“If you have to forecast, forecast often.”

- Edgar Fiedler

“An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.”

- Evan Esar

As I reflect back on the recently concluded third quarter, I would like to start by engaging you in a simple thought experiment. Imagine that you emerged from hiding on October 1st after a three-month vacation on a deserted island in the Pacific, and someone handed you the following list of data points from the most recent quarter. After you had a chance to peruse the list, they asked you to predict how the domestic equity, bond, and real estate markets fared during the period, in light of what you had reviewed. Here is the list:

- Impeachment proceedings against a U.S. President commenced for only the fourth time in our nation’s history

- The September U.S. Manufacturing Survey (the Purchasing Managers’ Index from the Institute for Supply Management) had its worst showing (47.8%) since June 2009, and its second consecutive month of contraction, a decline from 49.1% (any reading below 50% is indicative of economic contraction)

- The New Export Orders Index (also published by the Institute for Supply Management) was only 41%, its lowest level since March 2009

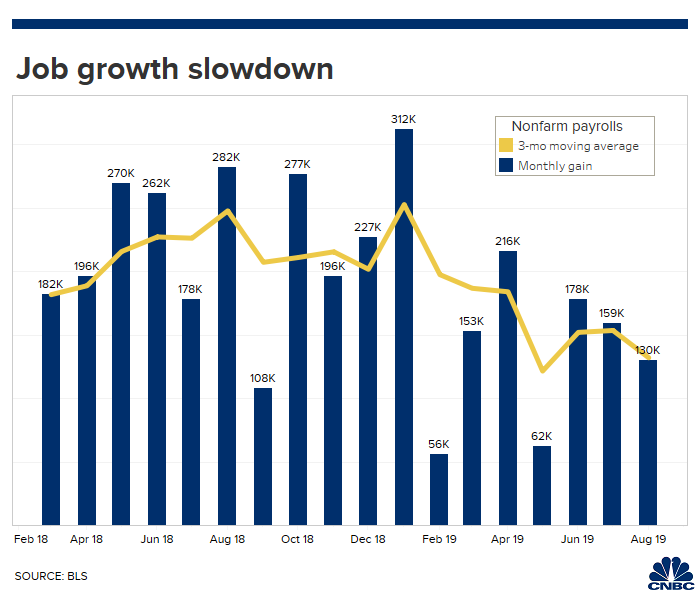

- Job growth slowed in September (135,000 new jobs added versus 168,000 in August, 223,000 in the same period in 2018, and forecasts of 145,000 new jobs), while wages rose just 2.9% (year-over-year), the lowest rate of increase in over a year

- California passed statewide rent control, joining Oregon and New York in this select (read: auspicious) group

- The Fed embarked on this decade’s first rate reduction “cycle,” with two 25 basis point cuts to the Federal Funds Rate

- In August, the yield curve completely inverted, with all maturities of treasury securities yielding less than that same Federal Funds Rate

- In mid-September, the Fed implemented “temporary operations” to relieve short-term stresses and soaring borrowing costs in the short-term funding markets (money markets) for the first time since 2008

- Brent and WTI (West Texas Intermediate) crude oil prices declined 8.5% and 5.8% during the quarter, respectively, despite attacks against Saudi Arabia’s oil infrastructure

- WeWork was forced to scrap its highly anticipated initial public offering, seeing its most recent valuation of $47 billion (from its last capital raise) evaporate to near insolvency in weeks, the latest in a string of stunningly weak public offerings of previously highflying “unicorns.”

- Utilities and real estate investment trust’s shares, generally considered safer and more conservative investments, significantly outperformed broader market indices in September

Further imagine that I added one other data point, that retailers, through the third quarter, had already announced nearly 7,900 store closures in 2019, easily surpassing 2018’s entire total of 5,844. Now I am going to go out on a proverbial limb to suggest that you (and I, for that matter, along with nearly everyone else) would conclude that any and all financial assets had been soundly trashed during the quarter, and that a significant economic downturn was not just imminent, but had quite possibly already begun. And yet…we would all be wrong, as not only did none of these things occur, but seemingly quite the opposite. Most domestic equity indices remain within hairs’ breadths of their all-time highs. As I type, the S&P 500 sits less than one percent below its record high. U.S housing starts increased 12.3% in September (from August), reaching their highest level since June 2007. Multifamily rents increased 0.8% during the quarter, and, while nothing to write home about, continued to outpace inflation. And while job growth has slowed, some 470,000 jobs were added in the third quarter, adding to the record number of consecutive months (109!) experiencing job growth, and the unemployment rate dropped to a 50-year low, 3.5%. A late 2019 or early 2020 recession, which seemed a certainty not too long ago, seems far less likely today, although economic winds can shift quickly in these fairly volatile times.

