“Change is the law of life. Those who look only to the past or the present are certain to miss the future.”

-John F. Kennedy

“Education is the most powerful weapon we can use to change the world.”

- Nelson Mandela

As I practiced my karaoke skills last week while listening to Sirius’ radio’s ‘70’s on 7’ and badly butchering Blood, Sweat, & Tears’ hit song, “Spinning Wheel” (“what goooes up, muuust come down, spinning wheel got to go round”), before moving on to Bloomberg Radio, where I was met with headlines like “record oil prices,” “highest inflation in 50 years,” “fears of recession and stagflation,” “a new Cold War,” and “waning stock indices,” I wondered whether I had become trapped in a Twilight Zone episode where my satellite radio had somehow transported me back in time.

But then news about Elon Musk’s offer to buy Twitter, China’s temporary closure of Shanghai in an effort to stymy the spread of Covid, and reference to California cannabis taxes and the resulting black market snapped me out of my daydream, reminding me that I was still firmly ensconced in 2022 and simply experiencing that old Twain adage that “history doesn’t repeat itself, but merely rhymes.”

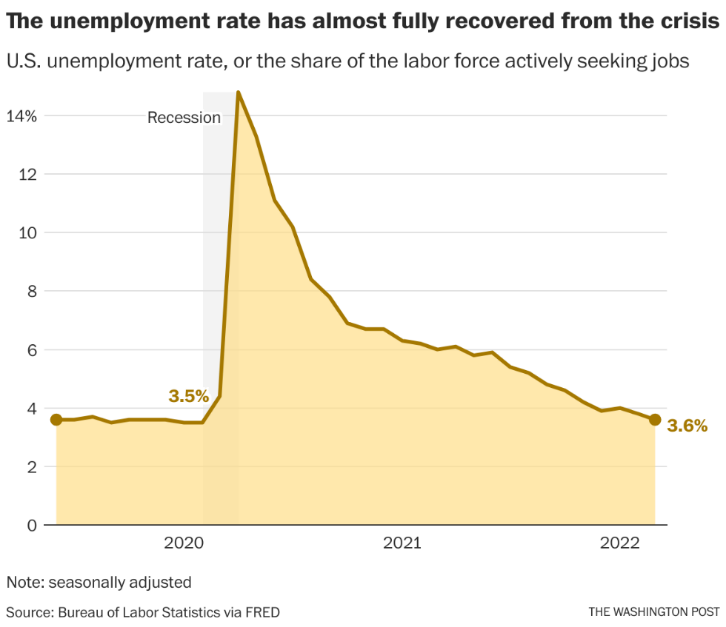

So, with my brief imagined trip back to the 1970’s complete, let’s cut to the brass tacks from the first quarter of 2022, one I am glad to see relegated to the history books. Despite good news about the job market and an economy that saw half a million jobs added in March, a drop in the unemployment rate to 3.6%, the confirmation of the first Black female Justice to the U.S. Supreme Court, and my parents turning 90 and 84, respectively, there were more than a handful of sobering headlines during the quarter.

During the Academy Awards a few short weeks ago and the slap heard ‘round the world, you may have missed one auspicious award category, “Worst News of the Quarter,” the nominees for which were as follows…:

• Russia’s unprovoked invasion of Ukraine, an obvious tragedy and travesty that history will remember as such

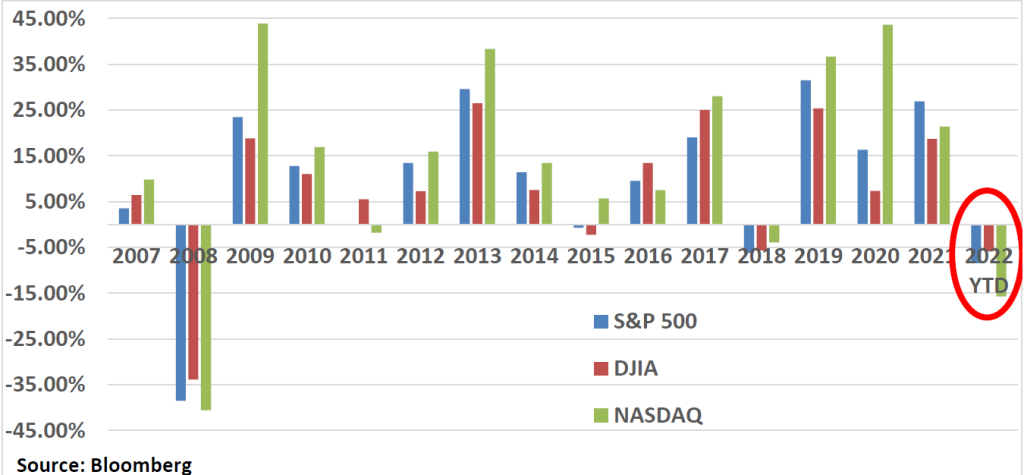

• The decline in U.S. equity prices, ushering in the worst quarter for stocks in two years, with the S&P 500, Dow Jones Industrial Average, and NASDAQ down 4.6, 4.9, 9.1%, respectively (and in a newsflash, the S&P is down 8.42% and the NASDAQ 15.67%, as of (a less than) Good Friday)

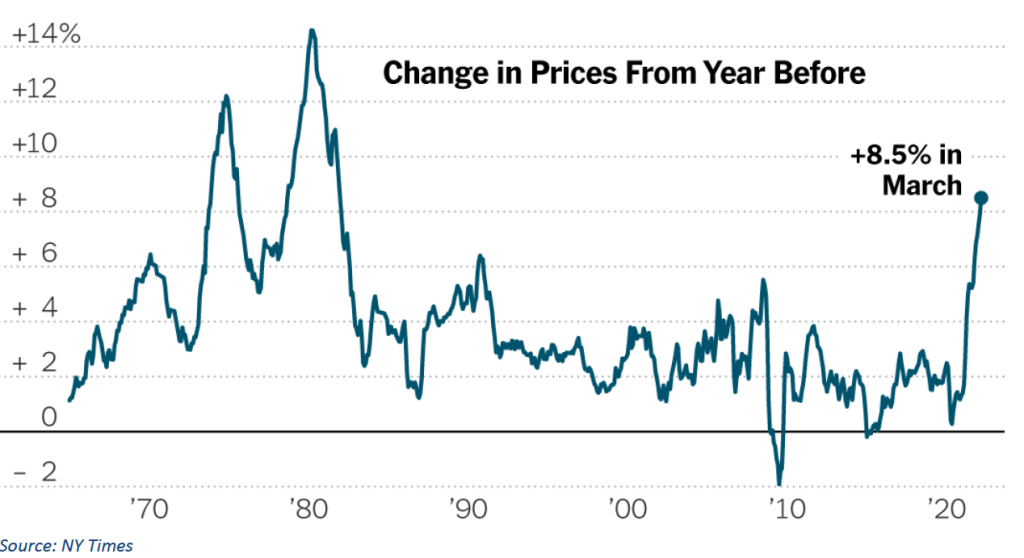

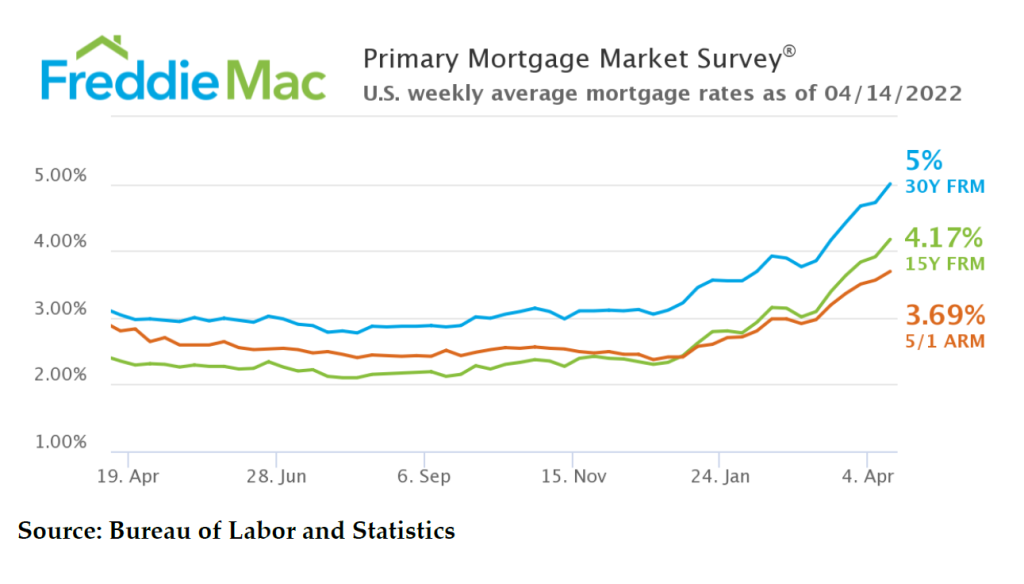

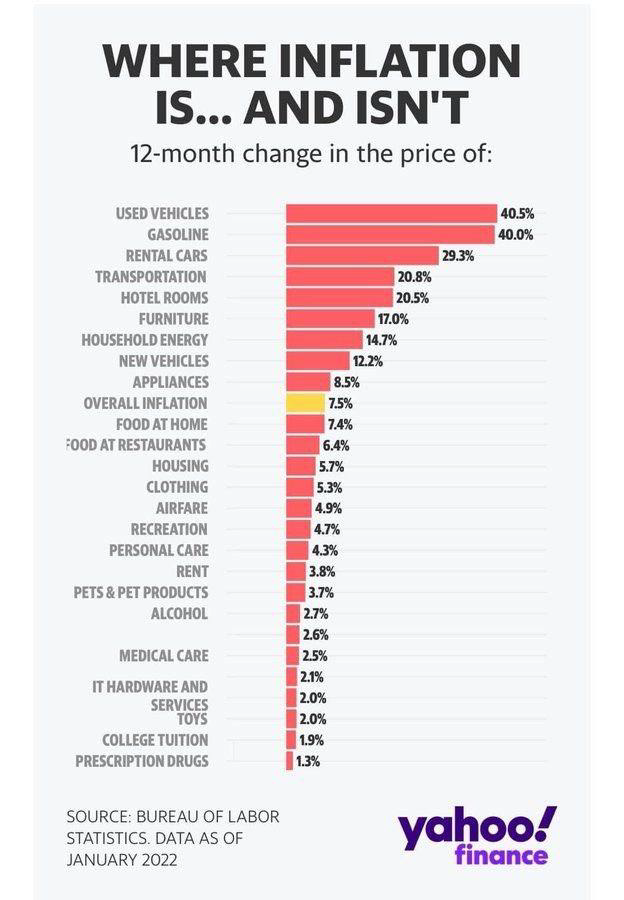

• The highest inflation seen in a generation (40 or 50 years, but who’s counting?) and the higher interest and mortgage rates it has engendered, along with Dollar Tree substantively becoming “$1.25 Tree”

