"It's no wonder that truth is stranger than fiction. Fiction has to make sense."

- Mark Twain"You see, but you don't observe. The distrinction is clear."

- Sherlock Holmes (Arthur Conan Doyle)

As a kid, I devoured mystery and detective books, and might even have been considered a Hardy Boys groupie. I read every new release in the series almost as soon as a new one came out. In any event, no crime was too complicated or any mystery unsolvable for Frank, Joe, and the Hardy Boys’ high school chums, and they were coincidentally fortunate that their fictional hometown of Bayport, New York was so riddled with shady characters and crime syndicates. Perhaps if Bayport were a real place, Clear Capital might consider investing there as a contrarian, value-add play.

Fast forward to today, as I wade through and try to make sense of a barrage of complex, if not seemingly contradictory, third quarter economic data, I sure could use the Hardy Boys, Nancy Drew, Encyclopedia Brown, Sherlock Holmes, and their hangers-on to help answer the numerous questions and solve the mysteries that surround today’s markets and the economy:

- Is this recent bout of inflation we have experienced transitory or something longer lasting?

- Are we going to experience a repeat of the 1970’s “stagflation,” reliving the worst of two worlds, economic stagnation and higher prices?

- When will all the missing workers return to the workforce? At what cost?

- How much higher can asset values, including real estate prices, go?

- When will the Fed taper its bond-buying activities and/or increase interest rates?

- When will the bottlenecks surrounding supply chains clear?

- Will Evergrande and other Chinese developers go kaput, with the impact felt in our markets?

- Are we finally getting towards the end of the COVID-19 tunnel? What will the post-COVID workplace look like longer-term in terms of remote work?

- Will politicians at all levels actually and meaningfully legislate, and what impact might new laws and regulations have?

- Will there be a second season of Squid Game?

These are some weighty questions worthy of discussion, and though I recognize the limits of my psychic abilities, I will weigh in on each, with apologies in advance that I don’t have the Hardy Boys et al to lend an analytical hand or four.

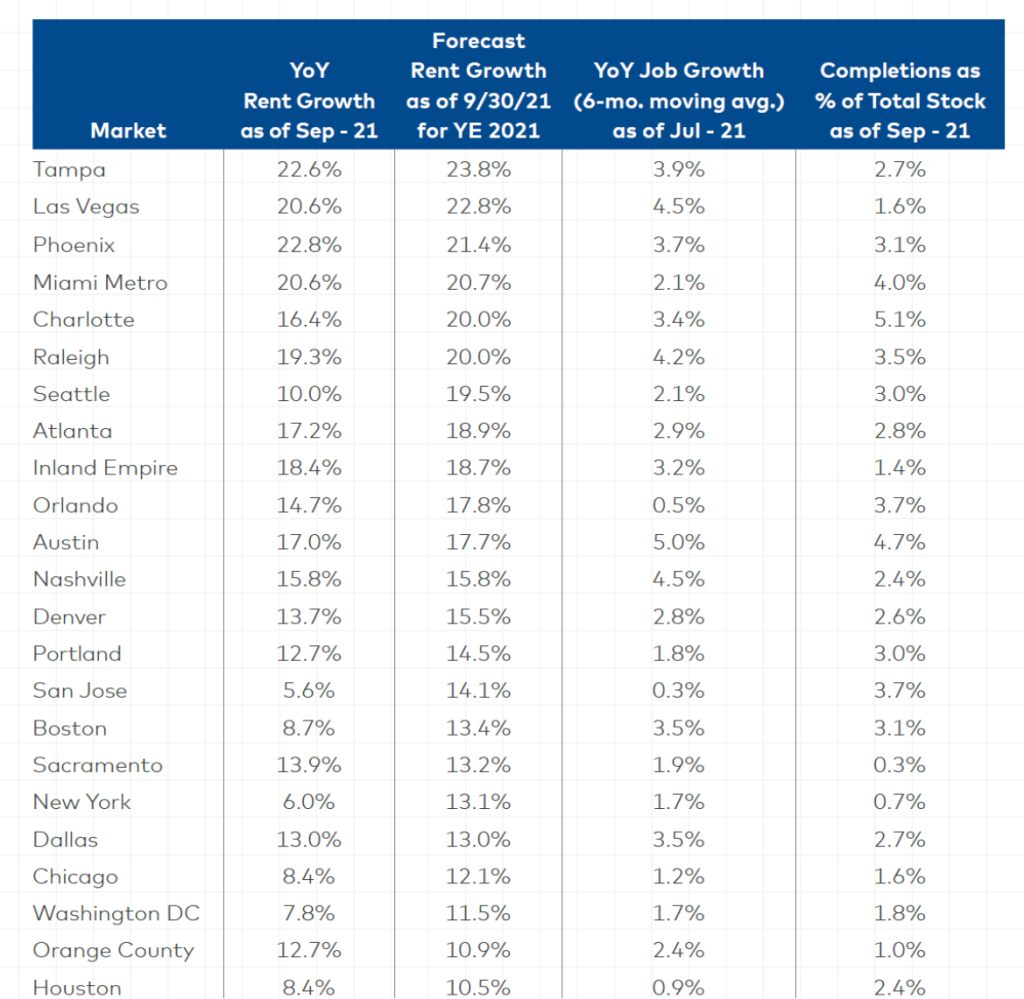

Regardless of how these economic question marks and mysteries are solved and resolved, I remain confident that housing prices and rents – whether single- or multifamily assets – will be heading higher in coming months and years, with non-coastal markets continuing to outperform

I suppose it is a question of perspective of whether this prediction is a positive or negative.

For Clear Capital, investors, and others that own financial assets, including residential real estate, this prediction would certainly be welcome and positive. On the other hand, for those seeking to purchase their first homes and/or those concerned about housing affordability and homelessness (all of us, I imagine), this reality would also have certain perverse outcomes. It is truly a two-sided coin.

