People ask me to predict the future, when all I want to do is prevent it. To hell with more of the same. I want better.

—Ray BradburyPrepare for the unknown by studying how others in the past have coped with theunforeseeable and the unpredictable.

—George S. Patton

“Auld Lang Syne,” the poem by Scotsman Robert Burns, set to folk music, and routinely sung on New Year’s Eve to bid farewell to the year just passed, essentially begins with a rhetorical question: “Is it right that old times be forgotten?”

Should auld acquaintance be forgot,

And never brought to mind?

Should auld acquaintance be forgot,

And auld lang syne?

Well, unless you own a lot of stock in a videoconferencing company, bought Bitcoin early in the year, or have the last name Bezos or Musk, the answer is very likely “yes,” and you are overjoyed to say goodbye to 2020. Then again, with the way that 2021 has started, with an insurrection in our Nation’s Capital, along with sobering employment and COVID news, I am beginning to wonder whether December is holding January hostage.

Regardless of the year’s auspicious start, I anticipate that 2021 will mark a turning point, as vaccines become more widely available, people slowly revert to their old ways, and the Washington political scene (hopefully) returns to more boring norms. However, it will take some time before people become completely comfortable dining at restaurants, traveling widely, or fighting over free food samples at Costco. I have often joked that inertia is the most powerful force in the universe, which not only explains the B- I received in AP Physics, but why a “V”-shaped recovery was really never in the cards and why I disagreed with those who made such rosy forecasts.

At the same time, I maintain my cynicism that “this time is different” or that 2020 represents the permanent start of a “new normal.” That is not to say that certain trends I have written about previously (i.e., automation, Amazon, AI, domestic migration) were not accelerated by COVID and won’t persist, and our divided electorate will present substantial challenges going forward.

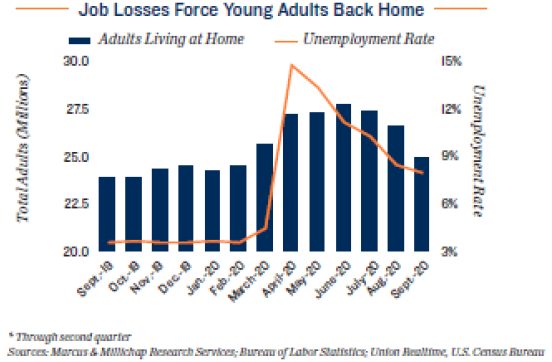

However, people will soon shed the Lulu yoga pants and head back into the office, though perhaps spending fewer days or hours there. Schoolchildren and college students will eagerly head back to campuses and live instruction, though perhaps engaging in more hybrid courses, integrating distant and in-person learning, creating opportunities and challenges in all levels of education. Young adults will leave their parent’s homes (can I get a hallelujah?), rent apartments, and return to urban cores, where social life is a tad more exciting than in the burbs. People will return to shopping malls, restaurants, bars, and even movie theatres; in time, and perhaps wearing masks all the while.

If history is instructive, and it so often is, the economy will bounce back sharply towards the end of this year and into 2022. My colleagues at UCLA Anderson recently predicted that we will reexperience the Roaring 20’s, Part Two. There certainly are eerie parallels between 1920 and 2020. Warren Harding, who won the presidency in 1920, following World War I and the Spanish Flu pandemic, campaigned on a platform that seems all too familiar, that “America’s present need is not heroics, but healing; not nostrums, but normalcy; not revolution, but restoration.”