• Record-high (nominal) gas prices (which seem to have had no effect on traffic)

• Persistent supply chain woes, exacerbated by sanctions on Russia, the shutdown of Shanghai as China experiences the limits of its “no Covid” policy, and Texas’ Governor Abbott slowing down all traffic crossing the Texas-Mexican border to address supposed “security concerns,” and last, but not least,

• The release of yet another variant of Covid, an unwelcome Omicron sibling

In the “honorable mention” category for “worst news of the quarter,” I would include my beloved Bruins’ loss in the NCAA Tournament to North Carolina, the ending of this season’s Bachelor that left two women in loving suspense at the final rose ceremony, and headlines about some rabid fox on the loose on Capitol Hill that ended up biting at least one member of Congress. I realize many may think the latter story might make you wonder why it had to be only one member of Congress, but I will leave that debate for another day.

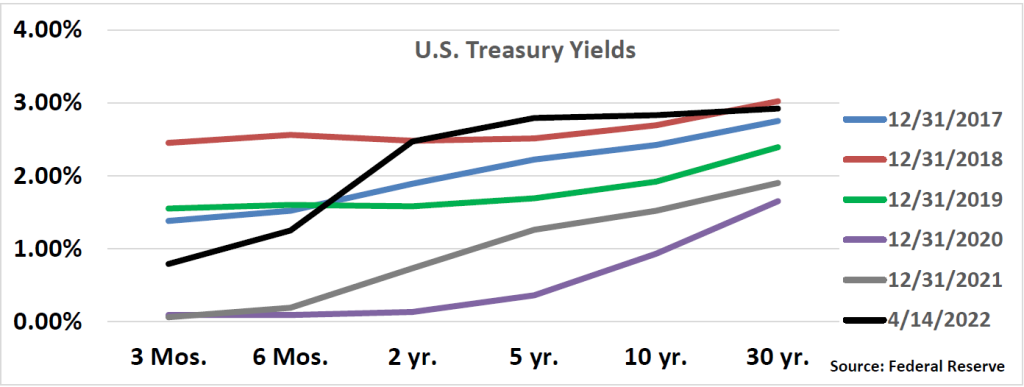

Without picking an Oscar winner (loser?), three pictures about the equity markets, inflation, and interest/mortgage rates, respectively, tell a thousand sobering words about the most recent quarter, and a tad beyond:

Now, the trillion-dollar question is what’s next? With so many macroeconomic challenges, are we inevitably headed into a recession? On the one hand, if I were to refer to my Easy-Bake Oven™ recession recipe, it might read something like this:

- One quart of higher interest rates

- Three cups of Federal Reserve tightening and balance sheet “reductions”

- Two tablespoons of broad consumer-based inflation

- A teaspoon of higher oil and commodity costs

- A pinch of geopolitical tension

- A dash of bubble-like trading action in speculative assets

Over the past 75 years, every time inflation has exceeded four percent and unemployment has gone below five percent, the U.S. economy has experienced a recession within two years. Today the U.S. inflation rate (CPI-U) exceeds eight percent and unemployment sits at 3.6%. Add in the boom in commodity prices, the Fed’s decision to increase interest rates and shrink its balance sheet, the war in Ukraine, and the flattened yield curve (note the very modest difference between yields on two- and 10-year Treasuries) and you would think a recession has to be in the cards. And that perspective is certainly not without merit.

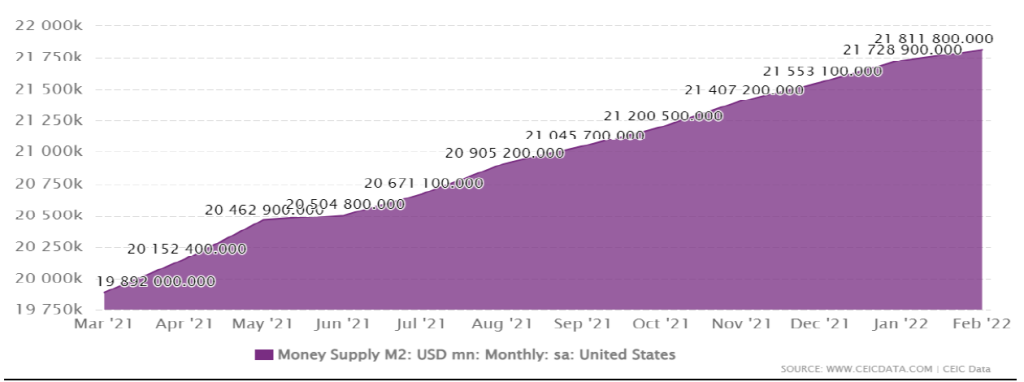

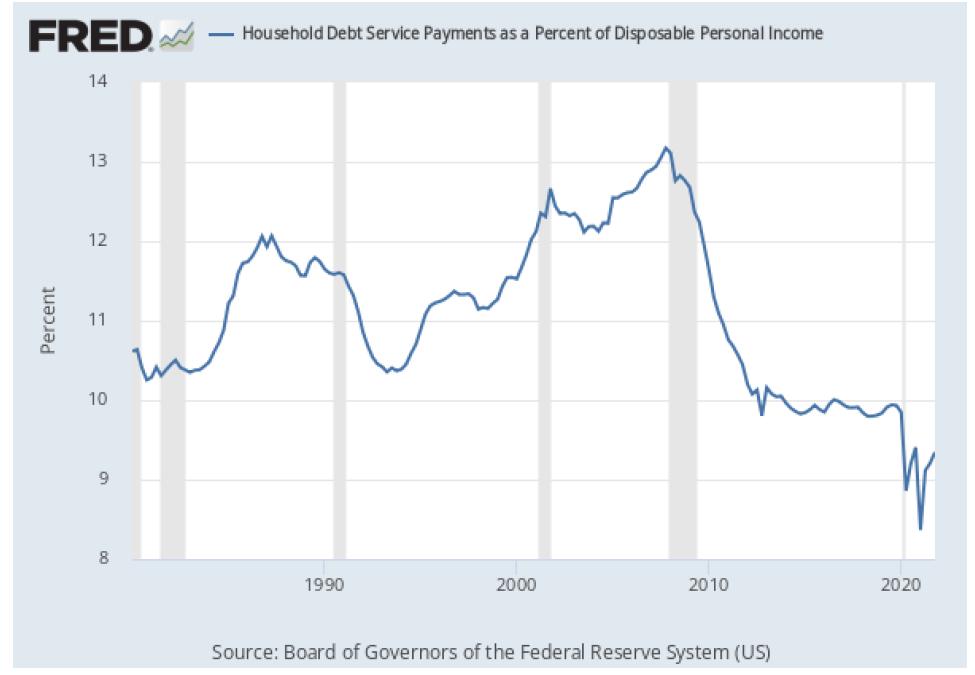

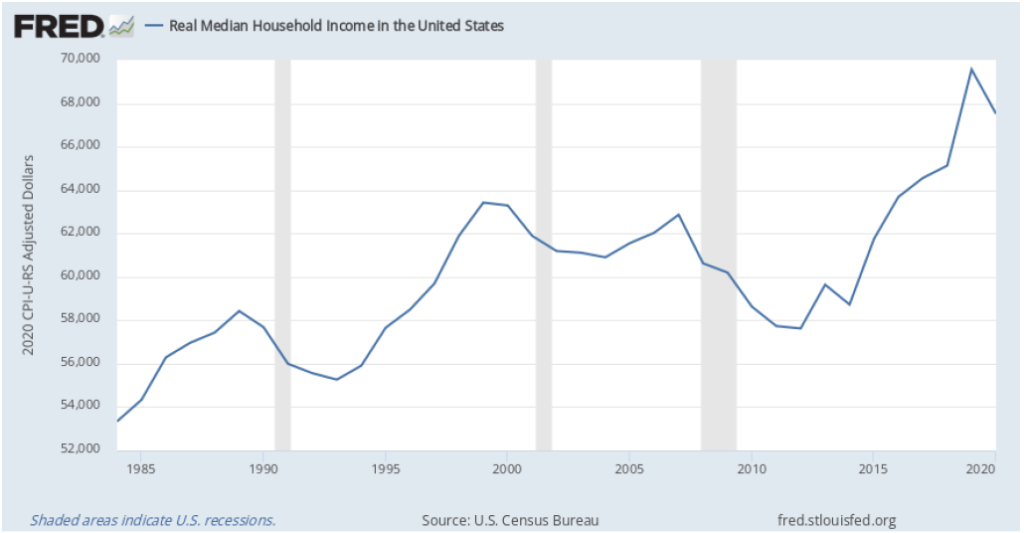

On the other hand (economic pundits must always have that second hand, if not a third), extraordinary liquidity (M2 money supply of some $22 trillion), near record lows of household debt service payments as a percentage of disposable personal income, and near record highs of real median household income (see graphs below), all combined with pent-up post-Covid demand, create plenty of economic tailwinds. The data is conflicting and confounding to say the least.