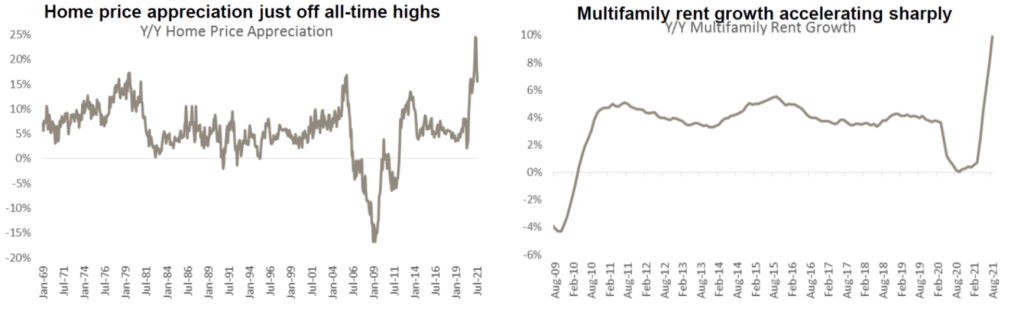

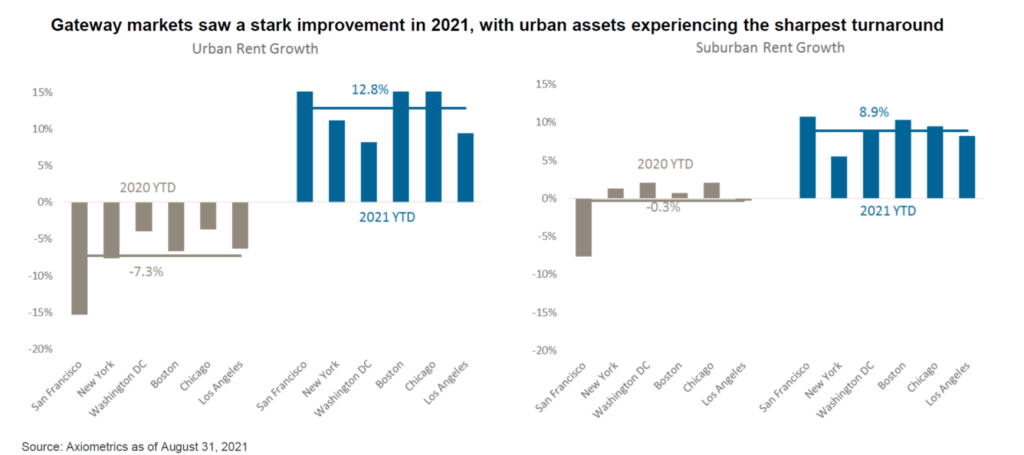

The third quarter was a very positive one for landlords and owners of residential assets, characterized by significantly higher housing prices and rents. Once again, several pictures tell the story, whether one is analyzing single- or multifamily markets. Prices and rents increased and increased sharply.

Nationally, home sales surged in September, with existing home sales up 7% (versus August), amidst already record-high prices, which were up another 1.4% from the prior month, and over 19% year-over-year. Here in Southern California, prices were up 1.3% in September, with the median sales price reaching $688,500, up 12.9% from the prior year.

In 182 of the 183 residential markets tracked by the National Association of Realtors, prices were higher year-over-year. In Austin, nearly 2,700 homes have sold for $100,000 or more above asking prices thus far in 2021. And in another telling anecdote, a Bay Area broker commented that she was not at all surprised that a home listed for $850,000 received six offers above its asking price, ultimately selling for seven figures, but that she was surprised that she received one offer below the asking price. I cannot recall ever hearing an agent being surprised at receiving an offer below its listing price.

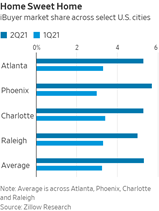

And who is doing all of this buying? Well, in certain markets, it is institutions, the Zillows, OpenDoors, Blackstones, and Invitation Homes of the world, and amazingly enough, more institutions are entering the fray (e.g., Flyhomes, Ribbon, Home-Light). Literally two days after I put the finishing touches on my last quarterly memo, I read an article about Tricon Residential, Inc., a Toronto-based company which already owns and rents about 25,000 homes, which announced that it is partnering with a Texas pension fund to acquire another $5 billion of U.S. houses to convert them to rentals. That is not a typo. $5 billion, which will theoretically allow for the purchase of 18,000 more homes, plus or minus. Institutions have already bought between 15 and 20% of all single-family homes sold thus far in 2021.

I cannot fathom how these business models or trends are sustainable. In fact, Zillow just announced last week that it was suspending its homebuying activities after buying 3,800 homes in the second quarter, resulting in a little single-family indigestion. Keep in mind that Zillow had announced plans earlier this year to acquire 5,000 single-family homes each month by 2024. Oops. Now I just hope that Zillow is willing to share their residential Pepto-Bismol with Tricon and others. Certain institutional investors, so-called “i-buyers” are buying homes sight-unseen, based strictly on mathematical algorithms (think “Zestimates” from Zillow).

The tremendous imbalance between demand and supply for housing, exacerbated by the impact of institutional homebuying, unparalleled liquidity, low rates, higher construction costs (e.g., labor and materials), anti-growth sentiment, and political shortsightedness will likely ensure that even higher home prices are in our futures.

Another interesting tidbit that caught my eye was that the top-performing single-family residential markets in recent years have been those with longer commutes to job centers (read: urban cores), according to the Brookings Institution. For the two years ended May 2021, home prices in neighborhoods with 70-minute commutes rose over 30%, strongly outpacing the 9.2% price gain and 2.5% price decline for markets 20 minutes and 10 minutes from job centers, respectively. The growth in such markets has led to those “exurbs,” areas that have seen significant net migration. Keep in mind that these trends pre-date COVID, which only accelerated them.

These exurb-type markets are really the ones worth watching, as they attract companies and employees alike, all seeking lower-cost locales. Take South Carolina’s Berkeley County, about 30 miles northeast of Charleston, which saw its population grow nearly 30% over the past decade, and local officials predict that the county’s population of 230,000 will grow to at least 350,000 in the next 20 years. While we have looked at investment opportunities in Berkeley County, Clear Capital’s investment strategy is absolutely informed by such data points, as we invest in exurbs closer to home.