In any event, how might we reconcile these seemingly inconsistent realities? The answers are likely several-fold, as no simple explanation suffices. One, market liquidity remains very high, aided by the Fed’s recent monetary easing. Two, the U.S. remains a destination for risk-averse capital in an environment of significant global uncertainty. While U.S. equity indices produced positive returns in the quarter, non-U.S. equity indices all finished in the red, with emerging market equity prices declining over 4.0%. Three, with interest rates, here and elsewhere, at or near record lows (see additional discussion below), if not negative, such inexpensive capital costs coupled with the widespread availability of capital compel investment in riskier assets. And finally, the broad trends in commercial real estate, those we have discussed for years, remain firmly intact, with strong demand for apartment assets and other income-producing real property.

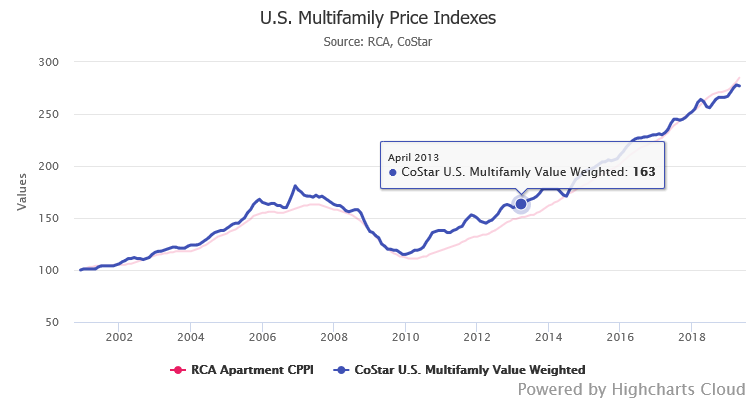

Focusing on multifamily markets, the sandbox where Clear Capital plays, market fundamentals remain squarely intact. Apartment occupancy reached an all-time high earlier this summer, exceeding 96% across the country, surpassing the previous high achieved in 2000. National asking rents rose very modestly during the third quarter, up about 0.8%, less than previous quarters, but above inflation. Net unit absorption approximated 33,000 units. Apartment asset prices continue to rise – up over eight percent during the last year – though the rate of price increases has abated, not surprising given how apartments have performed over the past ten years and the slowing (yet still attractive) rate of rental growth. Metros that posted the highest effective rental growth include two markets in which Clear Capital is acquiring assets, Phoenix and Colorado Springs. One picture provides a macro-view of the multifamily market over the past 20 years:

As discussed in greater detail below, the third quarter provided a number of significant and noteworthy data points, all of which we consider in our strategic decisions: what investment opportunities to underwrite and pursue and in which geographic markets, which assets we should monetize via sale and/or refinancing, and how to improve or upgrade acquired properties in order to maximize each property’s cash flows and returns.

With every passing quarter, it becomes clearer and clearer that apartments remain the most practical solution to the nation’s (and world’s) housing needs

Two recent articles from the Wall Street Journal say it all: “Financial Crisis Yields a Generation of Renters” (July 27th) and “So You Make $100,000? It Still Might Not Be Enough to Buy a Home” (October 15th). The headlines speak for themselves and echo sentiments we have written about for years. I won’t belabor the broader conclusions set forth in the articles, lest I sound like a broken record, but a few data points are worth repeating.

One, the median age of a homebuyer in the U.S. is now 46, higher than it has ever been since the National Association of Realtors began tracking such data in 1981. The average price of a “starter” home has risen over 64% since 2012, outpacing the 40% gain in higher-end homes. The median home price in the U.S. now exceeds $278,000, reflecting ninety consecutive months of price increases, and an increase of 4.7% over the past year. Employee wage gains have not nearly kept pace. Nearly a third of all renter households consist of individuals in their 20’s and 30’s, living alone, in middle-market, Class-B product. More than half (about 55%) have student debt. About a third of recent college graduates live with their parents, versus 19% in 2005. Nearly a fifth of U.S. households with incomes above $100,000 are renters, up from 12% in 2006. And in primary markets, it is estimated that at least half of recent graduates return to the nest, according to Apartment Guide magazine.

