Index stands at its lowest level since June of 2012, and represents the first reading below 50 (indicating industry contraction) since June 2014. As though the single-family residential market needed other headwinds, JP Morgan Chase just announced that it is raising its mortgage borrowing standards, requiring potential homebuyers to have FICO credit scores of at least 700 and 20% down payments at the ready. I have to believe that all lenders will be tightening underwriting standards, across every asset type, such that lower interest and mortgage rates won’t be nearly as impactful as one might think (or hope), as a result. That is, lower rates will be more than offset by higher spreads and tighter underwriting.

While multifamily assets are probably the safest place to be, they are not immune from the economic realities of job losses and furloughs, reduced wages for those still employed, and stay-at-home orders. While we have collected about 90% of April rents across our portfolio, not all assets fared equally well, of course. Moreover, we expect May’s results to be worse, simply recognizing the number of unemployment claims filed so far this month. Federal stimulus efforts will help, but can only do so much. Frankly, until the employment picture brightens, multifamily investors will feel the pinch. The drop in single-family home demand and purchases will provide some buffer and a modest tailwind, as will stay-at-home orders, boosting lease renewals.

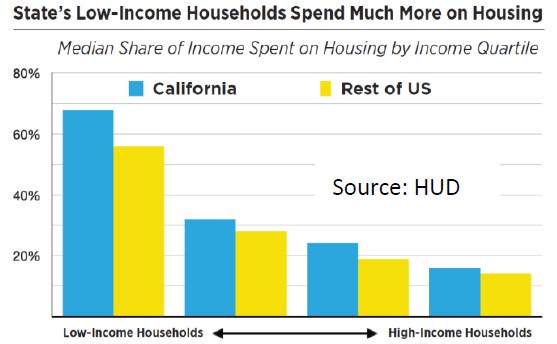

The pressure will be greatest on lower-income households, who not only spend so much more on housing (as a percentage of their total incomes), but have minimal savings or safety nets. And in those communities where housing costs are highest, especially California, the impact will be even more widely felt. As a result, the pressures on California residents to move elsewhere for lower housing costs, will become even greater from Coronavirus, at least in the short- to near-term.

The multifamily market remains the safest and best place to invest, with the trends favoring secondary and tertiary (and don’t forget quaternary) markets well intact.

Over the past several years, I have discussed, at length, the exodus of residents from California to other states, namely Texas, Arizona, Colorado, Oregon, Utah, Washington, and Idaho. It is why Clear Capital has

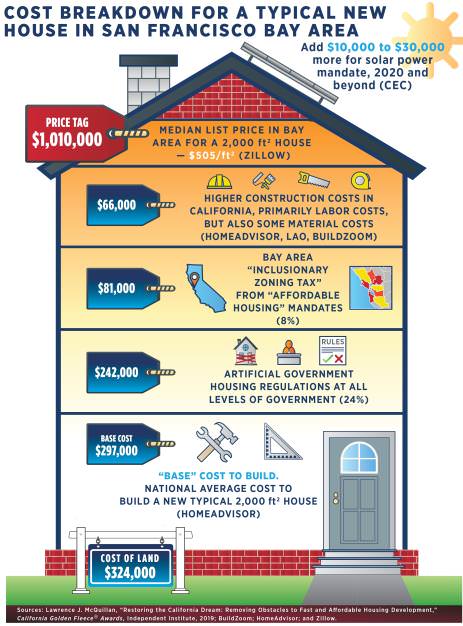

mostly shifted its investment focus to these other markets. After all, the price of an identical home in California costs three times as that same home in Texas. The median house price in California is up 72% since 2009, versus a 6.5% increase in median household income. With routine shortfalls in housing construction, due to everything from excessively burdensome regulations to NIMBYism to a scarcity of land to high costs of doing business to labor shortages to an ever-growing homeless population, California will continue to see residents depart for other states. Recent events will only increase motivations to leave. I found this simple picture to be sadly informative.