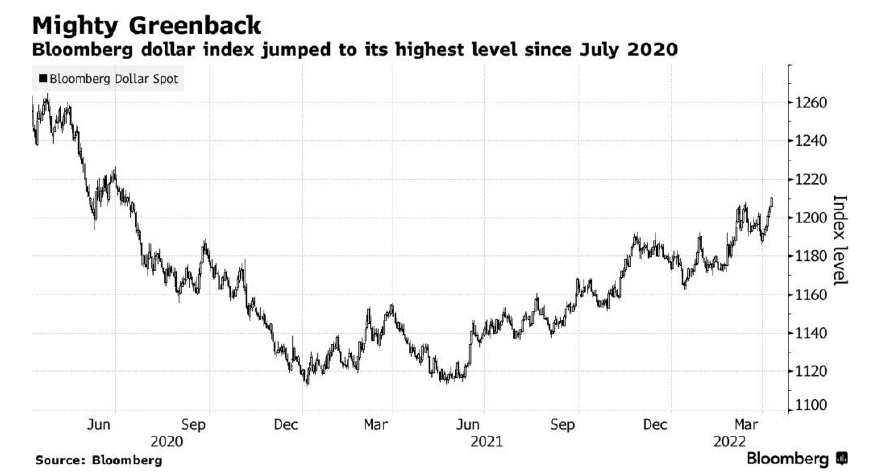

Meanwhile, anecdotally I have witnessed increases in traffic of late: on LA’s freeways (higher gas prices be damned), in LAX and Atlanta airports (Delta was offering $700 to seven passengers on an overbooked flight I recently took), and at the shopping destinations I frequent (yes, Costco, of course). In addition, geopolitical tensions, from Taiwan to Hong Kong, to Ukraine to Latin America, while creating a material drag on global GDP, will create additional capital flows to the U.S. as investors seek safe(r) havens in which to place their capital. Recent trends in the value of the U.S. dollar speak directly to this reality.

And remember that the likes of Blackstone and Trammel Crow, which just closed a new fund (Crow Holdings Development Opportunities Fund I, L.P.), along with their private equity compatriots, have raised significant capital (read: billions) in recent months that they will need to deploy. To wit, in February, Blackstone acquired Preferred Apartment Communities, Inc. in a $5.8 billion deal. Preferred owns about 12,000 units in the southeast, as well as a smattering of other commercial assets. I am sure Blackstone will continue its shopping spree like it’s Black Friday given its sizable war chest.

In short, a Vegas bookie would have his or her hands full trying to handicap the odds that a recession is on its way in the next year or two. At this point, I find myself in the “no recession” camp, but that perspective may change after first quarter earnings season is over or if Will Smith slaps me to my senses. For my money, the biggest question marks remain inflation and how consumers and investors react to the persistently higher prices they are likely to experience, from grocery stores to the gas pumps to cars; what the Fed does and how it tries to thread the inflation-recessionary needle; and, finally, what happens with all that capital sitting on the sidelines.

I continue to hoard popcorn as I evaluate all the data. And for the record, popcorn prices at Disneyworld are up from $12 to $13 a bucket this year….and I blame Russia, the Fed, and the late Orville Redenbacher. And what about real estate? Will higher interest rates necessarily mark the end of the hot housing market?

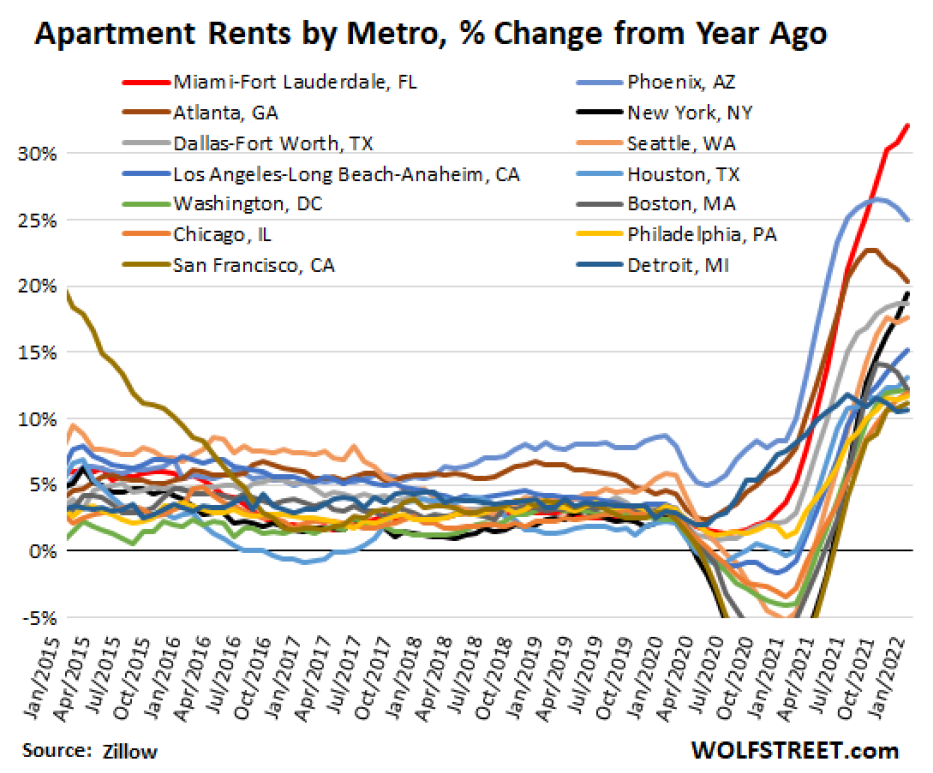

To say that the residential real estate market has been hot would be an understatement. I can almost hear that annoying voice from the 1980’s Crazy Eddie commercials shouting, “These Prices are Insane!” as rents and housing prices continued their upward marches in the first quarter. Through the first three months of the year, 2022’s national multifamily rent growth is outpacing 2021, according to at least one source (Zumper’s National Rent Report). According to Zumper, the national median rent for one-bedroom apartments reached an all-time high of $1,400, representing a 2.5 percent increase for the year so far, ahead of the 1.9 percent growth experienced at this time last year, while year-over-year increases reached double-digits in market after market. Markets like Miami, Austin, and Phoenix continue to lead the rental growth pack, but even markets like Detroit saw double-digit rent increases during the past year. Just two of the fifty most-populous metro areas saw rents fall from a year earlier. Rents declined three percent and two percent in Milwaukee and Kansas City, respectively. Again, a picture tells the story, in all its rainbowed glory:

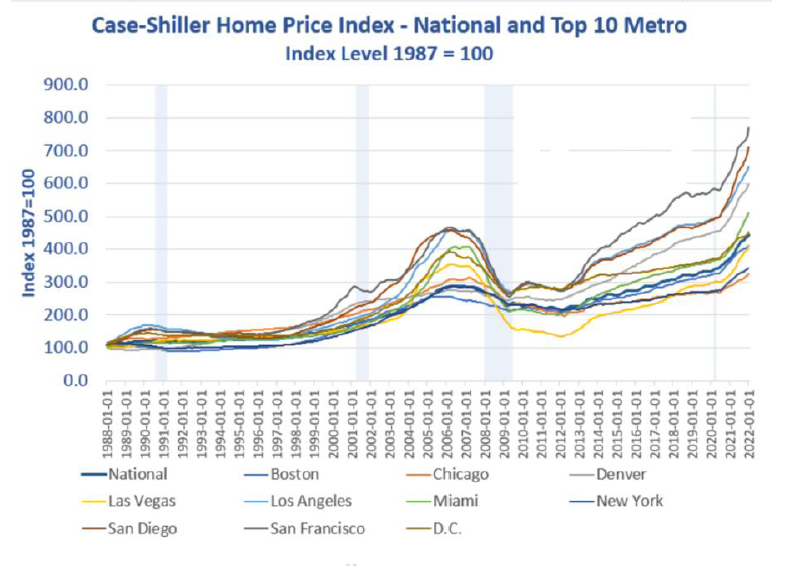

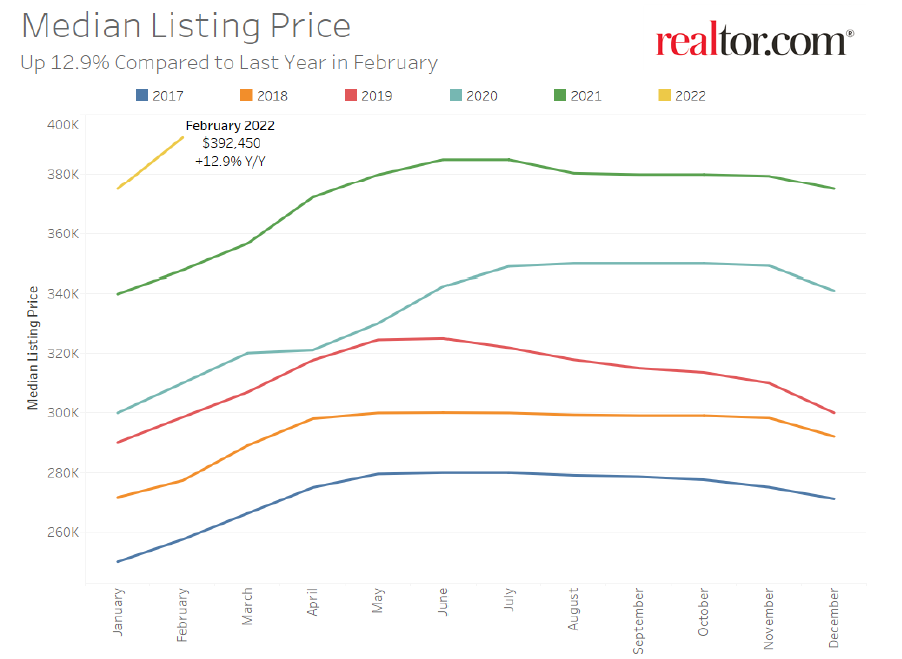

And single-family homes? It, too, is the “same old song,” as the Four Tops once sang (that would be ‘60’s on 6’ on your Sirius/XM dials for you satellite radio subscribers), with prices up sharply thus far in 2022, and year-over-year. The median sales price for a home here in Los Angeles rose by 11.2%, from $850,000 in February 2021 to $945,000 in February 2022. Nationally, the median listing price was 12.9% higher in February compared to last year.

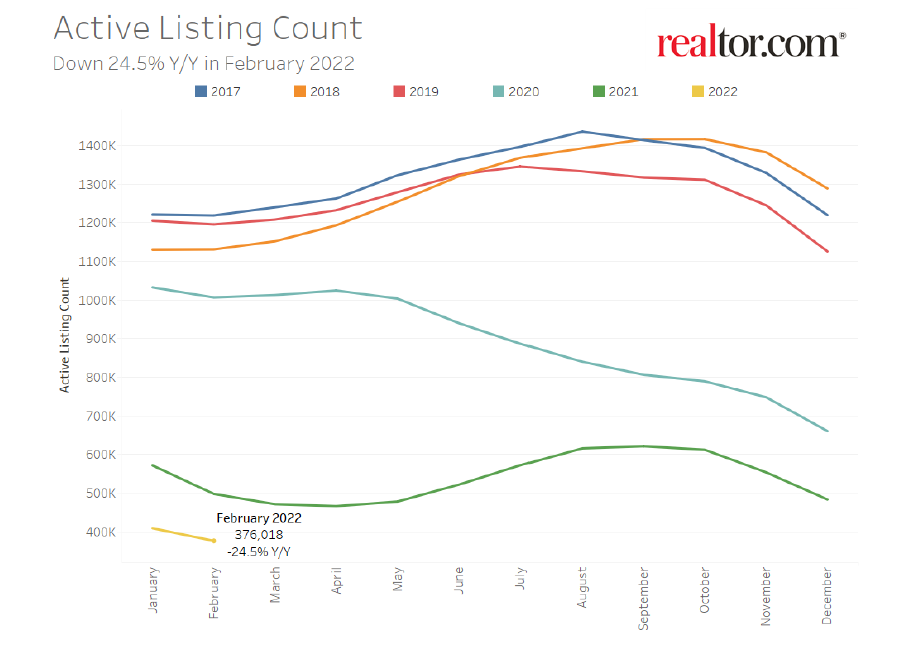

Meanwhile, the supply of homes for sales remains tight, with homes available for sale in Los Angeles and nationally down 41.3% and 24.5%, respectively, year-over-year (through February). It is no wonder that negotiations between prospective homebuyers and sellers are looking more like MMA bouts than normal negotiations. In any case, the multifamily market remains a significant beneficiary of these single-family trends and realities.

So, what now? Not surprisingly, the typical narrative is that higher mortgage rates will temper the housing market, and there is no question that they will to some degree, as some first-time or more cash-constrained homebuyers become shut out of the market. However, several factors make the housing market more robust and resistant to broad-based declines than in prior cycles. One, consumer and household balance sheets are in terrific shape, beneficiaries of everything from reduced spending and borrowing to governmental largesse during the pandemic. Take another look at the two charts above from the Federal Reserve laying out levels of household debt to personal income and real household income.

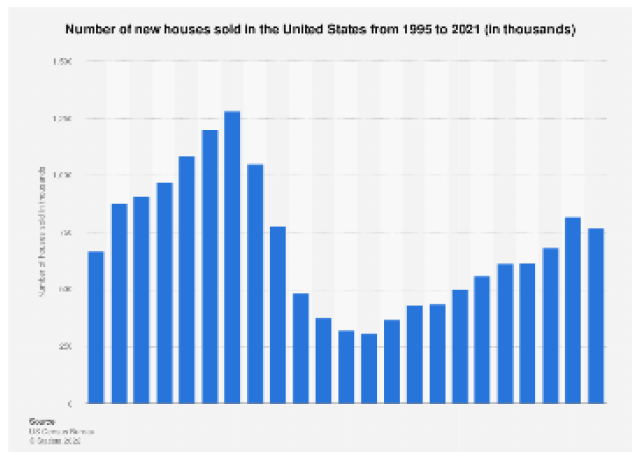

Two, there simply ain’t enough single-family homes to go around, with a lack of supply and persistent underbuilding following the 2007-2009 financial crisis, something I have written about repeatedly.

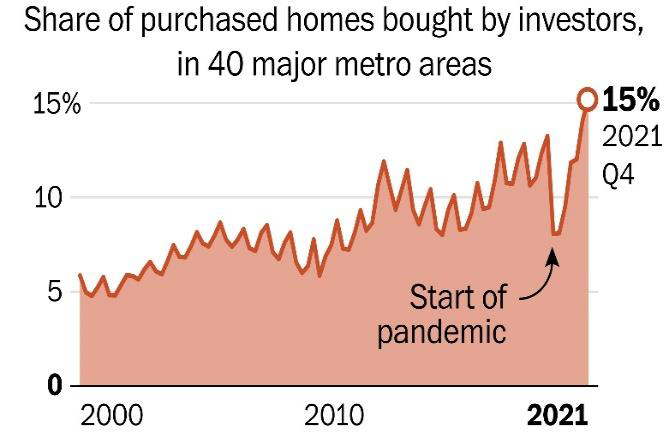

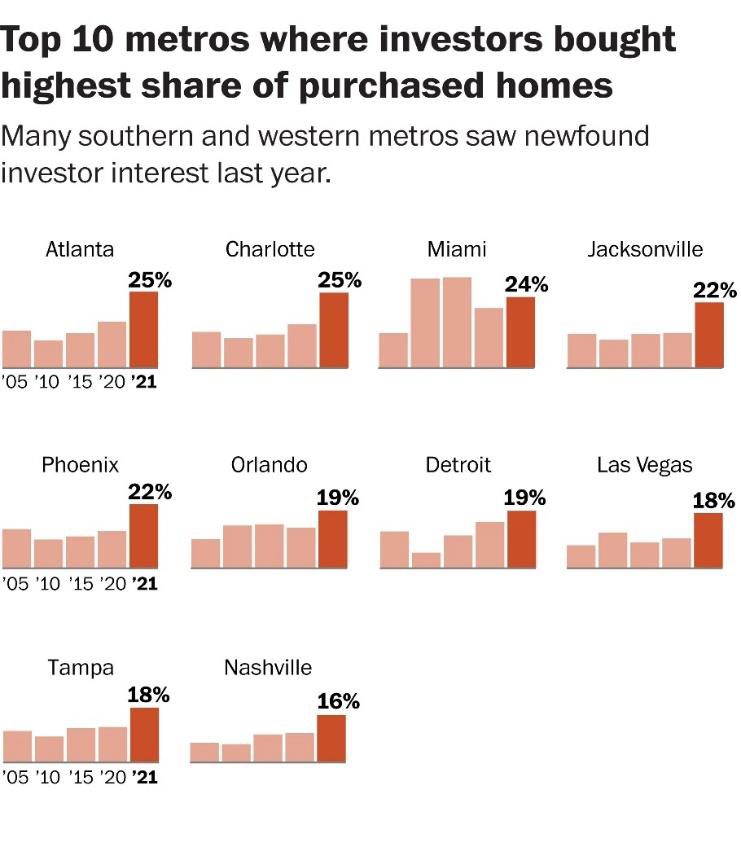

And finally, the influx of investors that have entered the single-family market, discussed at length in previous memos, present a newer source of housing demand. While investor activity may have slowed more recently as the likes of Zillow have left the market, investors are still active participants in the market. Data recently released from the National Rental Home Council and John Burns Real Estate Consulting shows that build-for-rent homes accounted for 26% of properties added to the portfolios of single-family rental home providers in the fourth quarter of last year, up from just 3% in Q3 2019. Of course, homes built specifically for rent reduces the already constrained supply of homes available for sale.

In fact, I recently read a Bloomberg article which introduced me to a single-family residential rental company I had never heard of previously, Pretium Partners, LLC, and its affiliate, Progress Residential, which raised $2.5 billion in 2019 and was the party that bought the homes that Zillow had to sell last year. Anyhow, it added 35,000 homes to its portfolio in 2021 alone and now owns about 75,000 homes. 75,000! And here I thought Clear Capital’s 5,000-unit multifamily portfolio was really something.