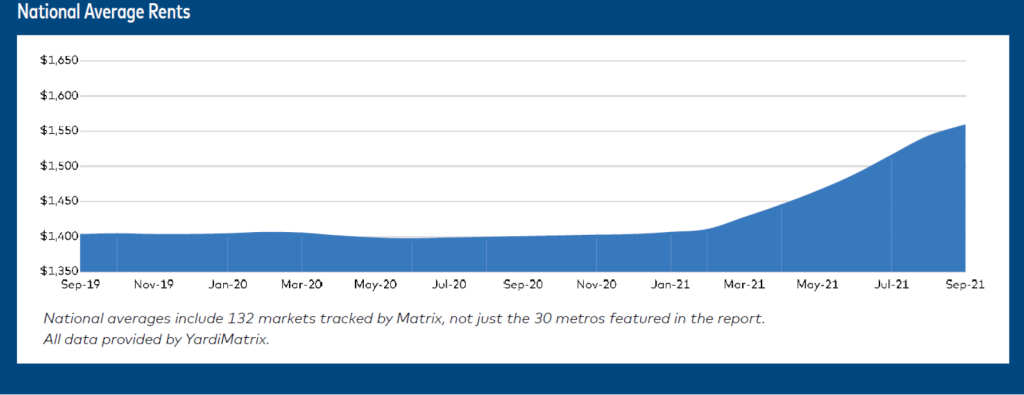

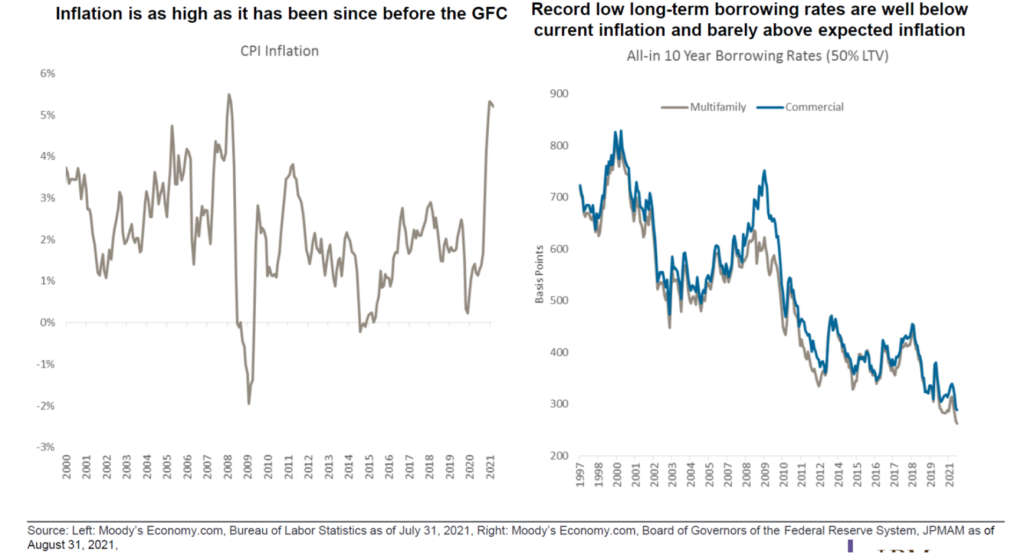

And multifamily markets? Asking and effective rents hit record highs, with asking and effective rents nationally increasing 7.5% and 7.9% nationally, according to Moody’s Analytics REIS, the highest quarterly growth experienced, at least since the firm began to track such data in 1999. Net absorption in the third quarter exceeded the first two quarters of 2021 combined, with third quarter demand representing record highs, resulting in the vacancy rate for the top 79 metros tracked by REIS dropping 60 basis points, to 4.7%. Household incomes for new renters reached a new high, at more than $70K/year. Data from Yardi Matrix provides additional color on the broader data:

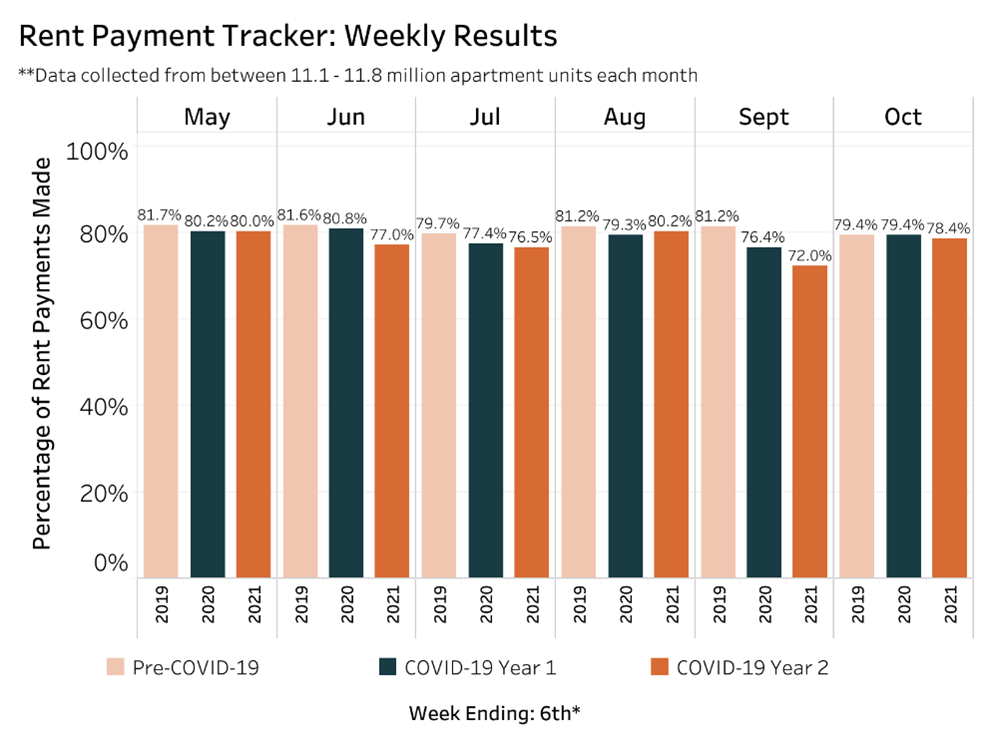

Meanwhile, rent collections post-COVID continue to lag, as the National Multifamily Housing Council found that 78.4% of apartment households made a full or partial rent payment through the first week of October, a one percent decline from the same period in 2020. Los Angeles landlords are owed at least $3 billion in back rent, according to a report co-authored by researchers at UCLA and USC. Across our portfolio, we are still owed significant sums in back rent, and we continue to await payments from the various rental assistance programs. For example, here in California, the State has disbursed less than 20 percent of the $1.4 billion in rental assistance aid that was given to the State by the Federal government, at least at last look.

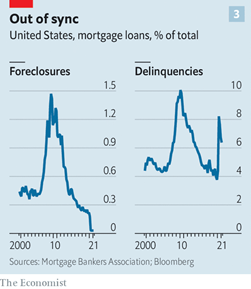

Finally, as eviction moratoriums are lifted, what will the impact be? Will there be a tidal wave of defaults, foreclosures, and evictions? Some 2.8 million households, comprising nearly 7.5 million individuals, are behind in their rent. However, my sense is that a combination of financial aid, rental assistance, and lender/landlord forbearances will stymy any significant increase in foreclosures or evictions, but time will tell.