Perhaps these trends are not necessarily bad things. Renting generally presents reduced financial burdens and risk, while providing greater flexibility. Companies like Roofstock (ironically run by a business school classmate of mine), American Homes, and Invitation Homes, firms that collectively own thousands of homes for rent, did not exist ten years ago.

In related news, homebuilders appear to be cutting back significantly on new construction due to trends we have also previously addressed: increasing construction costs and government fees (up over 25% in the past twelve to eighteen months), NIMBYism (Not in My Backyard), labor scarcity, higher land acquisition costs, more conservative lender underwriting (lenders now fund lower percentages of construction costs, generally 60%), lower foreign investment, and broader economic, political, and social uncertainties. In the first half of the year, for example, California builders obtained approvals for some 51,178 new homes, nearly 20% fewer than in the prior year period, and the first meaningful decline since the financial crisis. The drop was even more significant in Southern California, where approvals were down 25%. The trend is widespread (permits are down 6% nationally) and is perhaps a bit worrisome given where we are in the economic cycle.

Interestingly enough, not all markets are created equal, and some of the best performing residential housing markets are to be found in the Midwest, in markets like Cleveland, where home prices rose 12% in June, as compared to the prior year. Low mortgage rates are certainly doing the trick. One broker noted that she is seeing “an influx of buyers from expensive coastal cities.” While Clear Capital is not yet considering investments in Cleveland, don’t be overly surprised if we ultimately do so. In the meantime, other markets like Phoenix, Colorado Springs, Salt Lake City, or Cincinnati are more likely candidates.

Finally, while not necessarily impacting Clear Capital’s approach or strategy, I would note that the trends here in the States can be found globally. The recent protests in Hong Kong are the most visible example. Hong Kong remains the most unaffordable housing market in the world, where the ratio of home prices to median household income (21) make New York City or Los Angeles look like child’s play, and countless residents live in literal shoeboxes. Even Vancouver (12.6) and Sydney (11.7) pale in comparison. These sorts of market realities are supremely problematic and will remain a source of significant tension for the foreseeable future. As discussed below, growing wealth inequality, captured in all of this housing data, are giving rise to growing populism here and everywhere. I just returned from Mexico City, where I spent some time with alumni of UCLA Anderson, and they are experiencing these same trends. It is indeed a small world, but when it comes to global housing issues, I am not sure that is a good thing.

In a world of pervasive and seemingly sticky negative interest rates, finance professionals everywhere are suffering from collective migraines as they try to assess whether such an economic reality reflects a longer-term structural shift in the market or is merely a temporary blip

You may recall that I described a situation in an earlier quarterly update where a lender in Denmark was actually paying prospective homebuyers to borrow money, turning the finance world upside-down. Perhaps this situation is the punchline to that old accounting joke that “we may lose money on each transaction, but we will make it up with volume.” But this is no joke. Jyske Bank, the third largest Danish bank, was offering 10-year, negative 0.5% mortgages during the quarter. Yes, a negative rate mortgage, where they pay you to borrow. While I reach for some ibuprofen, I can say that this scenario reflects certain idiosyncrasies in Denmark (e.g., pegged currency, unique mortgage origination practices), but it is nevertheless something I have never seen or heard of in my career. And rates remain negative in a number of countries.

Meanwhile, closer to home, the Federal Reserve reduced rates twice during the quarter, dropping the Fed Funds rate by 50 basis points (two, 25 basis point reductions). The 10-year Treasury yield ended the quarter at 1.68%% (most recently 1.75%), a significant drop from 2.03% at the start of the third quarter, both below that Fed Funds rate of 2.25%. The low-rate virus is infectious as a trio of other central banks (India, New Zealand, and Thailand) aggressively reduced rates in August.

So, is the yield curve inversion a good thing for commercial real estate investors? Will the gap between short- and long-term rates or between bond yields and cap rates encourage even greater investment in the sector? These are tricky and complex questions, but my intuitive answer to both questions is “yes.” Obviously, it remains to be seen where equilibrium is reached between lenders, borrowers, buyers, and sellers in this new interest rate reality.