I realize some of you may read some of this and have a visceral response that all this institutional activity in our single-family housing markets is a big negative, increasing housing prices for families, changing the fabric of neighborhoods, and/or reducing opportunities to save for retirement through homeownership and related equity, and I can appreciate that perspective. On the other hand, many others will simply believe this is how capitalism and free markets work, and that allowing individuals and families to rent homes increases the pool of potential single-family occupants. I will stay out of the fray for now but would merely note that other wealthy countries like Denmark and Germany have lower rates of homeownership than the U.S., but far more robust social safety nets and pension benefits. In any event, the issue is as much economic as it is political, I suspect.

Finally, bank balance sheets are in far better shape than in the past, certainly less risky than in the period preceding the financial crisis when lenders were giving out mortgages like Butterfingers on Halloween. Some will point out, not incorrectly, that the “shadow banking system,” which includes financial institutions that are not regulated, has expanded significantly over time, making the overall system riskier than it may seem, but the overall systemic mortgage risks appear far more manageable than they were in 2007.

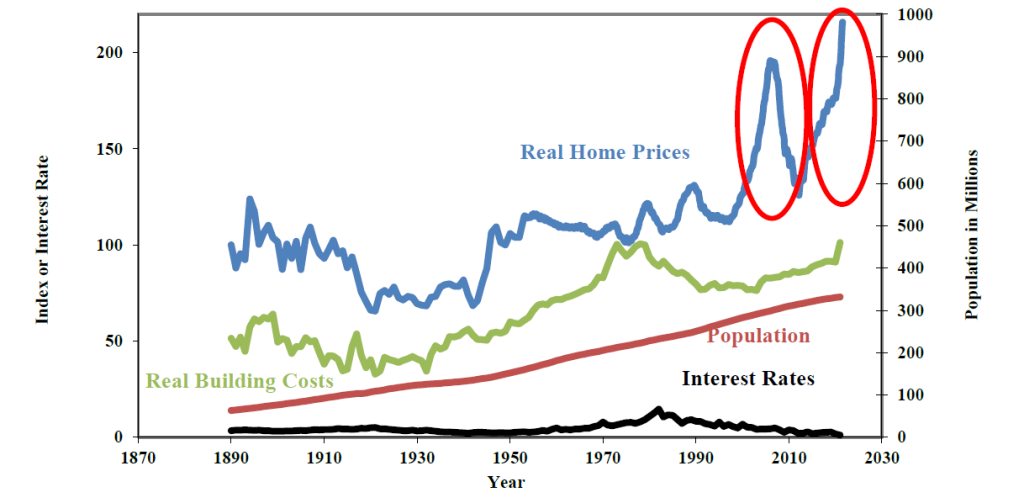

There may be one graph that looks a tad scary, one from Yale’s Robert Schiller (of Case-Schiller fame). The two lines I routinely think about are the correlation between real home prices and population. Common sense would tell us that the two should have reasonably high correlations, and over time, they do. However, the last time the disparity between the two was so significant was the period preceding the financial crisis.

Again, what to make of it all? Is this time different? Overall, I believe the answer is “yes,” that those waiting for housing prices to drop will be disappointed, as I have said repeatedly in recent years. That is not to say that higher interest rates will not dampen demand at the margin because they will, and they must.

But with housing supply constrained, ample liquidity wherever one looks, the significant presence of institutional players in housing markets, and interest rates still relatively low by historical standards, I expect housing prices to remain high and rents to increase, extending trends over the past decade. Those increases will just moderate from recent trends.

With the major quarterly punchlines addressed, let’s take a more granular look at inflation and interest rates, since both dominate recent economic news and so profoundly impact financial assets and real estate markets

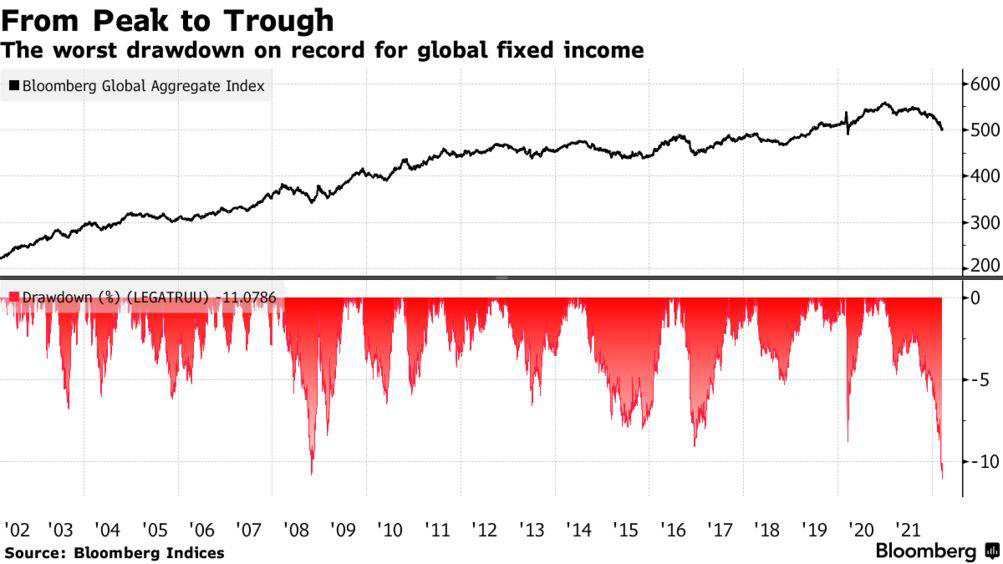

If you had just awoken from a six-month nap and glanced at a graph of U.S. Treasury rates, you would probably do a double-take. Maybe a triple-, as you took a large swig of whatever caffeinated drink you might have chosen after such a long slumber. In just the last six months, yields on 10-year Treasuries have more than doubled, from 1.40% to a recent 2.91%, an astonishing rise. As a result, the fixed income markets have been decimated, with bond prices suffering their worst drawdown on record. 30-year fixed mortgage rates have spiked to 5%, as detailed above, their highest levels in 12 years.

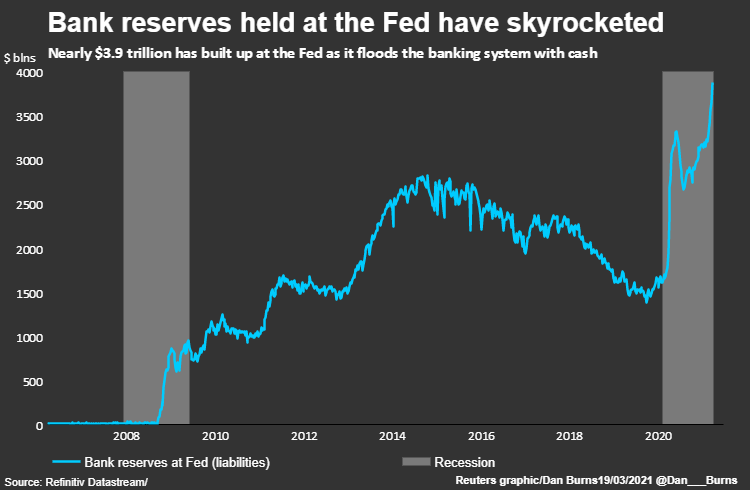

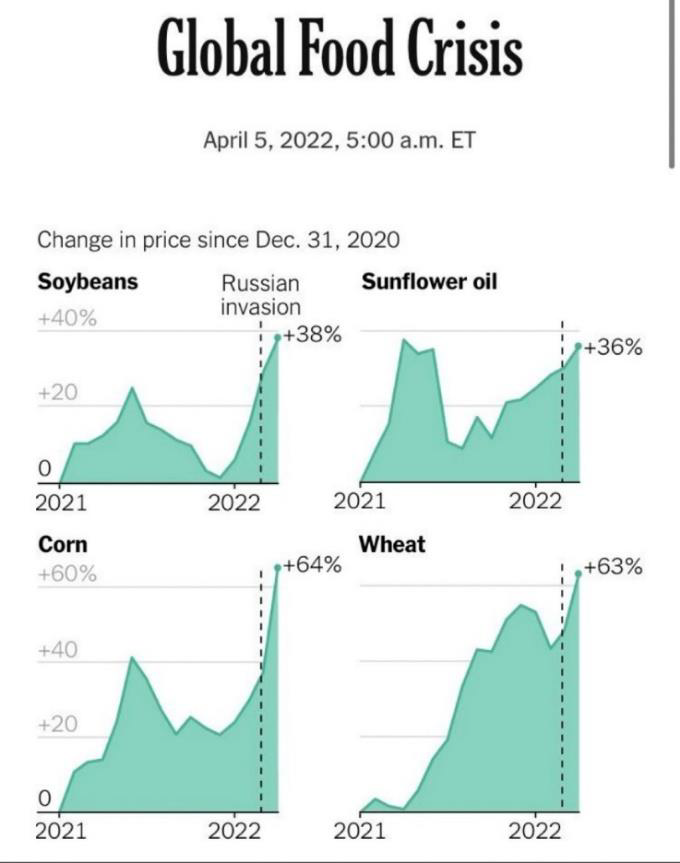

The culprits? Inflation, of course, as higher prices prove anything but transitory, and that over-the-top toner use by the Fed as it printed money like it was going out of style. Meanwhile, everything from Russian sanctions to the temporary shutdown of Shanghai to a slowdown in shipping across the Texas-Mexico border to a looming strike of more than 22,000 union dockworkers employed at 29 ports along the West Coast when their existing contract expires at the end of the June do not bode well for future inflation reports. The challenge is that higher prices are everywhere, from durable goods to travel to housing to food to energy prices. Heck, I won’t even tell you what I just paid for a standard coach ticket to Atlanta.

