“The good news is that economists are intelligent, engaging, and often charming folks. The bad news is their work is often of little use to investors.”

- Barry Ritholtz

The only function of economic forecasting is to make astrology look respectable.”

- John Galbraith

After reflecting on the events of the second quarter, I was tempted to begin this memo differently, with a quote from a Grateful Dead album cover, “What a Long, Strange Trip It’s Been.” How else might one reconcile U.S. equity markets at (or very near) all-time highs, unemployment at 50-year lows, U.S. Treasury yields at their lowest levels in three years (with a modestly inverted yield curve), and the Federal Reserve poised to cut interest rates later this month? Why would the Federal Reserve even be contemplating a reduction in interest rates in the face of such seemingly strong and compelling economic data? And here I thought the ending of Game of Thrones was hard to explain.

Indeed, trying to weave seemingly contradictory realities into a cohesive narrative is no easy task. To wit, not one of the 69 economists surveyed by the Wall Street Journal in January predicted that 10-year Treasury yields would be below 2.5% this year. And yet, as I write, 10-year Treasury yields sit at 2.04%. Talk about a whiff. I suppose that we can conclude that market “pundits” should not open up tarot card reading storefronts any time soon. Their primary defense would be that it has indeed been a long, strange quarter.

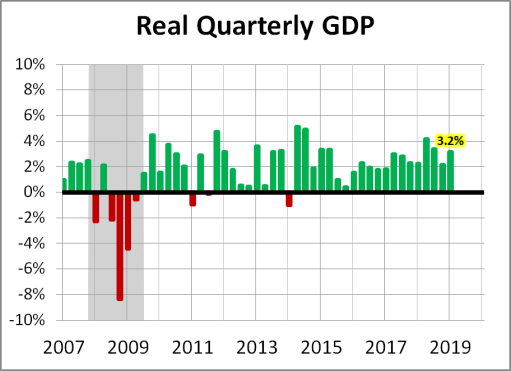

Perhaps the conflicting signals merely indicate a stretched expansion, somewhat past its “sell-by” date. The reality is that this particular expansion, despite its record length (120 consecutive months and counting), has been fairly uninspiring, with average annual GDP growth of just 2.3%, far lower than what has occurred in prior expansions (3.6% annual growth in the last three). However, there are few signs that a significant market correction is around the proverbial corner, as bank balance sheets appear in decent shape (Deutsche Bank notwithstanding), bank lending practices seem reasonable (unlike the recklessness we have witnessed in the not-too-distant past), and inflation modest.

Some individual stocks certainly seem overvalued, and mounting federal deficits ($1 trillion in 2019), significant national and global geopolitical and economic uncertainty, and that imminent, and arguably ill-timed, rate cut are causes for concern, but I don’t see broad systemic risks, at least not yet. However, my sense is that the markets are flagging a bit as they seek greater clarity about so many of these uncertainties and areas of concern.

With that being said, here are the highlights from the second quarter:

- Equity markets experienced their best first half of any year since 1997, with the S&P 500 up over 17%, marked by a flurry of noteworthy (and fairly successful) initial public offerings: Uber, Lyft, Zoom, Pinterest, and the gold medalist of the bunch, Beyond Meat, which has quadrupled from its initial offering price.