Therefore, I anticipate that we will continue to pursue investment opportunities in places where California residents are headed. These two pictures speak quite directly to the exodus of Californians, all pre-COVID-19.

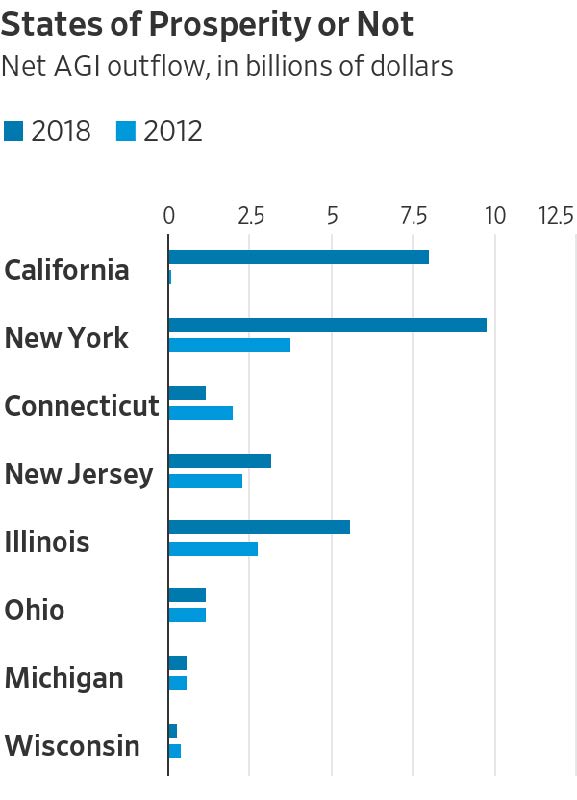

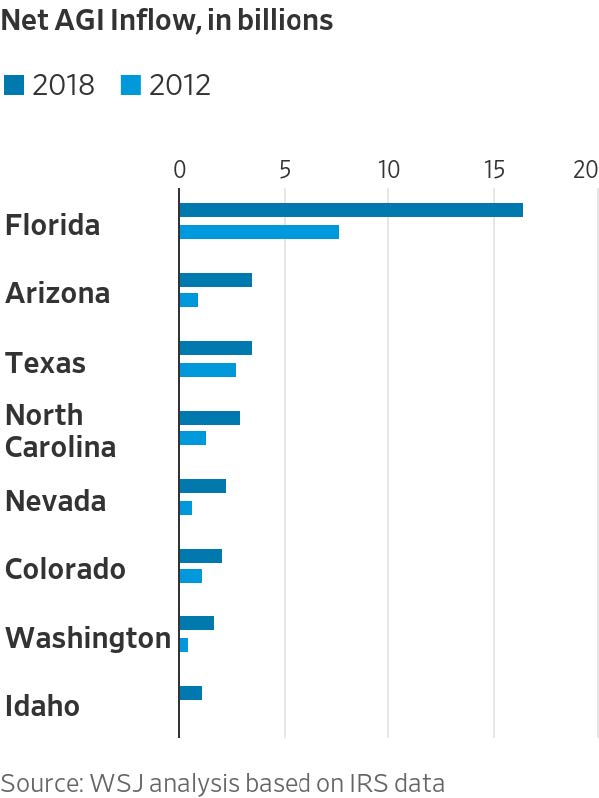

I recently came across one other interesting tidbit, and that is a look at which states have seen the largest changes in “Adjusted Gross Incomes” over time, as reported to the Internal Revenue Service on personal tax returns. Granted the data is from 2012 to 2018, but it is nevertheless entirely consistent with other data and trends. California and New York have seen the highest outflows, while Florida, Arizona, and Texas, the greatest inflows.

Finally, I read an interesting article in the (failing!) New York Times about how this population exodus from California is impacting politics in neighboring states. The 7.3 million people who have left California since 2007 have turned Colorado blue, likely resulting in a flipped senate seat. In Nevada, Democrats won the governor’s mansion and a second senate seat in 2018. And last, but certainly not least, Arizona may turn blue in short order. Texas, the top state for California’s diaspora, is in play, though the State is not likely to turn blue quite yet. But Democrats are growing their influence in major metros like Dallas, Austin, Houston, and San Antonio, and the overall trend cannot be ignored.