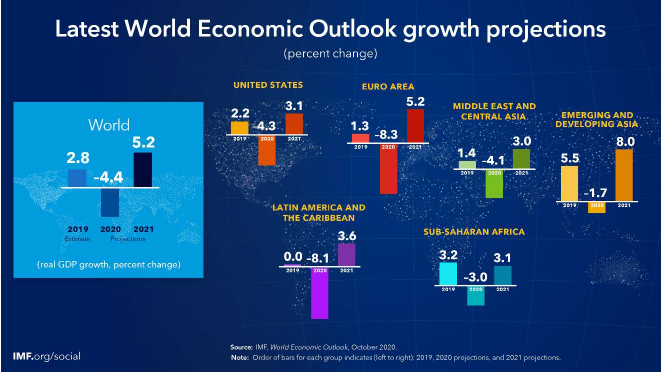

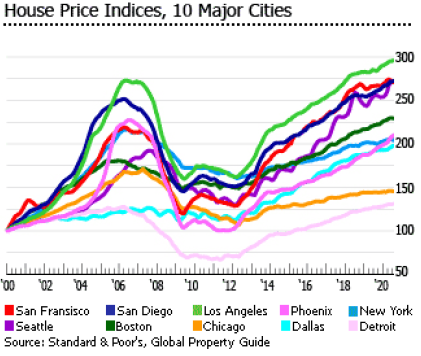

Yet I am not quite as bullish as my Anderson colleagues, if just because of how we have so profoundly bungled our response to COVID and the vaccine rollout. While Biden and the Democratic-controlled Congress will pass significant stimulus legislation ($1.9 trillion, they say) shortly after the inauguration, the economy and job market will take time to recover. Certain markets, especially Los Angeles, San Francisco, San Jose, Seattle, and New York will recover more slowly, as their relative high living costs create consequential headwinds. Meanwhile, the IMF issued a more subdued global outlook in October, predicting next year’s U.S. real GDP growth to be an uninspiring 3.1% (globally, 5.2%), following projected a 2020 decline of 4.3% (globally, 4.4%).

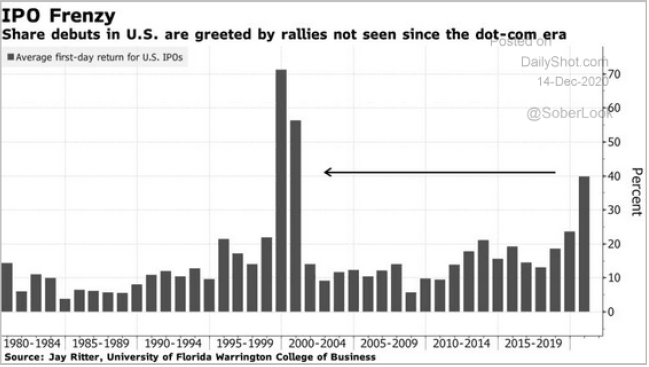

Regardless, it seems like the Roaring 20’s, if not 1999, have already reappeared in some parts of the financial markets. The initial public offering market is on fire, with the first day trading in stocks like DoorDash (up 85.7%), AirBnb (up 212.8%), and Poshmark (up 241.7%) providing 1999-like whiplash. These sorts of price movements, the record number of SPAC (Special Purpose Acquisition Company) or “Blank Check” public offerings, and values of certain equities completely detached from underlying fundamentals (e.g., Tesla) make me very uneasy. I have told many a class that significant increases in public offerings, including unique and widespread financial machinations – and SPAC public offerings certainly qualify – often mark market tops. In 2020 alone, non-financial firms globally raised nearly $4 trillion from public investors, including record levels of junk bonds, in the face of COVID and global recession.