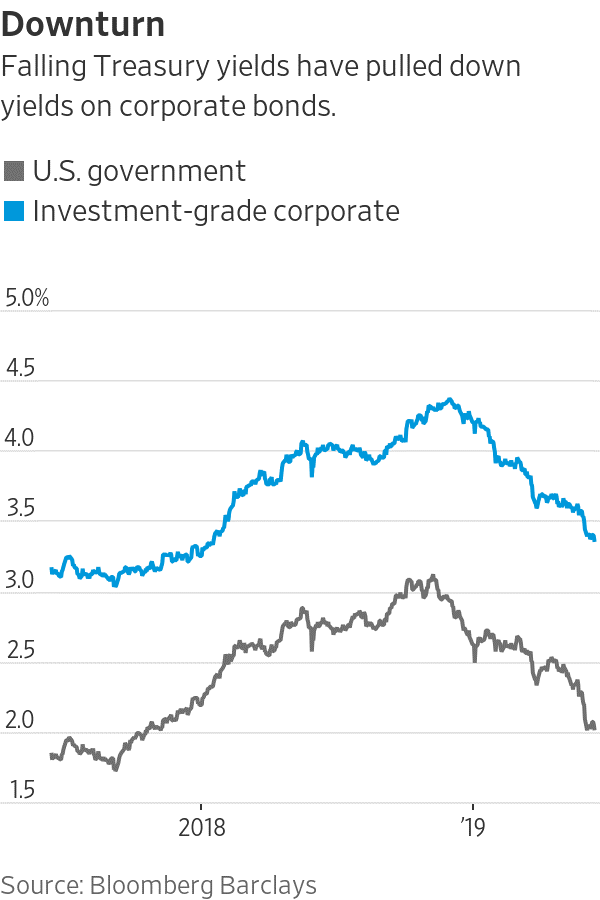

- Bond yields plunged with rates on 10-year Treasuries falling all the way to 2.0% from 2.41% at the start of the second quarter (most recently at 2.04% as noted above). On June 3rd, yields on three-month Treasuries exceeded that on 10-year bonds by the largest amount since 2007, reflecting the failure of GDP and inflation targets to hit Fed targets, declines in the Manufacturers Purchasing Manager’s Index (which fell to lowest levels since September 2009), ongoing trade tensions, an end to the stimulus resulting from the 2017 Tax Bill, political theatre in our nation’s capital, and/or simple secular stagnation at the tail end of an aging expansion.

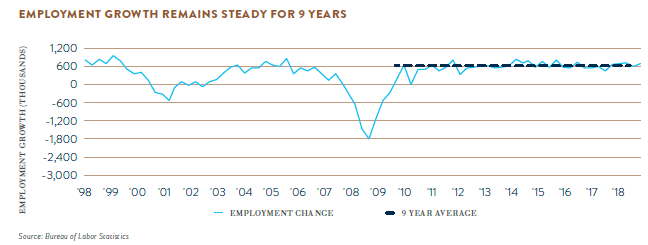

- In June, 224,000 new jobs were created, far surpassing expectations, and representing more than twice as many jobs needed to keep pace with workforce growth. In total, 562,000 jobs were added during the quarter, impressive results by any measure.

- New York passed what can only be described as the most tenant-friendly extension of rent control and tenant protections that I have witnessed in my 25 years in this business. The media generally described it as “historic,” which is not inaccurate, but perhaps a tad euphemistic. I might have chosen words like “draconian,” “misdirected,” or “excessively overreaching.” Perhaps most telling was when one of the lead organizers pushing for the new law stated that “it’s stronger than anybody predicted going into the campaign.” And as will be discussed in greater detail below, California is poised to follow suit with its own form of statewide rent control. Quasi-nationalization of rental housing seems to be the tool of choice for politicians trying to address spiraling residential occupancy costs, a worrisome proposition in my view.