And multifamily rents? Between economic and political pressure/activism, they are likely to drop in the short-run, especially in those regions with high “at risk” employment and high housing costs. However, they will likely continue to rise, longer-term

Over the last decade, multifamily rental growth, nearly anywhere you looked, was robust. In certain markets, especially on the coasts, the growth rate far outpaced inflation. However, more recently, it has been the secondary and tertiary markets that have shined, as residents fled the coasts in search of better job opportunities, lower housing costs, and higher net wages, as described above. Markets like Phoenix, Aurora and Colorado Springs, the Inland Empire, and Boise have led the pack in terms of rental growth.

So, what now? In those markets with average levels at-risk jobs, I actually expect rents to remain fairly flat in the short-run, as residents mostly stay put, remain in whatever job they might have (as opposed to relocating), receive stimulus and unemployment checks, and fail to buy homes. Over the next year, however, I do expect rents to decline, though modestly, mainly due to job dislocations and additional supply delivered to the market. There will be new projects coming on-line (some 330,000 units in 2020), and some residents will be doubling/tripling up and/or moving back home with parents, trends we witnessed during the Great Recession. It is really a question of how quickly the economy and job markets rebound.

In some markets, those with especially high levels of at-risk jobs, such as Las Vegas and Orlando, all bets are off, quite frankly. It is why I would avoid any market with excessive single-industry exposure, or a significant lack of employment diversification. Last year, for example, we evaluated a portfolio of multifamily assets in Midland, Texas. The purchase cap rate and buy-in were far more attractive than what we typically see cross our desks (or emails). But given the unique exposure that market has to the oil and gas industry, we did not pursue the acquisition, a prescient decision in hindsight.

One significant unknown is how lenders will reprice and restructure both existing and new loans

How real estate assets are ultimately repriced as a result of this crisis depends, to a significant degree, on how lenders respond. Obviously, innumerable outstanding loans will need to be restructured, mostly involving deferred payments and maturities, and waivers of certain fees and costs. Presumably, for most assets, such modest modifications will do the trick, provide time for the markets to recover, and allow borrowers to satisfy their obligations. In other cases, perhaps loans on certain hotel and retail assets, more dramatic and draconian actions will need to be taken, with assets needing complete or partial do-overs or redevelopment.

As expected, the Federal Housing Finance Agency, which oversees Fannie Mae and Freddie Mac, the largest residential lender, is offering forbearance of loan payments for up to 90 days, if borrowers can demonstrate that they have been impacted from COVID-19 and agree to suspend evictions of affected tenants. I have yet to see the formal forbearance documentation to understand the precise terms and conditions attached to any forbearance, perhaps because we have not yet requested any. At the end of the day, nearly all lenders, including banks, insurance companies, and debt funds will be motivated to work with and modify loans if the underlying assets and underlying fundamentals are solid, and borrowers, trustworthy. Workouts of CMBS loans will be trickiest, as they always are, due to the manner in which these loans are securitized and require the involvement of special servicers.

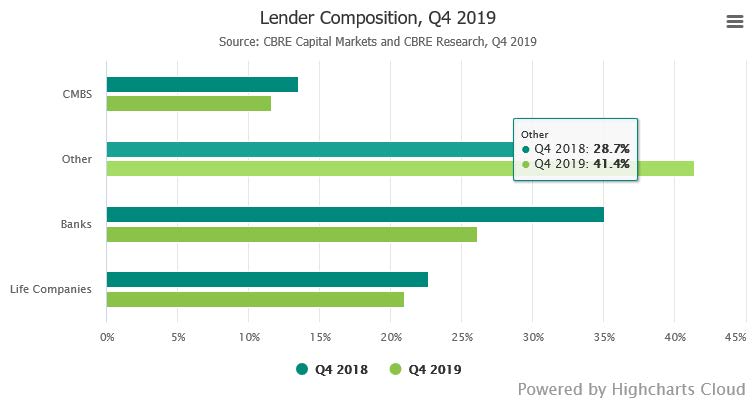

For new projects and investment acquisitions, I suspect most lenders will require additional reserves, employ stricter underwriting processes and procedures, resulting in lower loan-to-values, higher debt service ratios, immediate amortization (no interest-only), with lower rates on underlying indices, as seen below, offset by higher credit spreads. These restrictions should ease in time, but markets like these create dislocations everywhere.