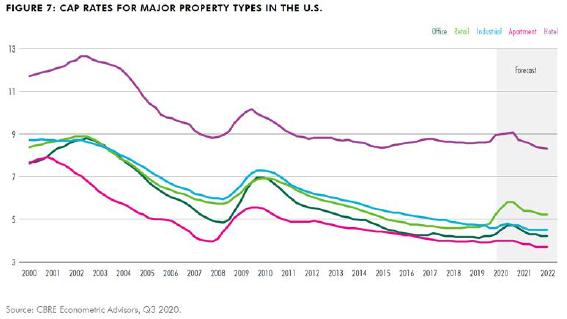

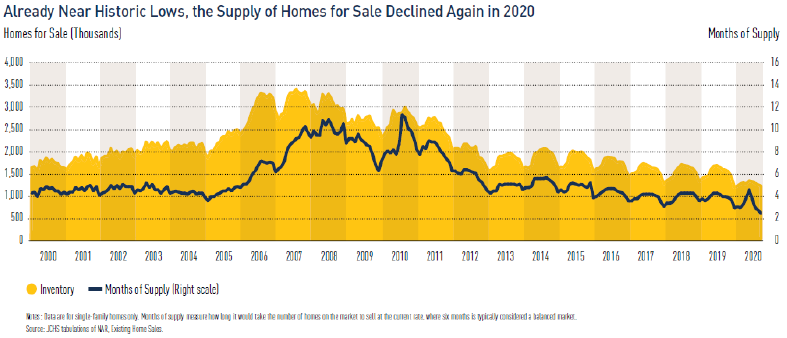

And commercial real estate? Industrial and multifamily properties, which have been the strongest performers, should continue to be stars of the show. That is not to say that either asset type is immune to broader economic challenges. However, the continued shift to e-tailing, last-mile distribution, and on-shoring of certain manufacturing activities will provide strong tailwinds for the industrial real estate, while high, if not unaffordable, single-family home prices, reduced housing starts, low supply of homes for sale, and an improving job market should provide strong foundational support for multifamily assets. Apartment cap rates should remain below five percent. Distressed retail, office, and hotel/hospitality markets may attract significant institutional capital seeking higher returns, but these opportunities will come with commensurate risk.

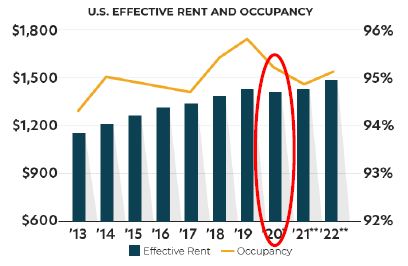

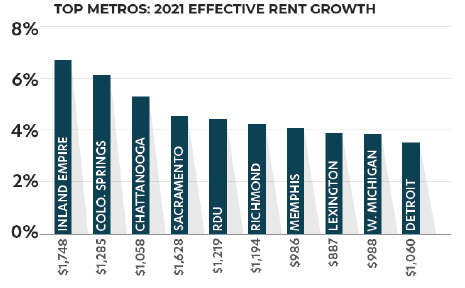

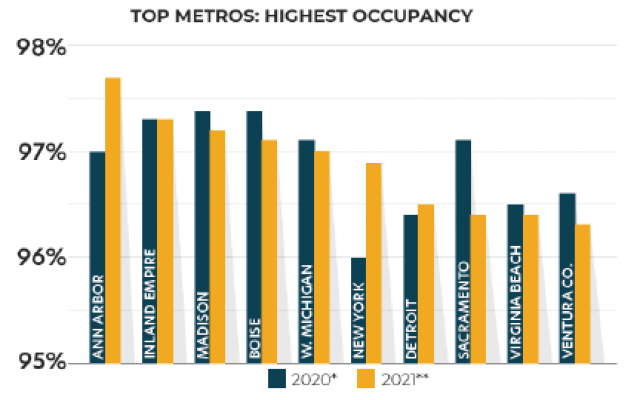

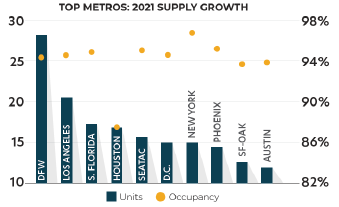

A couple of other data points in the multifamily markets are worthy of mention before I get much further. One, the national apartment vacancy rate increased to 5.2% in the fourth quarter, up slightly from 5.1% in the third quarter and 4.7% in the fourth quarter of 2019. Apartment rents declined 1.4% in the fourth quarter and over 3.0% during the year, with major metros like Boston, Seattle, Chicago, New York City, San Francisco, San Jose, and Washington D.C. suffering double-digit declines, while more affordable markets (e.g., Boise, Albuquerque, Bakersfield) actually saw higher rents (increases of 6.0 to 8.0%), so national figures mask significant variances in individual submarkets.