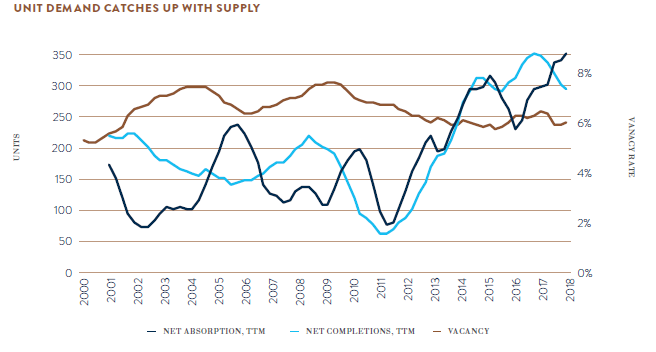

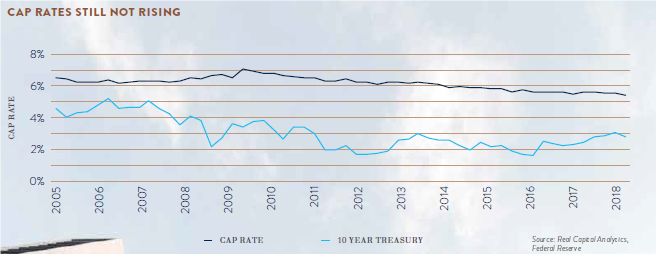

Meantime, strong investor appetite for multifamily assets continues unabated reflecting market liquidity, the decline in interest rates, and solid fundamental underpinnings. Prices for apartment assets increased 8.8% during the twelve months ending in May, far exceeding inflation, of course, though less than the nearly thirteen percent rise in the previous year. The result is a decline in investment yields and cap rates, which averaged 5.20% in the first half of 2019, down five basis points from the same period in 2019.

Investors, including Clear Capital, have been compelled to look to secondary and suburban markets in their search for opportunity and yield. We continue to evaluate opportunities in various Texas markets (e.g., Dallas/Fort Worth, Houston, San Antonio, and Midland), but are underwriting projects in other markets including Phoenix and certain submarkets outside of Denver, areas with favorable demographics, strong job growth, and good schools.

State politicians should receive overtime pay given how darn busy they have been passing housing-related legislation

Based on the number of housing-related initiatives and legislation that were proposed and promulgated this quarter, it is clear that politicians are squarely focused on doing what they can to rein in spiraling housing costs. My past predictions in this regard have, unfortunately, proved quite prescient. I alluded to New York’s recently passed legislation that provides significant protections for tenants, and prevents landlords from raising rents (even when rental units are vacated). New York politicians were indeed very, very busy as they also passed the Climate Mobilization Act, requiring large and medium-sized buildings to reduce their carbon emissions by 40% by 2030, and 80% by 2050, and another law prohibiting the conversion of rental units to condominiums. And lest you think this is merely a unique or blue-state only phenomenon, even Georgia passed some tenant protection laws in late April. Yes, deep-red Georgia.

Here in California, statewide rent control, mirroring what was passed in Oregon, is right around the corner. In late May, the California State Assembly passed a bill which would cap annual rent hikes statewide to seven percent plus inflation, though, if passed, it would only remain in effect for three years, a compromise to get it passed. The bill still needs Governor Newsom’s autograph, though I am fairly confident he will do so. Even closer to home, Los Angeles is considering passing a law, which would assess a “vacancy penalty” for residential property owners that do not occupy or otherwise rent their homes. Similar laws have been passed in Vancouver, Washington D.C., and Oakland, but their efficacy is profoundly unclear. Common sense tells you that such laws might have some modest impact on tax revenue, but is not going to make any discernible dent on housing shortages. Such regulations almost reek of desperation.

Other recent governmental regulations include toughening energy mandates for sustainable development. In Nashville, for example, newly passed regulations now require all projects over 5,000 square feet or that cost in excess of $2 million obtain to silver LEED (Leadership in Energy and Efficient Design) certification. Finally, across the pond, Berlin’s government has agreed to freeze rents for five years starting in 2020 in an attempt to halt “runaway gentrification.” Rents there were up seven percent in just the first quarter of 2019 alone.

Will any of these regulations address spiraling housing costs in any meaningful way? If history and economic theory have any probative value whatsoever, the answer is a resounding “no.” But politicians have bad habits of taking paths of least resistance, repeating sins of the past and passing laws that appear attractive on the surface, but do not really provide meaningful, sustainable solutions: increasing housing density and supply, relaxing laws and regulations that delay and/or deter new projects, and providing economic carrots and incentives to developers, property owners, and landlords. I am sure there are limits to how far politicians can push the quasi-socialization or nationalization of residential rental markets, but we do not seem to be there quite yet.