What’s interesting is that before the virus hit the fan, all real estate lenders were active. Obviously, we will just have to see how this data from the fourth quarter changes throughout 2020.

And finally, I sure was wrong when I predicted that 2020 would be a quieter year in terms of public policy initiatives and housing. If anything, COVID-19 has fanned the housing regulation flames

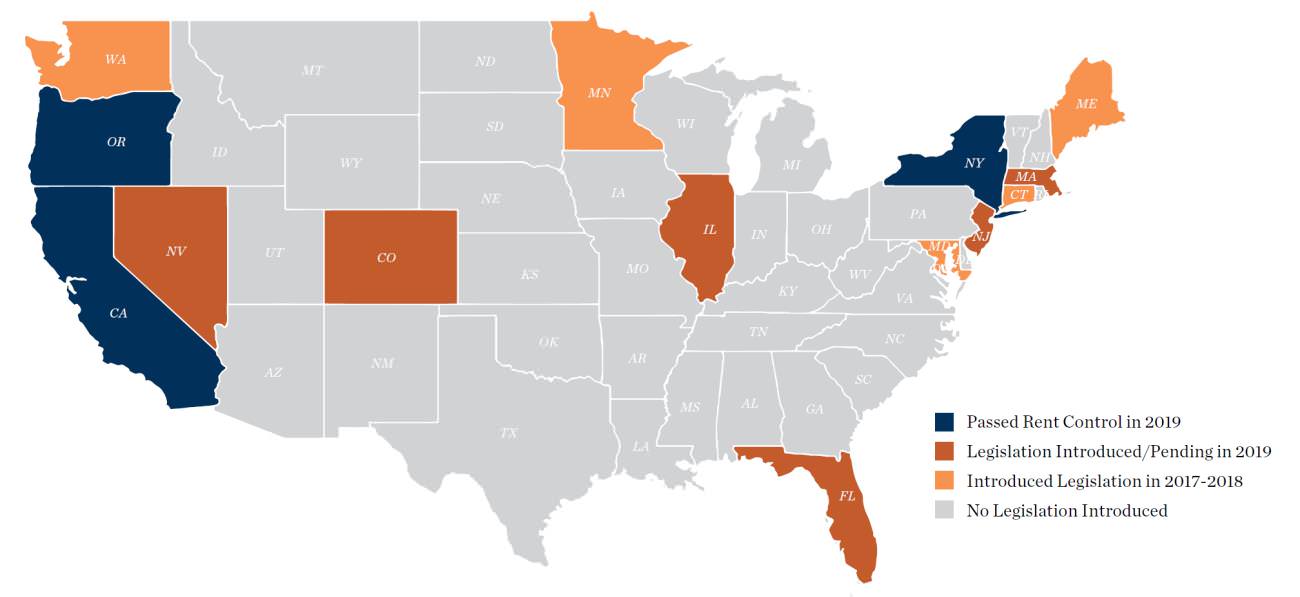

I suppose the one area in which I should just stop making predictions is politics. I honestly thought that after politicians were so busy in 2019, extending efforts to almost nationalize several residential housing markets, they might take a breather in 2020. Wrong. Maybe I should have hired the Houston Astros bench players and coaches to help me make better predictions. Obviously, much of the recent political machinations are responses to the Coronavirus. This simple map provides a bird’s eye view of what happened before 2020.