Meantime, apartment investors are finding new sources for debt financing, beyond Fannie Mae and Freddie Mac, which have curtailed their lending in recent months. In fact, new leadership of the Federal Housing Finance Agency (FHFA) recently hinted that it would like to take further steps to curtail the market dominance of Fannie and Freddie. The CMBS market has filled some of this void, recently offering loans equal to 75% of apartment values, at rates fixed at roughly 250 basis points above swap rates (about 4.0%). Life insurance companies remain active as well, offering fixed rates closer to 3.5%, at lower loans-to-value (65%).

In short, I see nothing to suggest that interest rates will be rising in any meaningful way for the foreseeable future, which will provide a significant floor for any and all financial assets, including commercial real estate.

While the job market has slowed, the data still suggests a growing and fundamentally solid economy

As highlighted above, the U.S. employment market remains fairly robust, as 470,000 jobs were created in the third quarter and the unemployment rate reached a 50-year low, 3.5%, down from 3.7% in August. The last time the unemployment rate reached such levels was in December 1969 (I was about three for those keeping track). While certainly slowing, the results certainly do not portend any imminent end to the country’s economic expansion and should allay some of the concerns many of us share about when a downturn or recession might occur. Meantime, average hourly wages for private-sector workers increased 3.2% from last year, a fairly meaningful increase, and certainly above recent inflation rates. The following graphical/tabular summaries are informative:

Not surprisingly, job growth is one of the most critical economic indicators we follow, and we will continue to closely monitor both national and local trends when both evaluating our existing portfolio and potential acquisition opportunities.

Meanwhile, our politicians remain steadfast in their efforts to rein in spiraling housing costs via increased regulation, which may be positive for progressive politicians, but is, ironically, profoundly negative for prospective renters, landlords, and investors alike, at least in the intermediate- to long-term

Well, it was another busy, busy quarter for our nation’s politicians, and I am not talking about the perpetual circus we are witnessing in our nation’s capital. California officially enacted statewide rent control, voting to expand rent regulations for the first time in 25 years, joining Oregon and New York, as the most auspicious threesome since Chevy Chase and the “Three Amigos” (with all due respect to Larry, Curley, and Moe). California rental adjustments are now capped at five percent plus inflation (less than the seven percent initially floated and that allowed in even more liberal Oregon), and tenants now have expanded protection against evictions. The Bill covers buildings that are 15 years or older (excluding single-family residences). In concert, cities and local municipalities have passed even more restrictive controls. Lest you think this trend will soon abate or end, you will be profoundly disappointed. What is nearly a certainty is that these economic “sticks” will ultimately fail.

Meantime to show that California is not completely myopic or ignorant, the State also enacted a new law, subject to which developers of affordable housing will receive property tax exemptions during the construction phase (three to five years post-land acquisition). Such a law demonstrates that the State understands the power of economic “carrots” as opposed to those “sticks.” While other impediments to widespread housing development remain firmly intact, these kinds of policies are far superior (in my view) to price controls and regulatory restrictions. Meanwhile, Oregon passed a law during the quarter that requires cities of 25,000 people or more to allow two-, three-, and four-unit residential buildings in single-family residential neighborhoods, something Minneapolis approved earlier this year. Obviously implementing these new laws will be contentious and have its own challenges, as “public interest groups” (often an oxymoron) continue to throw wrenches into nearly every effort to building housing in the places where it is most desperately needed, but laws and regulations with economic incentives reflect far better thinking and policy than price controls and similar restrictions.

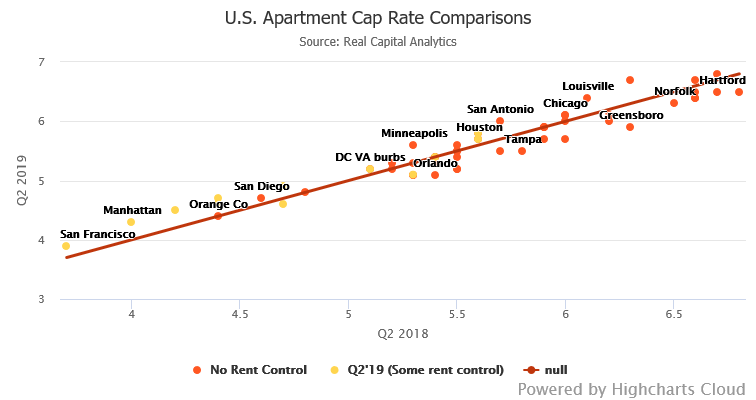

In any event, of the 58 unique markets tracked by Real Capital Analytics, twelve have some kind of rent regulation in place, ranging from strict price ceilings to simple vacancy de-control (rents can be raised to “market” upon the vacating of a unit). These markets include a range of cities and suburbs in New York, California, Washington D.C., New Jersey, and Portland, those with the highest rents and lowest cap rates.