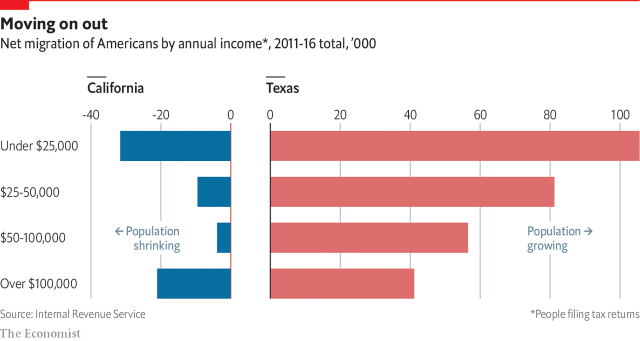

In light of all these public policy and regulatory machinations, the shift that Clear Capital has made in recent years, reallocating capital from California to other markets like Texas is not accidental. We are by no means abandoning our home state, but have to be considerate of the political climate in our underwriting and asset management practices.

While Q1 GDP growth rose more than expected, the outlook for GDP growth during the remainder of the year appears far less impressive

2019 started off strongly, with first quarter GDP increasing more than expected (3.1%), due principally to rising exports, declining imports, and higher investment in inventories, in response to increased tariffs and a flat U.S. dollar.

However, there is near universal agreement that lower growth is in our future, at least for the remainder of 2019. Granted, this is the view of “professional forecasters” surveyed by the Federal Reserve Bank of Philadelphia, and I am generally cynical about the whole forecasting business, and I have no idea what qualifies someone to be a “professional” forecaster (almost seems oxymoronic.)

However, I have always believed that three percent real growth is a realistic target (and likely long-term ceiling) for a large, fairly mature, and diversified economy like ours, already characterized by full employment. And if anything, I see downside risk looking into 2020 if simply because this period of economic growth has persisted for as long as it has, our nation’s capital remains in a state of legislative paralysis, and global growth rates virtually everywhere are dropping.

Meanwhile, the U.S. job market keeps humming right along….

Perhaps the employment figures remain the best news in a sea of economic data, if the June hiring data alluded to above is any indicator. I can’t imagine unemployment rates going any lower than 3.6 %, where they stood in May, and sure enough, in June they ticked up ever so slightly to 3.7% in June, mostly resulting from a greater number of people looking for work. The reality is that actual employment growth has been remarkably consistent and steady for nearly a decade.