Just take a peek at what has happened to certain commodity prices, with wheat and corn prices up over 60% since the end of 2020. You can count on Wheat Thins getting thinner, Frosted Mini-Wheats getting “Minier,” and Corn Flakes becoming Corn Crumbs in coming months.

How will investors respond to persistent inflation, something so many investors have never experienced before? It is impossible to say with certainty, but equity and bond markets are likely to have a rough going this year and next, while real assets (yes, real estate) ought to fare much better. I would be very wary of investing in anything that resembles “fixed income” for the time being. In March alone, the Consumer and Producer Price Indices rose 1.2% and 1.0%, respectively, and 8.5% and 9.2%, year-over-year. Ouch.

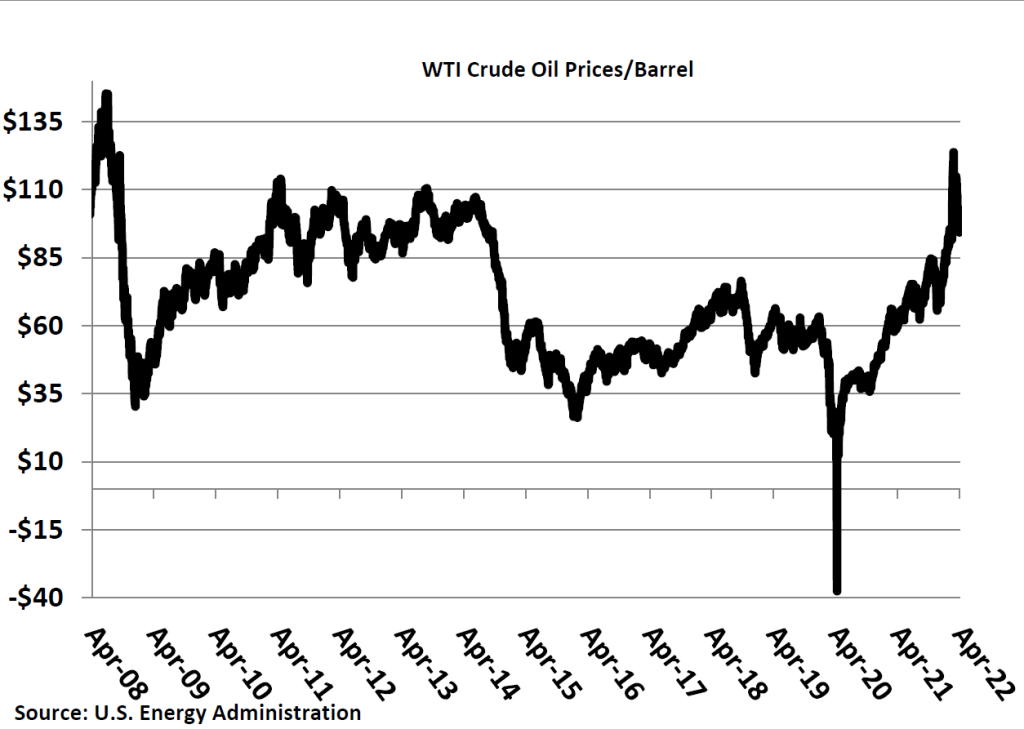

And oil prices? It seems like only yesterday (end of 2020) when many Wall Street analysts, commentators, and fund managers (Exhibit A: Jim Cramer and Cathie Wood, if they count) were predicting that oil prices were down for the count and would never recover, after they had dropped over 30% that year. Oops. I remember a fellow UCLA faculty member in the Public Policy Department, who had studied the oil markets for his entire career, telling me that nobody can predict the price of oil, not even OPEC. He appears to be correct, as this graph clearly communicates.

So, what is the Federal Reserve to do, while it fights a two-front war and the risks of persistent inflation and looming recession? Jerome Powell, the Fed Chair, may have the toughest job in America, right after Oscar host, coal miner, and ICU nurse (business school faculty member and real estate private equity managers are close runners-up). How much to raise rates? When? The Fed has indicated it expects to raise rates at least six more times this year, though many analysts are predicting seven to eight more increases, which would increase the Fed Funds rate from its current 0.50% to 2.0 to 2.25%. We shall see.

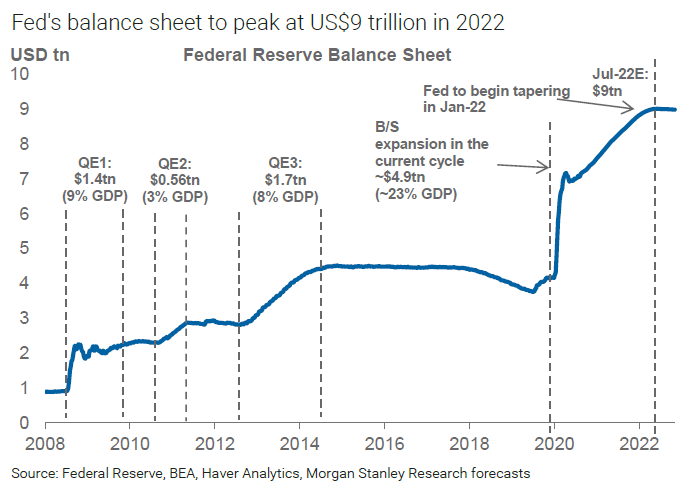

Meanwhile, the Fed has started its new Nutrisystem diet as it plans to shed $95 billion each month from its bloated $9 trillionish balance sheet, selling various securities it acquired in recent years as it implemented stimulus efforts and handed out money left, right, and center, which bloated its already hefty balance sheet by some 40% in just two years.

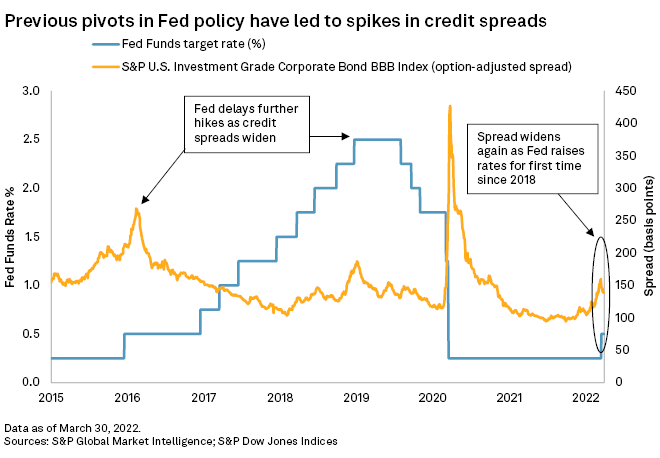

Higher interest rates continue to be in the cards, with the only question being how high do they go? These are such unprecedented times, it is simply hard to say, since so much depends on future inflation trends, and the to-be-determined Fed and investor response. What we are also seeing is not just higher rates, but higher spreads, the premium above Treasury rates that lenders are charging borrowers. In periods of uncertainty, lenders raise these spreads, which is hardly surprising.

Obviously, Clear Capital has not been immune to these trends, and we have been significantly whipsawed by higher rates. Because our value-add strategy dictates that we obtain variable-rate, “bridge” financing until we complete our planned improvements and replace the bridge financing with permanent debt, we have suffered the double-whammy of both higher rates and widening spreads. While we routinely acquire interest rate caps to hedge against interest rate increases, caps provide only partial protection against rate rises.

From the most recent inflation data, there may be a reason to be marginally optimistic that inflation will subside. Though the overall CPI-U increased by 8.5% in March of 2022 from the prior year, core inflation, which excludes more volatile food and energy prices was up “only” 6.5%, or 0.3% for the month. I suppose it is a question of perspective, but 6.5% is still far higher inflation that we have experienced in decades. I imagine that most Fed meetings are fairly dull affairs, but I think this year’s meetings may just be a little interesting than most. A tad.

Fortunately, multifamily investments ought to provide a reasonably good hedge against higher inflation, as rents rise to offset higher operating and capital costs

Perhaps the most common question I am asked these days is how multifamily investments will fare in an environment of higher inflation. Of course, it essentially boils down to four variables: rents, operating costs, cap rates, and financing costs, and

whether rents will (more than) keep pace with higher operating expenses (and capital improvement costs), and whether cap rates expand along with higher financing costs.

Overall, while I think the multifamily sector will continue to be a relative bright spot, investors will need to temper their expectations on future returns, continuing a trend that has persisted over time. While rents will continue to rise, so will operating expenses, albeit more slowly, if just because certain operating expenses are fixed or relatively so and should not change linearly with rents. Meantime, higher borrowing costs are inescapable, of course. Our cost of debt has increased nearly 200 bps (two percent) in what seems like the blink of an eye.

According to Redfin, multifamily rents rose 15% in February, year-over-year, while mortgage payments spiked by spiked by 31 percent. Both figures are the highest since Redfin began tracking this in 2019. The hottest markets generally remain those in the southeast and southwest, from Miami to Tampa to Orlando to Austin to Vegas to Phoenix to Portland, all of which saw rental increases of more than 23% over the past year, 8.5% inflation be damned.