There is one final topic I thought I would mention briefly before I move onto other subjects. During a recent UCLA Anderson event, I was asked by a former student as to how climate change might impact real estate values looking forward. It is not something I have completely ignored, as I did check predictions about future sea levels when I purchased an income property for my own portfolio down in the Pacific Beach area of San Diego a few years ago.

However, his question made me think more broadly about not just rising sea levels, but about fire risks, and its potential impact on future development and insurance costs, the latter of which is something I have discussed previously. Sure enough, just a few days later, an article appeared in the WSJ about a proposed housing development in Colorado Springs, where we own some assets and are buying others. In this case, a proposed development, a 420-unit project, “2424 Garden of the Gods,” was shelved because of concerns surrounding wildfire evacuations in the area. Similarly, in August, a California appeals court blocked a planned expansion of a resort near Lake Tahoe after agreeing with concerns raised by environmentalists about fire evacuation risks.

Therefore, his question was not only timely, but important. Rising sea levels, in addition to increased levels of drought and associated fire risks, will meaningfully impact real estate. On the one hand, insurance costs are going to continue their upwards march, and in some cases, may be impossible to procure. I bet more than a few of you have received “Notices of Non-Renewal” from your insurance carriers because your property poses “excessive” fire risk. I have. On the other hand, anti-development activists will have another tool in their arsenal, as they argue, in some cases with justification, that certain projects should not be approved because of wildfire risks. Ironically, the decision to mothball the Colorado Springs project may be good news for us, at least marginally, because caps on supply translate to higher rents, all else equal, and we will own three assets in that market by year end.

Higher inflation will persist, at least when it comes to wages, commodities, housing costs, and asset values

As I wrote in one of my recent, more condensed (yes, thankfully), monthly memos, I have always marveled at how Costco has been able to sell a mammoth-sized hot dog and bottomless soda for $1.50, and $4.99 for an entire ready-to-eat roasted chicken, year after year after year. During my last visit a mere three weeks ago, I was profoundly relieved to see that those prices still have not changed. Yet, everywhere else one looks, and I mean virtually everywhere, prices are higher, if not much higher, than they were in the not-too-distant past.

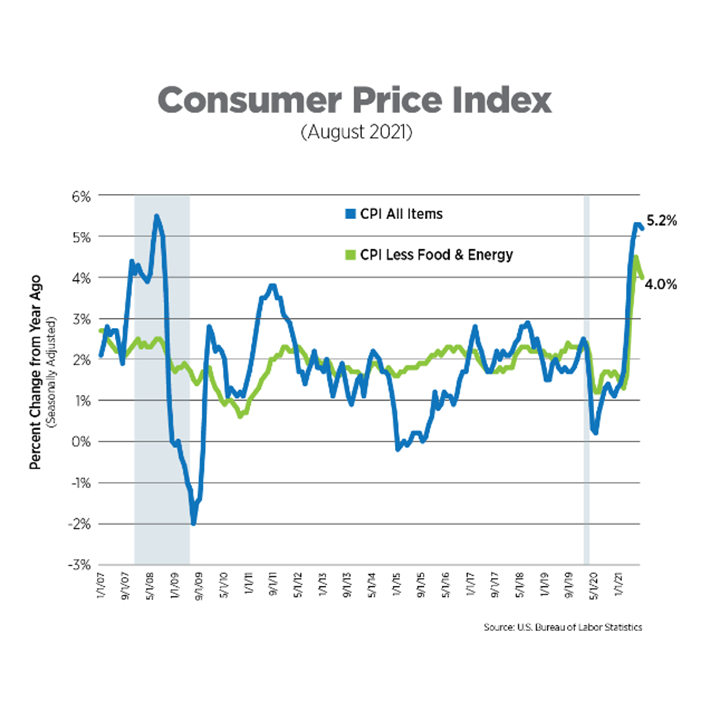

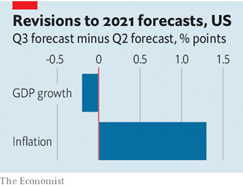

Inflation, as measured by the Bureau of Labor and Statistics, increased 5.2% in August (versus the prior year), excluding food and energy, the third time in the last four months that increases in the consumer price index have exceeded five percent, well above the Fed’s two percent target.

While the Fed has indicated that annual inflation will return to two percent by 2022, that seems like a pipe dream, at least according to investors, who are predicting that the consumer price index will rise by an annual average of 2.64% over the next decade, based on recent pricing in the TIPS (Treasury Inflation-Protected Securities) market:

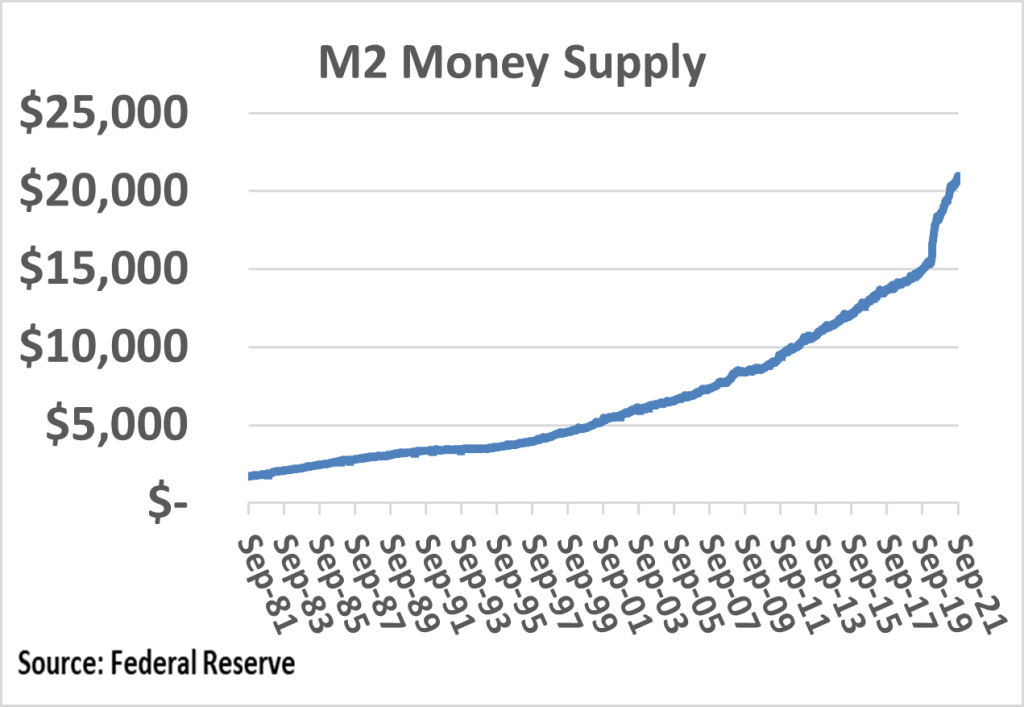

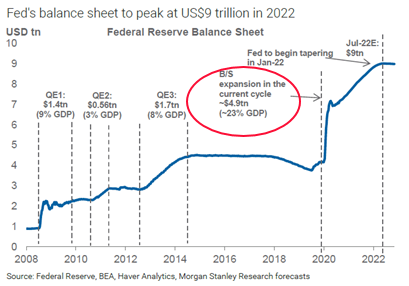

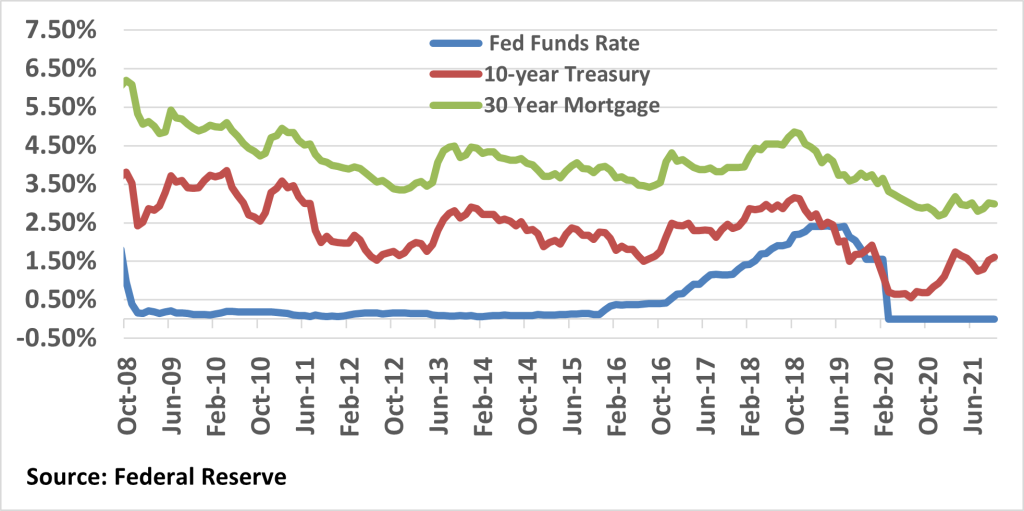

Meanwhile, there is simply too much liquidity on the sidelines for asset prices not to go higher: $20 trillion in M2 money supply and nearly $7 trillion in cash and investments on corporate balance sheets, mostly earning negative real returns. Much of that capital will eventually find its way into the economy and markets, driving real estate and equity markets higher. The impact of the unprecedented largesse of the Federal Reserve, perhaps borne out of economic and COVID necessity, will prove long-lasting, or at least for the next several years, as I see things. Two pictures tell a thousand words.

In fact, it can come as no surprise that Google recently announced it was purchasing a Manhattan office building for $2.1 billion, while in 2020, Amazon acquired the nearby former Lord & Taylor department store for nearly $1 billion and Facebook purchased REI’s office campus in Bellevue, Washington for $368 million. Expect more of the same looking forward.

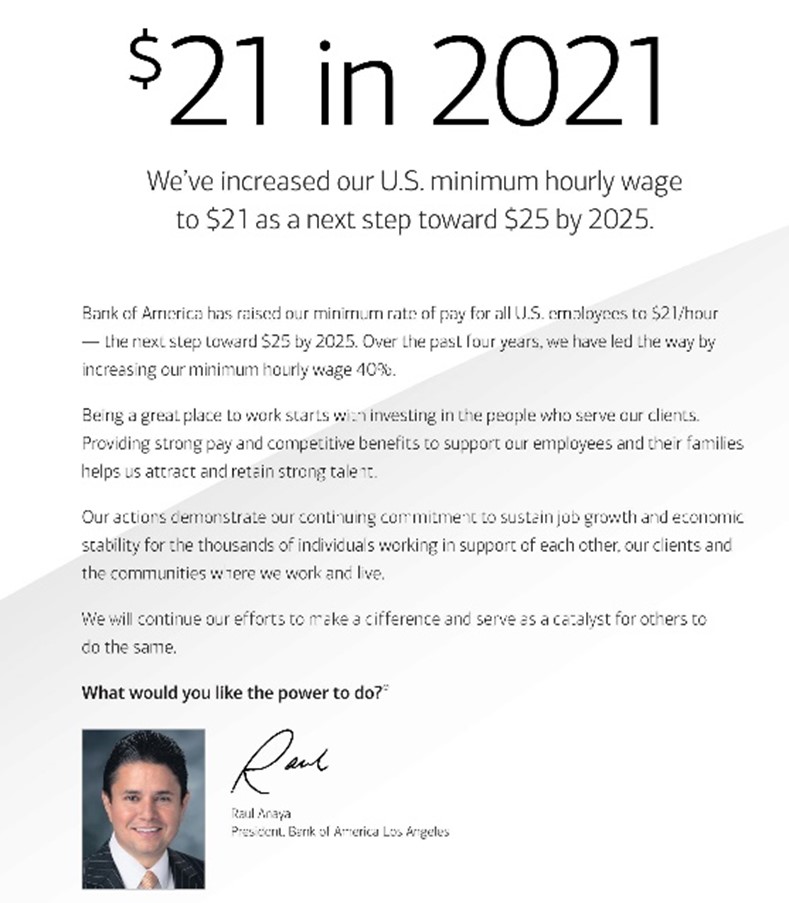

Meanwhile, wages are heading higher, and materially so. Recent labor strikes experienced at John Deere and Kellogg’s are only the beginning, and the principal way to move workers off the sidelines and back into the workforce, is higher wages. In this new reality, Walmart recently increased its minimum wage to $15 across the entire company, and check out this Bank of America advertisement, which appeared in last week’s Los Angeles Times:

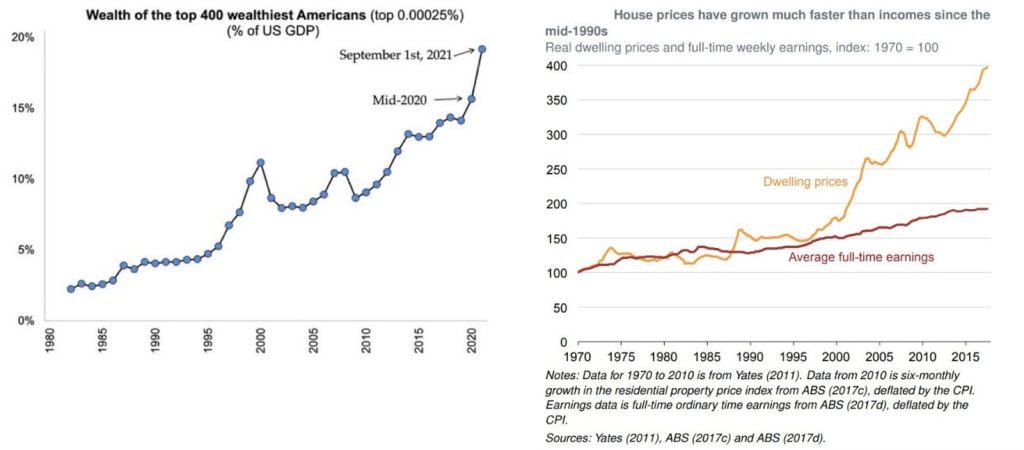

Although perhaps not a universally held view, I have long argued that wages need to be higher, and while I might be biased because higher wages will likely translate to higher residential rents, I believe that the widening gap between the haves and have-nots is economically and socially destabilizing. Since 2010, U.S. home prices have increased by a whopping 153.3%, compared to far more modest wage gains of only 14.2%, essentially matching annual inflation rates (about 1.25% per annum). The chasm between the haves and the have-nots has never been wider. Again, a couple pictures provide meaningful perspective.

Obviously, the biggest concern is that we enter some sort of perverse time machine and head back to the 1970’s, when inflation averaged 6.8% per year. Disco, bell bottom jeans, Studio 54, and hour-long gas lines (my mother’s Dodge Dart, the affectionately nicknamed Red Bomber was a real guzzler) were bad enough, but a return to 1970’s-like inflation would be deleterious, to say the least.

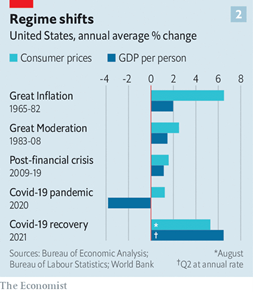

Food prices globally are up 30% this year, and oil prices recently surpassed $80 a barrel, a price last seen seven years ago, almost to the day. And this chart is, perhaps most frightening, apropos of the Halloween season, where slowing growth and inflation become unwanted bedfellows.

While the three A’s (Amazon, automation, and artificial intelligence), low fertility rates, and other demographic shifts provide deflationary counterforces, and all that money supply should keep interest rates low (or lower than they otherwise would be), the excessive liquidity, upward pressure on wages, coupled with supply chain disruptions and pent-up demand, will provide more than worthy inflationary competitors. It’s truly an MMA battle of competing tailwinds and headwinds, and my money is on asset inflation, net-net.

However, if the bond markets are to be believed, the high inflation we have experienced in recent months will, in fact, prove temporal, and I, too, cannot foresee a return to the 1970’s, if just because unions lack the power that they had back then, automation is increasing, and policymakers have thankfully learned a thing or three in the last 50 years. That is not to say that the Fed’s two percent target will not be breached, given the factors we have discussed (e.g., excess liquidity, supply chain challenges) as the TIPS market is already predicting somewhat higher inflation, but even if that 2.64% annual inflation comes to pass over the next decade, it should not be worrisome. Stay tuned.

The Fed is walking a very precarious tightrope, as it tries to thread an economic needle

Taper and raise interest rates too quickly, and the Fed risks pushing the economy into recession and economic stagnation. Continue their $120 billion a month bond-buying spree and a near-zero interest rate policies, and they risk adding more fuel to the inflation fire, if not asset bubbles, something we are already witnessing in several corners of the markets. Exhibit A might be this past weekend’s headline from the WSJ: “Trump SPAC Swept Up in GameStop-like Frenzy.” Buying frenzies in everything from cryptocurrencies (yes, Bitcoin has raced to record highs recently) to certain SPACS (check out “DWAC,” the stock symbol for the new Trump social media SPAC) to single-family-homes makes me inherently uneasy. And as I have discussed at length previously, the Fed’s Balance Sheet has already experienced unprecedented expansion in recent years.

My sense is that the Fed is going to maintain the status quo for now, until there is clearer economic direction. As I mentioned, the bond markets don’t seem spooked by the specter of higher inflation or interest rates, and rates remain low, even with 10-year Treasury yields now trading at about 1.60% (versus 0.97% at the end of 2020).

In recent Congressional testimony, Fed Chair, Jerome Powell agreed that “we are seeing upward pressure on prices, particularly due to supply bottlenecks in some sectors,” and stated that “these effects have been larger and longer-lasting than anticipated, but they will abate, and as they do, inflation is expected to drop back toward our longer-run two-percent goal.” His subsequent commentary was fairly generic, as he ambiguously stated that the Fed will respond to “market shifts,” whatever that means. We will just need to stay tuned, and we will.

Supply chain bottlenecks, resulting in dozens of ships anchored off our coasts awaiting delivery of goods and empty store shelves, will clear in time, but how long that takes is unclear

It is not merely a shortage of truckers, labor shortages generally, or new environmental regulations causing our supply chain bottlenecks, though they are certainly significant contributing factors. Frankly, COVID-19 and the economic dislocations it caused revealed longstanding risks and vulnerabilities of interconnected and geographically concentrated global supply chains. While the bottleneck should clear in the coming months, policy makers and businesspeople alike will need to rethink supply chains and how they procure goods and services to prevent future disruptions. The primary beneficiary in the real estate market will be industrial assets, which will benefit from the onshoring of previously outsourced goods.

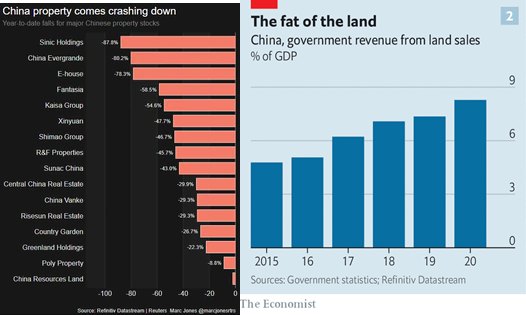

Because the real estate sector accounts for such a significant part of China’s economy (20 to 25% of GDP, versus 15 to 18% here in the U.S.), China cannot afford widespread failures in the sector for fear of the resulting fallout

While Evergrande and its compatriots (e.g., Sinic Holdings and R&F Properties) are clearly over-leveraged ($2.8 trillion in debt, collectively), the Chinese government will likely bail them out in some way, shape, or form, having learned the lessons from Lehman Brothers’ collapse and the subsequent financial crisis. Perhaps we should think of the real estate tightrope China must deal with as analogous to the challenging balancing act our Fed must perform. I just don’t see China allowing a wave of developer defaults, and in fact, late last week, Evergrande made some outstanding and past-due interest payments.