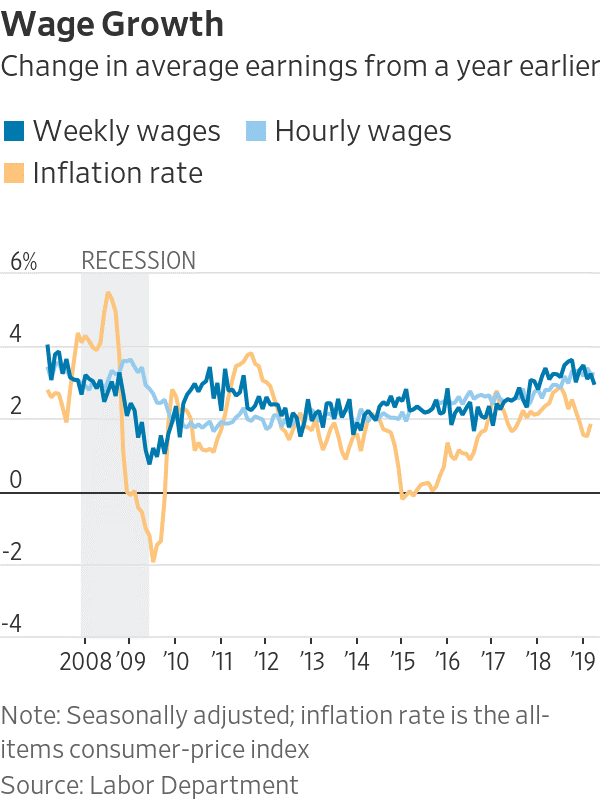

Perhaps the bigger question is wages, as the traditional correlation between employment levels and wage inflation (the Phillips Curve) has not applied for some time, reflecting the impact of technology and increases in productivity as we have discussed in previous missives. However, I sense this is starting to change, in part due to more widespread increases in the minimum wage, but also due to employers having greater difficulties in filling available positions. While a federally-mandated $15 per hour minimum wage has been recently passed by the House, it certainly won’t reach a vote on the Senate Floor. Meanwhile, 18 states began 2019 with higher minimum wages (than the prior year), and 29 states now have minimum wages above the Federal minimum of $7.25 per hour.

While extremely low interest rates and bond yields, here and abroad, continue to defy expectations and confound those professional forecasters…

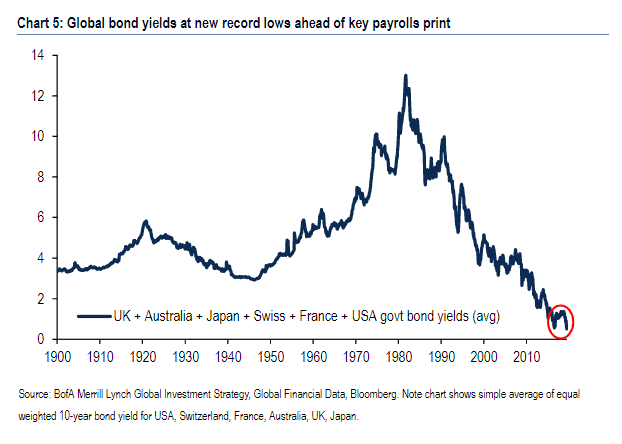

While 10-year U.S. Treasury yields hover around 2.0-2.10%, well below what

“professional” forecasters (and even an amateur or three) predicted, global bond yields remain at or near record lows, while as much as twenty percent of the $55 trillion in global debt has negative yields, in the face of slowing growth and tame inflation. In fact, a recent Business Week cover asked rhetorically, “Is Inflation Dead?” I imagine countless economics and finance professors around the globe are suffering migraines as they try to answer this very question and make heads and tails out of this new interest rate reality.