Meantime, San Francisco recently passed what I consider to be perhaps the most absurd housing-related ordinance I have ever seen, the Community Opportunity to Purchase Act, which became effective on September 3rd. In short, the Ordinance requires that prospective sellers of any multifamily buildings with three or more units, or land entitled for such assets, must first offer the assets to “qualified non-profits,” essentially entities involved with affordable housing or community development. While the seller can refuse any offer received from the non-profit, it must then offer the non-profit a right of first refusal, to purchase the property on the terms of the proposed sale to another third-party. There are other elements to the Ordinance, but suffice it to say that they simply make what I consider to be an absurd, if not seemingly unconstitutional ordinance, even more so. And I see more practical issues, challenges, and pitfalls associated with this Ordinance that my head is spinning. And many lawyers must be salivating about challenging it as I write.

One final question you might have is how the Democratic nominees, especially those leaning further left, feel about rent control. Issues surrounding housing are not issues typically addressed during debates or presidential political campaigns. But as one recent Nobel Prize winner once sang, “The times, they are a changin’.” Bernie Sanders, Kamala Harris, and Elizabeth Warren have mentioned their partiality to rent control. In July Bernie actually penned an op-ed piece, “As a Child, Rent Control Kept a Roof Over My Head,” capturing his predictable views.[1] I probably don’t need to tell you that this memo writer thinks his opinions and policy views, while well-intentioned, are impractical and will not work, and that might be considered a generous description.

As always, there are numerous other significant and noteworthy trends we monitor as we formulate and evaluate Clear Capital’s go-forward investment strategy, both for existing assets and prospective acquisitions

- Goldman Sachs and Blackstone’s new real estate funds: Goldman Sachs is soliciting investments for a new $2.5 billion real estate fund, which sounds like a big yawner, except that it is the first real estate fund they have sponsored since the financial crisis, when their Whitehall Funds got creamed. What I also found noteworthy is that they state that the new fund will assume less risk (loan to values limited to 60%) and will target returns of 12-15% annually (IRRs), which are not nearly as aggressive as the returns they targeted previously (unsuccessfully, I might add). Meanwhile, Blackstone announced that they had raised (buckle your seatbelts) $20.5 billion for their latest global real estate fund, which closed in mid-September, the largest real estate fund in history. I am not sure we can draw anything definitive from such data points, other than global demand for real estate quite clearly remains strong. The contrarian in me cannot ignore that such a strong appetite for real estate could be meaningful.

- Lessons from the WeWork debacle: All I can say is that I have never seen anything quite like it, with a near $50 billion valuation and an imminent public offering both evaporating almost overnight. The last time I witnessed something so dramatic was probably the demise of Bear Stearns over one particular March weekend in 2008. Whether history looks back at the WeWork mess as some sort of near-term top in domestic equity markets or an end to the illogical valuations of the so-called “unicorns” remains to be seen. Regardless, I did learn a new term from WeWork’s S-1 filing with the SEC, “community-based EBITDA,” which reinforces my belief that we should be wary when companies feel the need to invent new, never-before seen financial metrics. I do recall the last time a company became notably creative with its accounting metrics, when Groupon went public, and its initial filing documents contained the metric, “Adjusted Consolidated Segment Operating Income,” or ACSOI for short. The SEC made them remove this metric from their filing, but no matter. Their IPO was a dud. Not a WeWork-level dud, but a dud nevertheless. I suppose the takeaway is to beware the creative and previously never seen financial acronym.

- Shrinking of three largest U.S. metros: In recent memos, I have described how California has seen annual population declines since 2010, certainly due in part to the state’s high cost of living. However, the trend is more widespread. New York, Chicago, and Los Angeles have all seen their populations decline. In 2018, the New York City area lost more than 100,000 people (277 people each day). This trend is a significant reversal from what we witnessed prior to the financial crisis, when many of the country’s urban cores saw renaissances. It is no mystery why such migration is occurring, as affordability becomes of ever increasing significance in impacting where people decide to live. To wit, the four principal Texas metros – Houston, Dallas, San Antonio, and Austin – have collectively added more than three million additional residents since 2010. The most popular destinations are now Phoenix, Dallas, and Las Vegas. Immigration has historically made up for a certain amount of domestic migration, but that trend is also abating, certainly impacted by recent crackdowns on immigration – both legal and not – as well as those high housing costs. California’s population growth has slowed to its lowest rate in history. To be clear, I don’t see any of these trends reversing soon.