But that is not to say it will be easy or painless. In fact, just last week, China disclosed that its third quarter growth in GDP was 4.9%, which hardly sounds unhealthy, but it compares quite unfavorably to 2020’s third quarter growth of 7.9% and higher analyst forecasts. With countless construction projects now being halted, China’s GDP data may be even more sobering in coming quarters. However, I don’t anticipate that China’s real estate challenges will spread to our shores in any meaningful way.

Remote work, or some sort of hybrid-work model, will persist, allowing some workers to live remotely indefinitely, with long-lasting impact on secondary and tertiary real estate markets and their suburbs

Just before the second quarter ended, Price Waterhouse announced that none of its 40,000 workers need return to the office, adding to the dozens of others companies that have made similar announcements (e.g., Adobe, Capital One, Coinbase, Dropbox), at least for a portion of their employees. As a result, the demographic shift we have seen over the last decade, with significant numbers of households relocating from urban cores to suburban secondary, tertiary, and quaternary markets will persist.

In fact, I recently learned a new word, “Exurb,” referring to suburbs of suburbs, which have experienced significant growth in recent quarters, in part due to the trend of relocating workers. Areas outside of Denver, Salt Lake City, Phoenix, Charlotte, or Nashville represent these new and growing exurbs. The shift to remote work will provide additional tailwinds to these markets, and Clear Capital’s strategy and acquisitions of assets in these markets is no accident.

Political paralysis will persist, minimizing the likelihood that meaningful legislative changes to public policy, spending, or taxes that might impact real estate markets are significantly reduced

A question I am frequently asked is what is likely to happen to tax rules surrounding 1031 transactions, in which gains realized from the sale of investment property can be deferred, so long as the sales proceeds are reinvested in another investment property (or properties) in a timely manner. You may recall that President Biden has on more than one occasion indicated that this provision of the tax code ought to go the way of the dodo bird. Well, I think we should rest easy. While the current version of Biden’s tax reform bill does cap 1031 transactions at $500,000, I see little, if any, chance that the legislation will be passed.

After all, the Administration is still focusing on the stalled $3.5 trillion infrastructure legislation, which has now been reduced to less than $2 trillion, and any vote on that legislation still seems out of view. The parties themselves can’t seem to agree on much, with political infighting providing meaningful legislative impediments, with numerous old-timers being “eliminated” in quasi-Squid Game style, as they decide not to run for reelection or lose primary battles. On a more local level, politicians will continue to address housing affordability and homelessness with their typical incompetence and myopia.

During the quarter, California Governor Gavin Newsom, having survived the recall effort, signed into law Senate Bills 9 and 10, which eliminates R-1 zoning, and allows for up to four units to be built on lots previously restricted to single-family dwellings. While perhaps a step in the right direction, the impact will prove marginal, likely adding less than half a million new rental units. The new law does nothing to address other impediments to new construction, from higher building costs, labor shortages, and the need for local officials to approve projects more expeditiously. For example, when Los Angeles passed an ordinance allowing detached garages to be converted to dwellings (Additional Dwelling Units or “ADUs”), the ordinance required that the city approve qualifying projects within 30 days. Well, approvals are now taking more than six months. Color me shocked.

Finally, there are two other public policy related tidbits I thought I would mention, one from across the pond, in Berlin, which you may recall enacted the most restrictive rent control policies I have ever encountered and described previously. Well, in late September Berlin’s voters decided to expropriate apartments from any landlord which owns more than 3,000 units in the city, a move akin to eminent domain. The referendum is not legally binding, so the next move belongs to city officials, which would need to acquire the properties from these landlords, requiring some 40 billion euros. Where it would find this sort of funding is beyond my knowledge. Perhaps it should just issue its own cryptocurrency and purchase the assets with a new “Berliner Coin.” Sarcasm aside, I don’t believe that the city will expropriate anything meaningful, but it speaks to just how deep divisions are between landlords and tenants in certain housing constrained markets, and radical maneuvers being considered to address them.

Lastly, I came across a story in the Los Angeles Times a couple of week ago, describing how a local judge struck down a previously approved 1,119 residential housing project in San Diego County (Otay Ranch), which would have included commercial stores, a new school, and a fire station. The project was consistent with zoning regulations, had been approved by the County Board of Supervisors, and was supported by local fire officials. However, the development was opposed by the Sierra Club and a group of other environmental groups, who raised concerns that the project did not do enough to address affordability issues, wildfire risks, greenhouse gases, and the potential impact on the endangered “Quino checkerspot butterfly.” Without commenting on the case specifics, the story reflects why housing supply cannot possibly keep up with demand…and won’t, in California, or just about anywhere else.

Where have all the workers gone and when will they return to participate in the labor force?