With that backdrop, allow me to provide a summary of what different cities and states have been up to this year:

• Countless cities and states have passed emergency legislation to protect residential tenants from being evicted, if they are unable pay rent because of the Coronavirus. These include Arizona, California, Illinois, Kansas, Louisiana, Massachusetts, New York, among several others, both red and blue. Practically speaking, because unlawful detainer courts are closed everywhere, actually processing evictions would be hard, if not impossible. In addition, the CARES Act put a 120-day national eviction moratorium for tenants in properties that are part of government programs or that have a federally-backed mortgage loan.

• California Assembly Bill 828, if passed, would establish a moratorium on evictions and foreclosures while a state of emergency related to COVID-19 is in effect, and until 15 days after that state of emergency has ended. And if this were not restrictive enough, tenants impacted by COVID-19 and subject to an unlawful detainer action, would be entitled to reduce their rent by 25% for a year. While seemingly unconstitutional on its face and unlikely to pass, I would think, such heavy-handed tactics scare the bejeezus out of me.

• Meantime, and ironically, California once again shot down a bill (SB 50), which would have allowed more mid-rise apartment buildings near transit and job centers. The Bill failed to pass because it took too much power away from local governments, those same local governments that have essentially done squat to meaningfully address housing shortages. California should be building 250,000 housing units a year, plus or minus, and yet we are producing less than 100,000. No wonder the exodus from the state continues. There is no monopoly on myopia or stupidity.

• Before COVID-19, Utah was considering statewide rent control, as were the cities of Seattle and Atlanta.

• Also prior to the arrival of COVID-19, the mayor of San Francisco was pushing a ballot initiative to streamline approval of 100% affordable projects or where developers agree to set aside 15% additional units as affordable above what would be required. On Super Tuesday, San Francisco passed a ballot measure to charge a “vacant storefront tax,” a tax on commercial storefronts that remain vacant for at least six months, which sounds both absurd and illogical. Let’s take a group of landlords, already struggling financially with vacancy (assuming these landlords have been unsuccessful in finding commercial tenants) and tax them! Yet, in a surprise to absolutely nobody, the measure passed with almost 70% voting in favor of it. Being a landlord in the Bay Area must feel like what it feels to be a UCLA football fan in recent years.

• Oregon’s governor, Kate Brown, and the state’s lawmakers are considering adding transfer taxes to real estate transactions to pay for affordable housing.

And across the Pond, Berlin’s five-year freeze on residential rents (“Mietendeckel”) went into effect this quarter. In addition, the new law will allow renters paying more than $10.80/sq. meter to petition the city to force landlords to reduce their rents. As bad as California and New York might be, I am not sure there is a place anywhere which dislikes its residential landlords more than Berlin. In some very perverse economic thinking, supporters of the new bill indicated that it will give renters time for supply to “catch up” to demand. From Spain to Toronto, renters are feeling the pinch of higher rents caused by urbanization and the failure of supply to meet demand. According to the Economist, 68% of the world’s population is expected to reside in urban areas by 2050, up from 55% today, so these challenges are only going to worsen over time, and anti-landlord sentiment and pro-tenant legislation are sure to follow.

In closing, while the COVID-19 crisis has presented us all with unique and unprecedented challenges, I remain optimistic about our ability to confront them, persevere, change, and grow.

I believe it was Teddy Roosevelt who said that “nothing worth having comes easy.” I am not sure I believe this to always be true (just ask a Super Lotto or PowerBall winner!), but it sure rings true today. Crises have a way of inducing fear, panic, and gratitude, all at once. I am, by nature, a “glass half-full” sort of individual, and while this crisis has been extraordinarily difficult and disruptive, I am truly grateful for friends, family, our Clear Capital team, our partners, and investors, and of course, our collective good health. I reiterate my sincere well wishes to you all, and hope that my next memo will celebrate an end to social isolation and a return to greater normalcy, in whatever form such normalcy may take.

Meantime, we will continue to evaluate investment opportunities, believing that market dislocations and crises always present opportunities, so please stay tuned.

Best,

Eric Sussman

Founding Partner