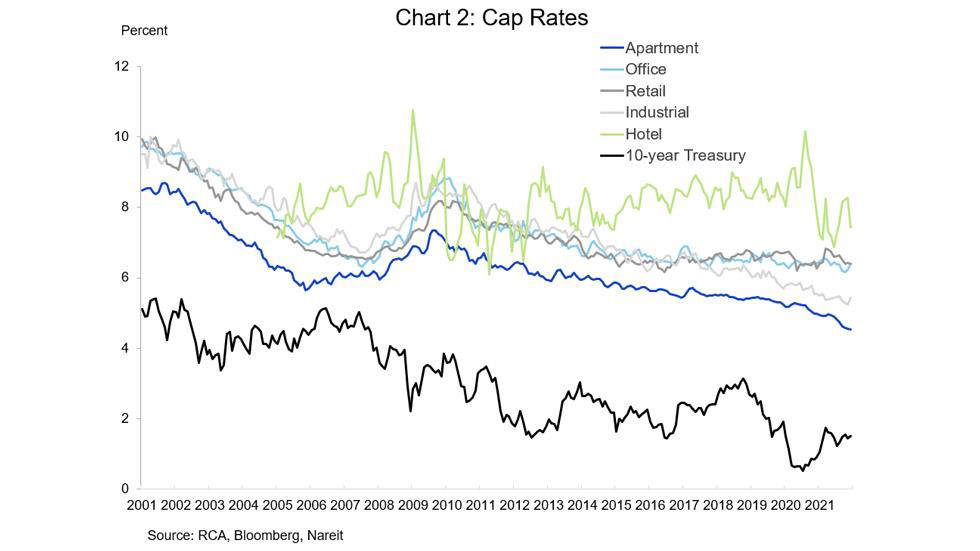

The biggest uncertainty is what happens to cap rates, which have steadily declined over the past decade. Common sense (which is often neither common or sensible) tells us that cap rates would have to move higher in the face of higher interest rates and resulting negative leverage, but there is still so much darn liquidity out there chasing investment opportunities and it is not exactly a secret that real assets should benefit from higher inflation. In the fourth quarter of last year, national cap rates reached a low of 4.7%, down 30 bps from the prior year.

In a nutshell, I am optimistic that the multifamily, self-storage, and hospitality sectors should fare best in an inflationary environment, but future returns in all sectors will be lower than in recent years, and that investors of all sorts ought to temper expectations looking forward.

One economic bright spot remains the strong labor market, though attracting and retaining talent remain challenges

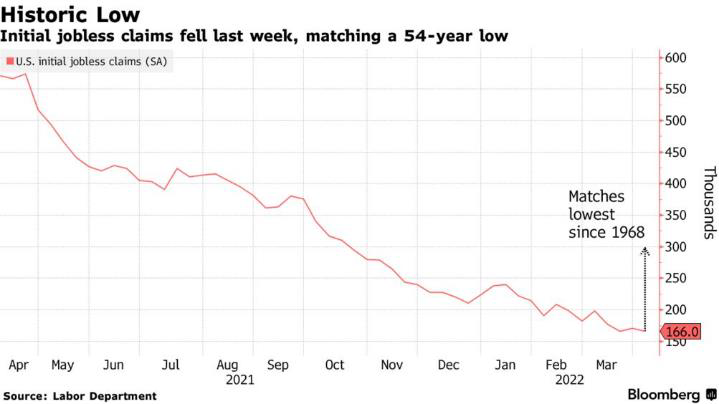

Despite the sobering headlines, the job market remains robust. Total nonfarm payroll employment rose by 431,000 in March and the unemployment rate declined to 3.6%, not too far away from the 50-year low of 3.5% we saw before the pandemic. Notable job gains were made in leisure and hospitality, professional and business services, retail trade, and manufacturing. Meantime, job openings remain at a record high, some 11.3 million at the end of February, while new jobless claims reached a 54-year low. In one sign of how desperate employers are to attract workers, Walmart is offering starting annual salaries of $110K for new truck drivers.

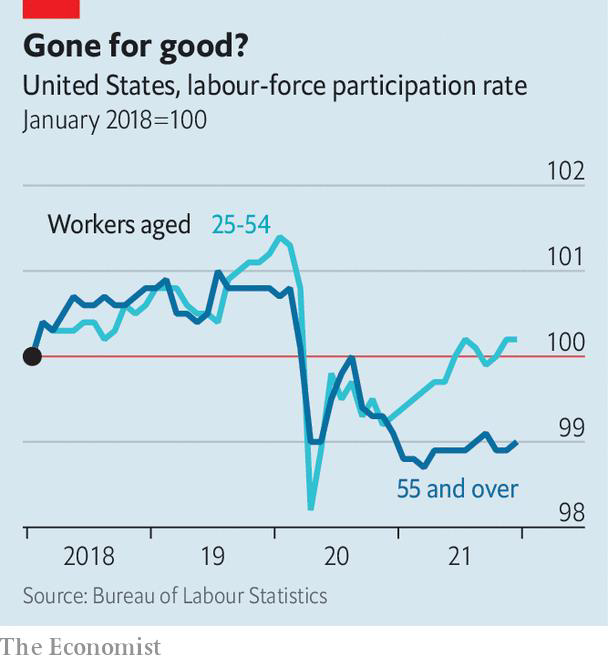

Finally, there were a couple of other interesting labor-related tidbits I happened to stumble upon that I thought were interesting. A recent article from the Economist argued that the pool of potential workers in the U.S. may be far smaller than previously thought because of the surge in asset values, which have increased household wealth, allowing many to work from home in some self-employed capacity or to leave the workforce (read: hang out poolside with mai-tai in hand) entirely. Data on “labor participation” seems consistent with this argument:

The other was the theory that many previous blue-collar workers - those working in construction, mining, and transportation - have transitioned to white collar positions, taking “office jobs,” as employers offer better pay, working conditions, and relax certain standards for employment, including the requirement that employees have a college degree. I suppose working for folks like Michael Scott, the fictional Regional Manager of Dunder Mifflin on “The Office” may look more appealing than driving for Walmart, no disrespect intended. The reality is that college enrollments dropped by one million during the pandemic, and as college gets more and more expensive, providing skills that might not translate to today’s workplaces, relaxing certain job prerequisites makes sense to me.

After a quiet end to 2021, politicians have been busy, busy bees in the first quarter, not just in California but throughout the country, as they deal with housing affordability and homelessness

Politicians continue to reach into their policy bags of tricks as they try, ineffectively, of course, to combat higher housing prices and rents. More broad use of rent controls and extensions of eviction moratoriums are mostly on the menu, while zoning restrictions are relaxed as well. The problem is that these policy changes either don’t work or are simply band-aids in nature, appealing to constituents, but offering little, if any, real relief. And, to be clear, these policy endeavors are not just limited to the “Blue States,” as these issues confront constituents just about everywhere.

• Senate Bill 9, “California Housing Opportunity and More Efficiency Act,” (whoever came up with this name should get an award), which I have mentioned previously, went into effect at the start of 2022, allows up to four units to be built on any particular lot previously zoned “R-1” and single-family units. The Wall Street Journal could not have been more effusive about the Bill, with one op-ed author estimating that around 2.5 million single-family homes could be converted to duplexes. However, the author is naïve, failing to recognize and appreciate the numerous impediments to additional construction, from the availability of contractors and subs, higher material costs, the permitting process, the higher cost of and access to debt or other capital that might be used to construct these additional units.

• Assembly Bill 2179: A week before California’s eviction moratorium was scheduled to expire, the Legislature announced and the governor signed into law a proposal to extend Covid-19 protections for tenants by an additional three months, to July, so that the state can “finish sending out rent relief payments.” California politicians have kicked this can down the road for so long, they are almost reaching the Oregon border.

• Regents of the University of California v. S.C. (Save Berkeley’s Neighborhoods): In 2019, a local neighborhood group, “Save Berkeley’s Neighborhoods,” sued the University to compel it to redo an environmental impact report regarding the impact on increased enrollment levels on everything from housing prices to traffic, and that the report that had previously been submitted violated California’s Environmental Quality Act. Between 2010 and 2020, attendance at UC Berkeley jumped up from around 36,000 students to over 42,000 students and now exceeds 45,000. In a ruling that surprised no one, at least not yours truly, the California Supreme Court ruled in favor of the Defendants and that the University must freeze enrollments for failing to provide enough housing for students around campus.

• Rent Control Bills in Numerous Jurisdictions: A recent Globe Street headline read, “Rent Control a Top Priority for Local Lawmakers,” the scariest publication title since “The Amityville Horror” (dating myself again). From Boston to Montclair (New Jersey), to mobile-home communities in Colorado, to several metros in Florida, proposed rent controls are on the menu. In those places with previously enacted rent controls, proposals to establish more restrictive caps on rent adjustments are in the works. In St Paul, Minnesota, for example, voters will decide whether to limit annual rent increases to 3%, regardless of inflation. Such a proposal, if passed, would constitute some of the more restrictive rent controls to be found in the country.

Frankly, there are others in the works, but in the interest of brevity (#sarcasm), I will leave discussion of other public policy brilliance to future quarterly updates, since I think you get the point.