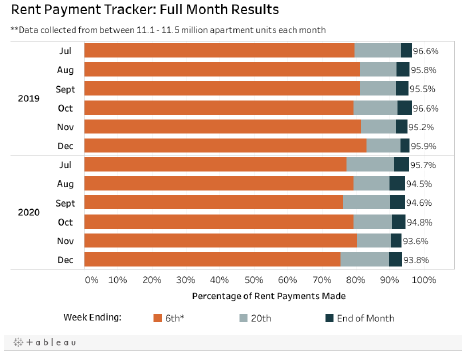

Finally, while overall rent collections nationally remain high, collections are down year-over-year and more payments are being made during the latter half of any particular month. Our overall portfolio has experienced similar collection patterns. Presumably, stimulus checks and an improving job market later this year should help, though we will have to see how the second quarter shapes up, once the next round of stimulus checks goes out and most people await their turn in the vaccination lottery.

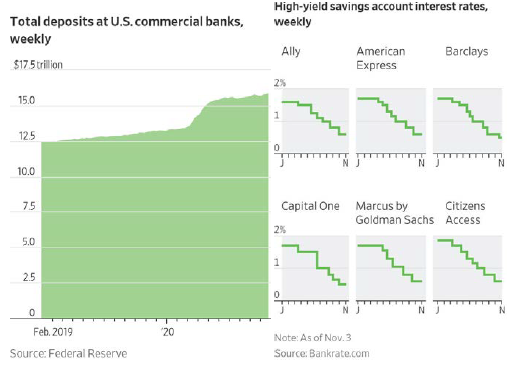

In summary, it is a mixed economic bag, with the promise of widespread vaccinations providing room for optimism and an economic recovery in the latter half of 2021 and into 2022. The record high deposits at U.S. commercial banks ($16 trillion), all realizing negative real returns, will continue to provide substantial support for financial and tangible asset values. With real estate collateral underpinning something like 60% of the U.S. banking system, monetary policy will also likely continue to support asset prices and economic growth.

Meanwhile rich equity valuations (if not speculation in some corners of the market), increased deficit spending, burgeoning government borrowing (at all levels), higher household debt, and political divisiveness create uncertainty. On the other hand, the contrarian in me is not disappointed with some uncertainty, as we seek to identify and acquire investment opportunities.

While I usually minimize political discussions in these quarterly missives, the November elections will prove very impactful and cannot be ignored

Now that it is clear that the Democrats will control both the executive and legislative branches through 2022, performing a Georgia miracle along the way, we can expect a flurry of significant legislation and executive orders regarding taxation, infrastructure, healthcare, immigration, housing, and the environment. In the short-term, Congress will be preoccupied with a second round of impeachment proceedings and the proposed stimulus package, but our elected representatives will be busy bees during the next 24 months. Expect significantly higher corporate and individual income taxes (for those earning in excess of $400K per year) and less favorable tax policy for commercial real estate investors, including the likely elimination of 1031 tax-deferred exchanges.

How influential the progressive side of the Democratic Party will be remains to be seen, but I expect President-elect Biden to promote bipartisanship and balance, if he is true to his word…which I realize may be an oxymoron when it comes to politicians. However, in this case, I expect it to be true. And while I am concerned about deficit spending and increased levels of government debt, I have never been much of a believer in “trickle-down” economics, as I made clear in my memo from 2018 following the Tax Cuts and Jobs Act of 2017. I have since expressed my profound concerns about growing wealth inequality, so it may simply be the lesser of evils. I don’t know how our Republic can survive without a solid middle class, and higher taxes may be the bitter pill to be swallowed to accomplish this objective.

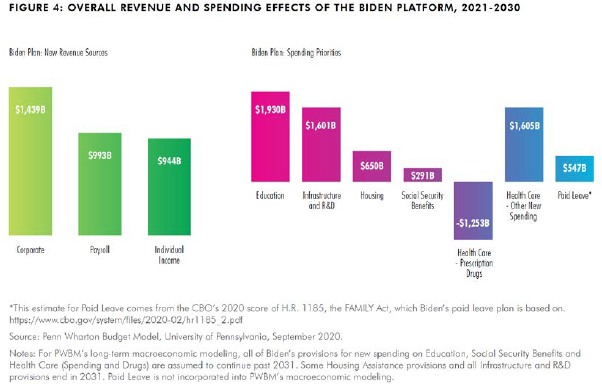

In any event, I found the following effectively captures the impact of the proposed Biden platform and the $5.4 trillion in additional spending it would compel over the next decade, only partly offset by higher taxes:

Clearly, the U.S. Treasury will also be busy bees, issuing greater levels of debt to fund these ambitious plans, with debt to GDP ratios likely reaching all-time highs by 2025.