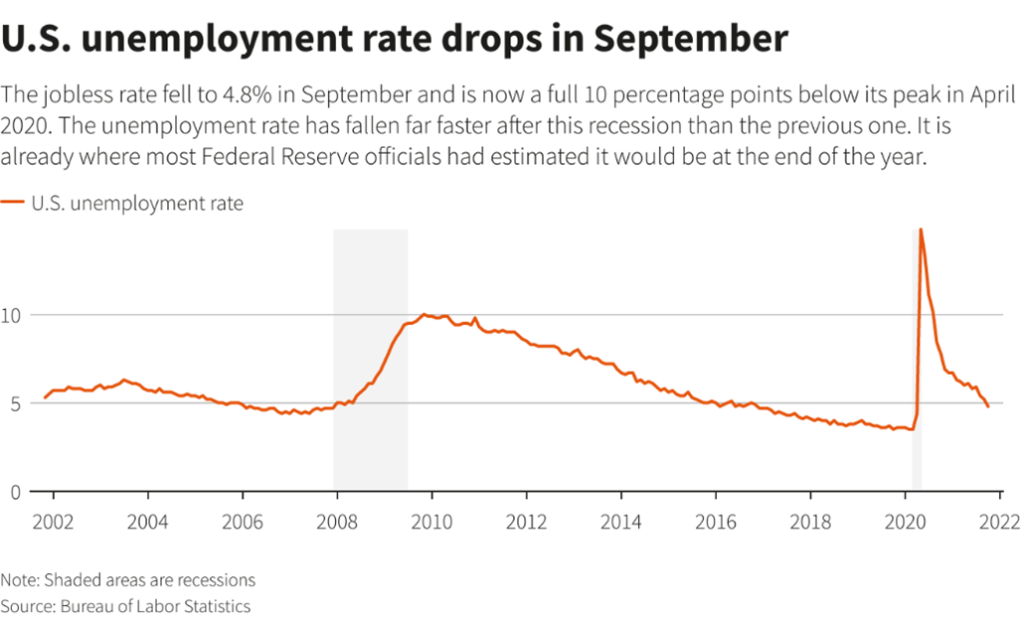

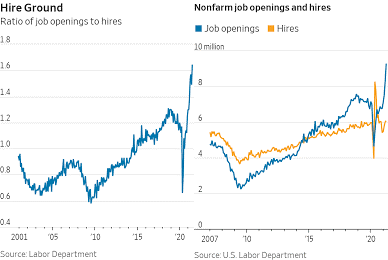

While the overall unemployment rate dropped in September, to 4.8%, some ten percent below where it was in April 2020, when some 23 million people were unemployed immediately following the COVID outbreak, we are experiencing near record-low rates of labor participation during an economic recovery. Is this going to be the latest installment in the Hardy Boys series, “The Mystery of the Missing Worker?” Well, according to the Department of Labor, there were nearly 11 million job openings at the end of July (seasonally adjusted), or 1.3 jobs for every person considered unemployed, records for both metrics, so perhaps the Hardy Boys could indeed have a meaningful mystery on their hands.

Is it really all about unemployment benefits, as some would have us believe? No. While certainly impactful, the labor shortage is multifactorial, as I have discussed previously, and we should all avoid simple singular narratives trying to explain complex topics like the labor shortage. Sure, enhanced federal and other unemployment benefits and government-sponsored assistance programs were impactful, but the causes are numerous, from a lack of childcare, lingering concerns over the virus, a reduced worker base in urban cores, increased automation, inadequate wages, and/or retiring Baby Boomers (and others, perhaps). Some may simply be fighting employee mask mandates or trading various cryptocurrencies.

In fact, the labor force shrunk in September, for the first time since May, indicating that lots of folks seem content with sitting on the sidelines. Despite record job openings, employers only added 194,000 jobs in September, below expectations for the second consecutive month. In August, the economy added just 235,000 jobs, less than a third of the 720,000 that was anticipated.

Finally, real estate developers are on the front lines of the labor shortage. In a recent poll conducted by the National Multifamily Housing Council, 50% of respondents said they had been impacted by the lack of available labor. Thus, contractors and real estate developers are being hit with multiple whammies, a shortage of labor and materials, along with higher prices for both.

And, as always, here are a few other tidbits I found newsworthy from the third quarter

- The 2020 Census data is out. Initial details from the 2020 Census were released in August, revealing a few noteworthy data points. One is our increasing diversity, as our non-Hispanic, white population declined 2.6% over the last decade, while the country’s total population grew only 7.4% during the decade, the second slowest on record, second only to the 1930’s, the period of the Great Depression. Meantime, the under-18 population decreased, by 1.4%. I find our slowing and aging population growth to be concerning, as it will translate to slower economic growth and deflation. We do not want to repeat the mistakes of our Japanese friends, who have suffered with the consequences of unfavorable demographics – slow population growth and an aging populace - for decades.

- The corporate diaspora continues. Over the last few years, I have written extensively about population moves away from the coasts. Frankly, this reality has driven much of Clear Capital’s acquisition strategy, as we pursue opportunities in the Southwest, Northwest, and Mountain West regions of the country. However, the population shift is both a cause and effect of corporate migration, which has also been occurring, as large, multinational companies relocate from the coasts to less expensive locales. In mid-August, AECOM, the large infrastructure, construction management, and engineering firm with deep and long-standing roots in Southern California announced that it is relocating its headquarters to Dallas. About three weeks ago, Tesla officially announced that its new headquarters will be in Austin, a move from Fremont, in Northern California. These two companies are now part of a fraternity that includes Hilton, Northrop Grumman, Occidental Petroleum, Nestle, Toyota, CBRE, and hundreds of other companies who have relocated over the last decade or so.

- Household debt continues to soar. U.S. household debt soared to nearly $15 trillion in the second quarter, increasing by $313 billion (2.1%), the largest nominal jump since 2007. Mortgage balances – the largest component of household debt – rose by $282 billion, while auto loans, credit card balances, and student loans increased by $33 billion, $17 billion, and $14 billion, respectively. Mortgage originations (including refinancing of existing mortgages) reached $1.2 trillion, surpassing volumes in the preceding three quarters combined. The data is likely skewed by COVID and pent-up demand, but low rates, an improving economy, higher asset prices, and all that liquidity are impacting household borrowing and leverage. While I do not see excesses or the sort of reckless lender behavior witnessed before the last financial crisis, I am watching the data carefully. We all should.

In closing, it has been a newsworthy quarter, such that the Summer Olympics and Afghanistan withdrawal debacle seem eons away, like distant memories. Many challenging questions remain, and I don’t think even a consortium of Sherlock Holmes, the Hardy Boys, and the Psychic Friends Network can provide definitive answers as to what lies ahead. Regardless, I remain convinced that higher asset prices, longer-lasting inflation, higher wages, and anemic economic growth will characterize the remainder of this year and next, while politicians continue to spend more time talking to news outlets and any microphone in front of them than legislating in any meaningful way. Let’s hope I am wrong in a few of my predictions.

As always, I would like to express my sincere appreciation and thanks to you, our investors, supporters, and friends as well as the entire Clear Capital and Clarion Management teams for their extraordinary efforts over a challenging period. I remain grateful and feel very fortunate to work alongside such a talented and dedicated group of individuals.

With that being said, I would be terribly remiss if I did not end this missive by acknowledging the loss of one of our own, Clear Capital’s very first employee, Dan Lukes, Director of Asset Management, who passed away from COVID last month. Dan’s contributions to the firm were immeasurable, and he will be profoundly missed, personally and professionally. Our sincere and heartfelt condolences go out to his colleagues, friends, and family members. May his memory be a blessing.

Best,

Eric Sussman