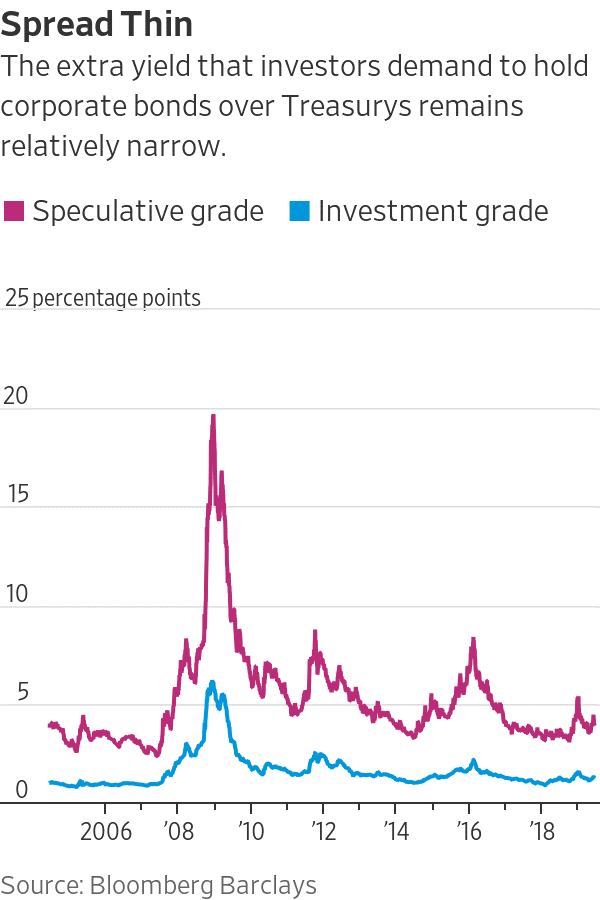

Here at home, investors chasing yields have narrowed the gap between investment grade (read: “junk”) bonds and risk-free bonds, while issuances of investment grade debt globally has ballooned, to $52 trillion, double that outstanding at the time of the financial crisis.

Finally, there are some other trends and data points worth noting, as there always are…

Growth in Co-Living Housing and Co-Working Sectors: Imagine a high-end fraternity house (or sorority, if you wish), where individuals rent beds instead of units while sharing certain common area amenities (e.g., kitchens, bathrooms). For younger, cash-strapped individuals, such units might make sense in certain core housing markets, and several developers are building such projects. In fact, the largest co-living building is coming to San Jose, thanks to Starcity, a start-up which plans to build an 800-unit, 18-story “dorm for adults” to help affordably house some of the Silicon Valley workforce. The firm has already broken ground on seven such developments in Los Angeles and San Francisco.

In a typical Starcity project, residents receive a furnished 130- to 220-square foot bedroom (read: shoebox) and share communal kitchen and living space at rents of some $10/foot. Yes, $10 per foot. Meanwhile, co-working commercial tenants also remain very active. For example, WeWork leased over 360,000 square feet across five new leases in the Los Angeles submarket in just the last quarter. How sustainable and scalable this trend is remains to be seen, but it appears to be a logical reaction to broader market forces.

The zombie apocalypse may already be here: I recently read a report published by Bank of America- Merrill Lynch, which determined that thirteen percent of developed-country and sixteen percent of U.S. public companies cannot cover their interest payments, and are relying upon the largesse of the capital markets to remain in business. Think about all of the so-called “unicorns” that recently went public (e.g., Lyft, Uber, Pinterest). Think about Tesla or Netflix. These so-called companies carry extraordinary valuations but have never generated sustainable, if any, operating cash flows and repeatedly raise capital to fund cash flow deficits. This remains a modest systemic risk if and when the capital spigot turns off, and these zombies could suddenly and unexpectedly face their day(s) of reckoning.

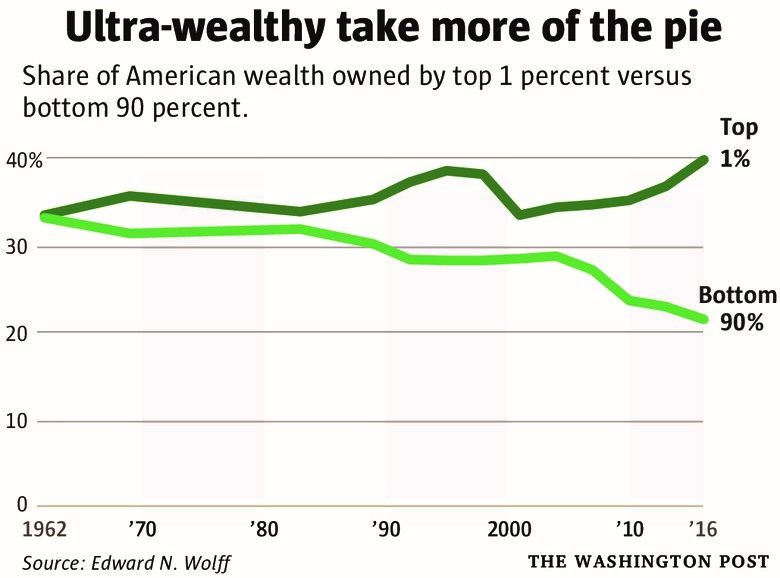

The inequality between the “haves” and the “have-nots” continues to grow in the U.S.: I continue to believe that growing wealth inequality is another material systemic risk. As it stands, the top 0.1% of U.S. taxpayers control 20 percent of American wealth, the highest level since 1929. The top one percent controls 39 percent, and the bottom 90 percent only 26 percent. I don’t think this is something that can simply be ignored, and history tells us so.