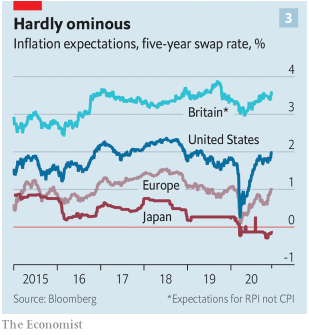

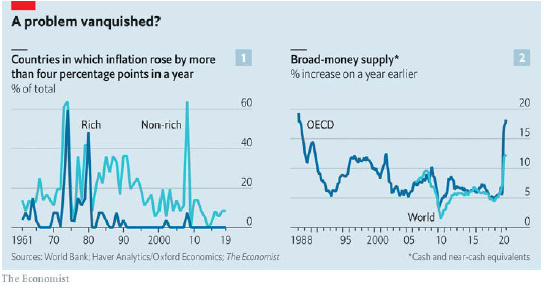

While not concerned about increased debt levels in the short-run, as mentioned, I do fear the higher inflation and asset values they will likely fuel in the intermediate to longer-term. I don’t think for a second that the Fed’s “easy” monetary policies and elevated equity values are unrelated. However, at this point, the markets are not forecasting significantly higher inflation. It may just be that inflation in financial assets (including real estate) will be offset by broader deflation in everything from energy to consumer goods to office and retail rents.

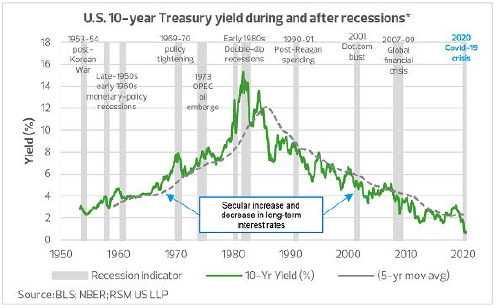

In short, while I am not projecting a return to the 1970’s and the 10 percent inflation it brought, the after-effects of monetary stimulus, deficit spending, and corporate investment may catch investors off guard in 2022 or 2023.

History is full of surprises and when consumers see the light at the end of the COVID tunnel, significant increases in spending and prices may follow. Perhaps anticipating increases in government stimulus, deficit spending, and government borrowing, interest rates have begun to creep upward during the last few months.

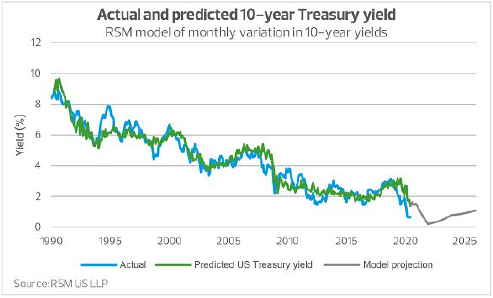

While the Fed has indicated that it will keep interest rates “at or near zero” until 2023, yields on 10-year Treasuries have been creeping up as of late, to 1.10% at last glance (end of second week in January), versus 0.68% at the end of the third quarter. They began 2020 at 1.88%. While short-term moves and 50-basis point increases in short-term rates may seem insignificant, they can materially impact borrowing costs tied to both residential and commercial mortgages. For example, 30-year mortgage rates for single-family homes averaged 2.84% this past week versus2.67% at year-end.

In short, I expect interest rates to move in a narrow range during the first half of the year, as the economic recovery proves sluggish and uneven, but to rise during the latter half of 2021 and into 2022, as economic growth and consumer spending resume and the Fed’s money-printing endeavors result in greater financial and real estate asset inflation.