- Increasing wealth inequality: The rise in progressive and populist political candidates, both here and abroad, is no surprise, in the face of rising wealth inequality. In the U.S. wealth inequality (the Gini Coefficient) sits at its highest levels in more than 50 years, with the gap being the widest in five states: California, Connecticut, Florida, Louisiana, and New York, but the trend is widespread. It is my opinion that these trends have given rise to progressive politics and strongly socialist policies ranging from wealth taxes, Medicare for All, and the elimination of student debt. While I am concerned that all of these policies are poorly conceived for one reason or another, a discussion I will avoid here, their growing popularity among a large number of elected politicians and those seeking office, reflects the expanding gap between the haves and the have-nots, which I believe to be a significant threat to our economy and future stability.

- Latest updates of what younger renters desire in multifamily communities: Every year, different publications covering the multifamily market survey tenants to determine which features, amenities, and services they value most. For obvious reasons, we follow these surveys closely. It is no surprise that tenants are placing greater value on technology and convenience. Automated storage areas or lockers for deliveries (e.g., Amazon shipments), trash valet services, community dog parks, dog-walking and on-site grooming services, Nest thermostats, smart fitness equipment (e.g., Peloton bikes), yoga and Zumba classes, access to personal trainers, ride-sharing drop-off and pick-up zones, and even on-site services significantly increase the attractiveness of multifamily communities, at least those that are considered Class-A. It is a simple formula: Downton Abbey + Apple store + Petco + Spectrum + Peloton + Burke Williams + apartment community = Very Desirable Class A multifamily project. I cannot testify to the academic robustness of this formula, but it seems to fit empirical realities.

- Continuing brick-and-mortar closures: As mentioned above, 2019 has been another brutal year for traditional retailers, with nearly 7,900 store closures already announced. 2017’s inauspicious record of 8,139 closures seems sadly in reach. Recent casualties include Forever 21 (which it wasn’t), Barney’s New York, Dress Barn, and Perkins/Marie Callender’s. Those retailers needing oxygen tanks include J.C. Penney, Rite Aid, and Pier 1. Even Bed, Bath, & Beyond is on the danger list. While we don’t play in the retail sandbox, the challenges in traditional retail will have profound economic consequences.

Finally, with all the unique macroeconomic, social, and political goings-on, several of which we routinely discuss in these memos, I thought I would take a final moment to reflect on the overall strategy and thinking of the Clear Capital team.

As sponsors of investment opportunities and fiduciaries of both your capital and our own, which we take very seriously, we are compensated for several things. One is to make macro-level assessments about specific geographic markets in which we consider investing; the second is to underwrite and identify attractive opportunities within each market, and acquire such opportunities at what we believe to be attractive prices; and finally, we must manage the acquired assets as best we can, consistent with our strategic plans. With that being said, our optimism about the multifamily market remains unwavering, as the long-term fundamentals underpinning the market remain squarely intact, and I see nothing that will change that perspective as far out as I can see. The most significant headwind I see is increased local and state regulation in certain primary markets, as politicians and understandably concerned constituents try to rein in spiraling housing costs.

If we were to engage you in one last thought experiment, and we were to somehow fast-forward decades into the future, I strongly believe that we would find that multifamily investments, as a class, provided very favorable risk-adjusted real rates of return. With that being said, our recent focus on markets in Texas, Arizona, Colorado, and a few others is not accidental, as we believe various submarkets in each of these states are characterized by compelling, long-term fundamentals, including solid population and job growth. Our pending acquisitions of Lantana Gardens in Mesa, Arizona, and Palmer Park in Colorado Springs, Colorado (marketing materials coming soon) fit squarely into our strategy. The Clear Capital team always puts its own capital “where its mouth is” and we are sincerely appreciative of those of you who will be joining us in these and our other endeavors.

We remain grateful for each of you and the trust and confidence you have placed in me and our team.

[1] https://www.google.com/amp/s/amp.cnn.com/cnn/2019/07/30/opinions/bernie-sanders-2020-affordable-housing-policy/index.html

Best,

Eric Sussman

Founding Partner