Finally, is Texas the adolescent California? The June 22nd edition of the Economist included a lengthy article (actually a series of smaller articles) about California and Texas, comparing and contrasting the two states. The articles were very interesting in their own right, but especially so given Clear Capital’s change in strategy over past few years, as we have actively pursued projects in Dallas/Fort Worth, and significantly reallocated capital from California under our premise that Texas markets have substantially more upside. In that regard, the Economist posed the question as to whether Texas is merely an “adolescent California?” In any event, here are some interesting tidbits from the article:

- One in five Americans call Texas or California home, and one in four will do so by 2050. The Dallas and Houston markets each gained over one million people since the 2010 census, so that they now rank as the fourth and fifth most populous cities in the U.S., behind New York, Los Angeles, and Chicago.

- If California and Texas were standalone countries, they would rank fifth and 11th respectively, in terms of overall GDP.

- The cost of living in California is 40% higher than the national average, while in Texas, it is 9% below the national average.

- Between 2007 and 2016, a million California residents (net), representing approximately 2.5% of the population departed for other states. Texas was the most common destination.

- In 2019, several California companies relocated their headquarters to Texas including McKesson (medical products distributor), Core-Mark (supplier to convenience stores), and Jamba Juice. Other California companies are adding significant jobs outside the state. By the end of 2019, for example, Charles Schwab, founded and headquartered in San Francisco, is expected to have more employees in Texas than California.

- In terms of the “ease of doing business,”, Texas was ranked first and California, 25th. One person interviewed for the story quipped that, “It is easier to do business in Cuba than San Francisco”. For example, one can generally secure a building permit within a few months in Texas, while in California permits can take years due environmental reviews, legal challenges, and mind-numbing bureaucracy.

- As much as the article was extremely bullish on Texas, one of the articles noted that the lack of a state income tax in Texas is problematic as revenues from other sources, namely sales and property taxes, need to satisfy the State’s funding needs. In fact, we have had to appeal the extremely aggressive reassessments of property taxes that we have received on some of our recently acquired properties in the Texas market.

In short, I believe Texas to be, in many ways, an adolescent California, with significant economic upside. However, that upside and the business and population growth that it brings will create stresses on the State’s infrastructure, political, and tax systems, and it will be interesting to see how the state responds. In any event, Clear Capital’s substantial allocation of capital and resources into the Dallas market was not made accidentally.

In closing, the second quarter provided as many questions as answers as we wonder how much longer current economic expansion can continue. Regardless, the multifamily market appears poised for continued success, especially in the markets on which we focus

Reviewing and evaluating so much disparate economic, financial, and demographic data can be a bit like reading tea leaves, especially when we are flooded with new, different, and seemingly conflicting data so regularly. While there are certainly some causes for concern and yellow lights flashing, no recession appears imminent and the fundamental underpinnings supporting the multifamily market remain well intact.

For those of you who have committed to invest in our most recent offering, Woodmeadow DFW, LLC, we are excited by the opportunity and upside that it presents, and we hope to offer similarly compelling opportunities in the latter half of the year. Each week, our recently expanded underwriting team is evaluating numerous projects for potential acquisition, and I remain confident we will find some.

In the meantime, thank you once again for the trust and confidence you have placed in the Clear Capital team, and let us know if you should have any comments or questions about your investments with us, our offerings, or even the views or opinions I express in these memos.

Best,

Eric Sussman

Founding Partner