And finally, before we put another quarterly chronicle to bed there are a few other economic, financial, or real estate related tidbits from the first quarter I found noteworthy

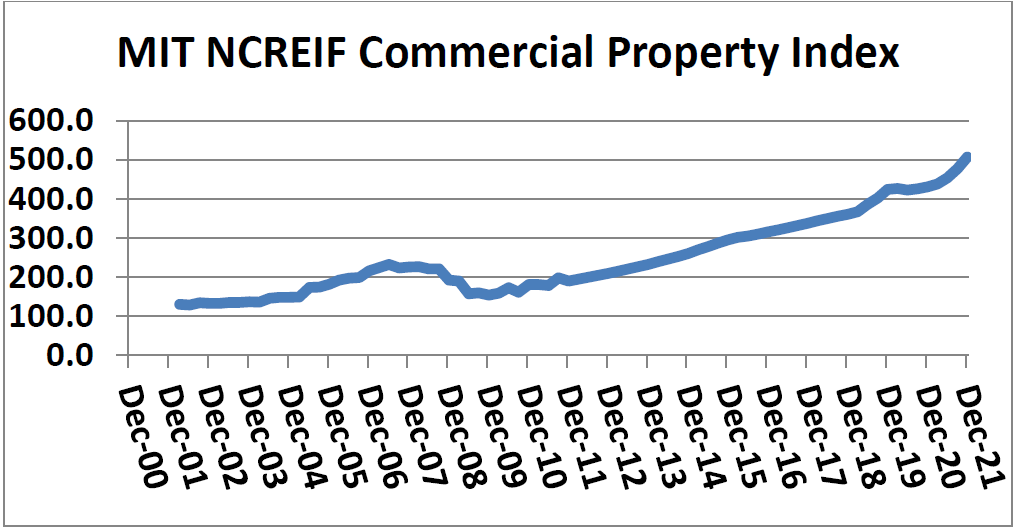

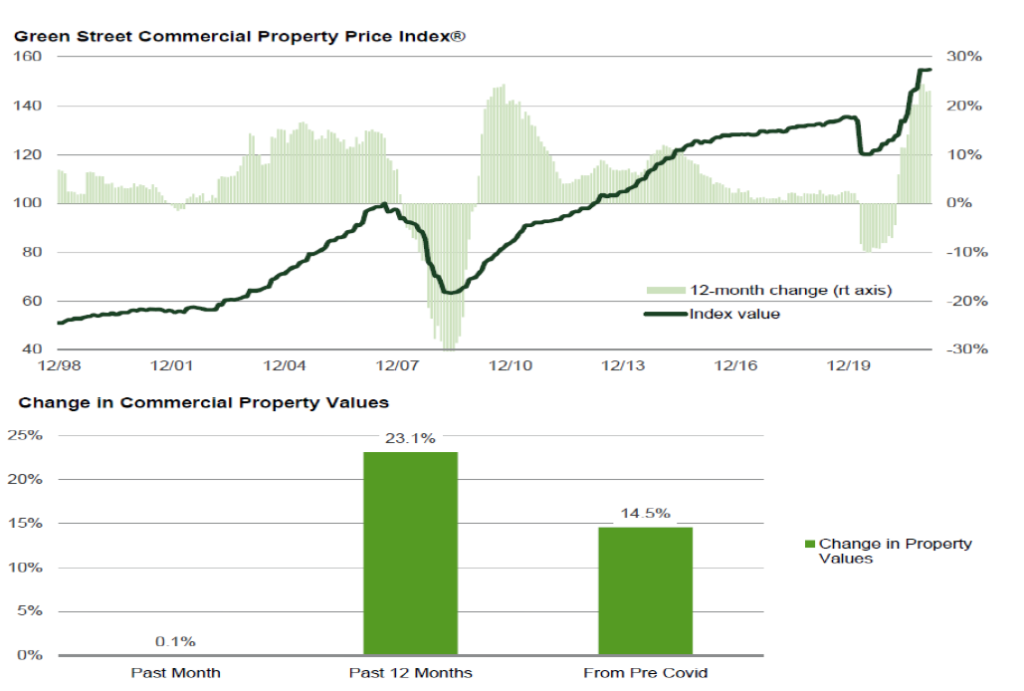

• Commercial real estate continues to shine: Despite facing many of the same headwinds as the multifamily markets, and others, from the increase in remote work and Amazon.com, commercial real estate values, from office buildings to shopping centers to industrial buildings to hotels, continue to appreciate. Obviously, excess liquidity remains a tailwind, as does the perception that real estate provides a reasonable inflationary hedge. According to Real Capital Analytics, commercial properties saw record sales last year, reaching $809 billion, nearly double 2020’s total and the previous record of $600 billion record in 2019, preceding the pandemic.

• Recent data confirms recent trends in demographic shifts and fertility rates: Data published by the U.S. Census Bureau at the end of March indicated that California saw a net loss of 262,000 residents for the year ended June 2021, with the lion’s share of the losses coming from Los Angeles County (159,621 people, about 1% of the total population). The second largest countywide loss was experienced in New York, which declined by about 111,000 residents (6.9%), followed by San Francisco (54,000 residents or 6.7%). Obviously, the Covid-19 pandemic was impactful, but the data underscores how California’s housing crisis and other demographic forces are reshaping some of the country’s largest cities.

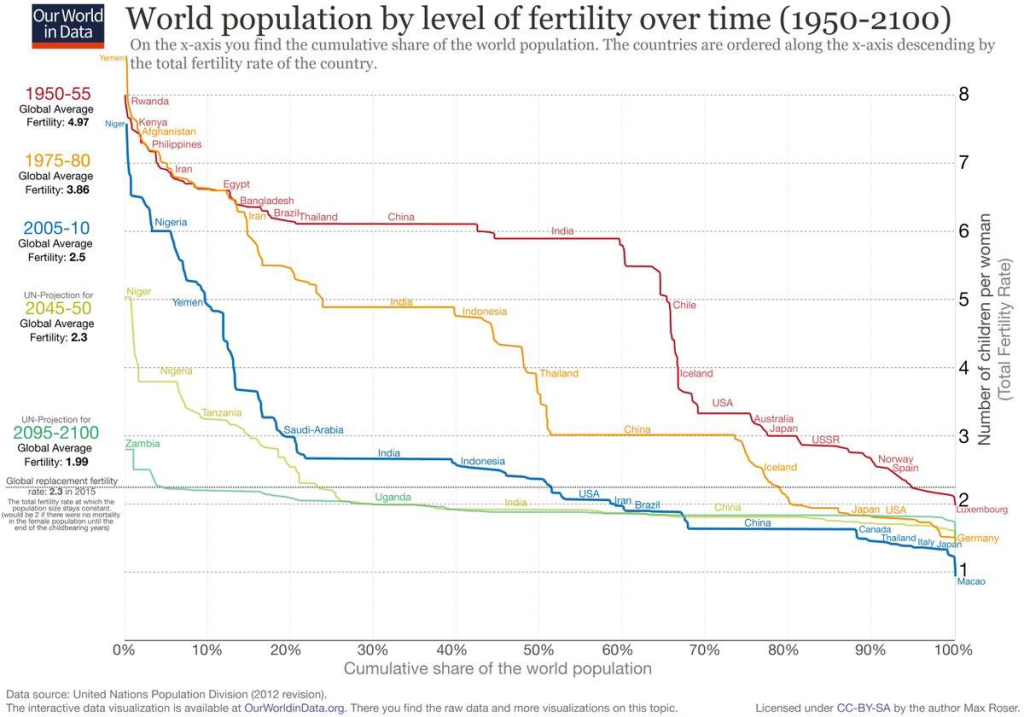

Meantime, the following graph is a bit sobering as one thinks about long-term global economic growth. The bottom line is that global population growth is expected to continue to decline over time, with drops in economically developed nations being the most pronounced. Perhaps U.S. politicians should spend less time talking to media microphones and more time promulgating meaningful tax and immigration policy to stem this negative trend.

• Employers are beginning to mandate that employees return to work: In early March, Apple CEO, Tim Cook, told employees that they needed to return to the office full-time on April 11th. And if traffic on Los Angeles freeways is any indicator, most companies are asking employees to leave their home offices and Lululemon pants behind and return to the workplace. You may recall that I wrote sometime ago that I could not imagine firms hiring the best and brightest so that they could work separately and remotely from home, not with collaboration being so crucial. Perhaps employers recognize the importance of the ”Allen Curve,” named after the author of a 1970’s study, which indicated that communication between office workers declined exponentially with the distance between their desks.

Concluding Thoughts

As I look at the bottom of the MS Word version of this memo and realize that I am on page 24, I really hope that the second quarter will be less newsworthy. More than a few of you have noted that these memos continue to grow in length, and I can only tell you that it’s not my fault. There is just so much material economic data to digest and think about, and it is important that I/we do so.

Markets are fickle creatures and investor sentiments move on a dime (ok, a quarter or more given inflation), especially in this technological age. Just think about Phoenix for a moment. Fifteen years ago, during the Great Recession, Phoenix real estate prices tanked, and single-family foreclosures dotted every block. Prospective homebuyers in that market were able to shoot fish in a barrel, as they say. The median home price was something like $218,000. Fast forward to 2019, preceding the pandemic, and prices had increased, but modestly, to $285,000 (about 31%, or 2.5% annually). And today? The median price is $435,000 (a nearly 53% increase) and moving higher each week.

Perhaps the picture below from October 2020 says it all. Jim Cramer, one of my favorite television entertainers (comedians?), was waxing effusively about “The Magnificent Seven,” stocks in which “investors don’t care what they do. They just want to own the names.” Well, if you have some spare time on your hands, you might want to check out the charts for Netflix, Roku, Peloton, Square, Paypal, and Zoom, to see just how “magnificently” those stocks have done since then. Tesla is the only name yet to implode, so tread carefully.

In closing, the beginning of 2022 has begun as I anticipated, with some significant headwinds and challenges (e.g., inflation, less accommodative Fed), and that was before Vladimir Putin decided to add his name to the sadly long list of despicable autocrats and warmongers. Investors will need to place capital thoughtfully during the first half of 2022, focusing on investments that can withstand if not perform well in excessively inflationary environments and paying close attention to data as it emerges.

Finally, and as always, we remain so appreciative of those of you who continue to support our firm and its endeavors. I am so grateful that that list is as lengthy as it is. And to those of you who somehow got through all 25+ pages of this missive, I owe you a very special round of thanks!

Best,

Eric Sussman