Meanwhile, the multifamily market should remain solid in coming years, with physical occupancies remaining high and rental growth resuming later this year

With slightly increased national vacancy, modestly lower rents, and collection challenges caused by COVID, 2020 was a tougher year for multifamily assets, following years of strong performance. Regardless, multifamily assets certainly outperformed other classes of investment real estate (e.g., retail, office, hotel/hospitality).

However, not all multifamily markets are created equal, and national-level data obscures significant local and regional differences, as mentioned above. For example, overall rents dropped in all 10 of the most expensive cities for renters during 2020, with San Francisco, Seattle, Boston, and New York rents declining 20% or more between March and year-end. Yes, 20% or more. Eighteen of the 30 largest U.S. cities saw more renters departing, as opposed to 2019. With the option to work from home, many renters fled these larger, dense cities for suburbs, mid-sized cities, and even vacation rentals, resulting in higher rents in many locales.

Before the pandemic, remote work was already expanding in the U.S. In 2019, work-from-home employees accounted for nearly 12.0% of the total labor market, but in response to the pandemic, that figure shot up to 35%, according to a recent report from Newmark. While most of these workers will return to the office once the pandemic ends, it is clear that the remote-work segment of the market will grow significantly, perhaps evolving into an office-remote hybrid model. As a result, many apartment units are being reconfigured to better accommodate work-from-home needs, by creating indoor workspaces, adding balconies and more outdoor space, and providing high-speed internet and cellphone coverage throughout particular properties.

Meanwhile, the U.S. is becoming a “renter nation” yet again. According to RENTCafe.com, an estimated 45 million Gen-Zers (people born in late 1990’s or early 2000’s), will have entered the housing market by 2025, most of whom are likely to rent. Overall, renters still comprise 33.6% of the U.S., up from 33.0% in 2010. The reality is that renting remains more affordable than purchasing a home in 18 of the 25 most populated counties in the country, and in 29 of 44 counties with populations exceeding one million, assuming that potential homebuyers have the funds to meet down payment requirements.

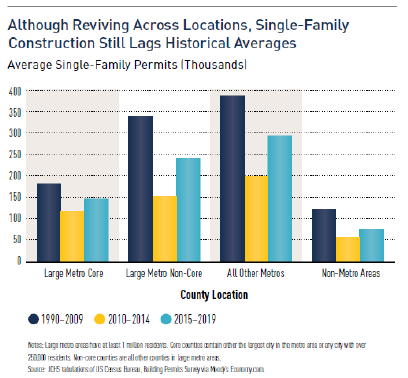

Between the high cost and lack of supply of buildable lots, high land and infrastructure costs, volatile material prices (i.e., lumber, copper, brass, steel), a challenging labor market, and excessively lengthy entitlement processes and regulations, single-family residential home construction lags substantially below longer-term historical averages and the supply of new homes declined again last year. These trends are likely to persist longer-term, which may be mediocre news for prospective homebuyers, but good news for apartment owners and investors.

The combination of low supply of homes for sale and record-low interest rates (30-year mortgages under 3.0%), it can’t come as any surprise that home prices nationwide increased 8.2% between November 2019 and November 2020, according to CoreLogic, with virtually every region sharing in the fun. But with the median home price in the U.S. hovering around $320,000, affordability remains a challenge in many markets, providing additional foundational support to the multifamily markets.

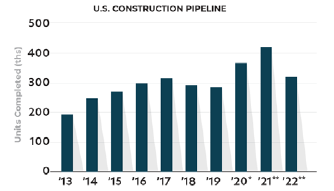

Meanwhile, developers are poised to add over 300,000 apartment units in 2021, down slightly from 2020, as construction delays caused by both the pandemic and economic slowdown push some projects into 2022.

Finally, if you are interested in reading more about our housing markets and find yourself with substantial free time, I might refer you to this year’s “State of the Nation’s Housing,” published by the Joint Center for Housing Studies of Harvard University, which you can find here: https://www.jchs.harvard.edu/state-nations-housing-2020. The Report echoes many of the same themes from prior years: a lack of affordable housing, unequal access to homeownership, and calls for “comprehensive re-envisioning of national housing policy.”

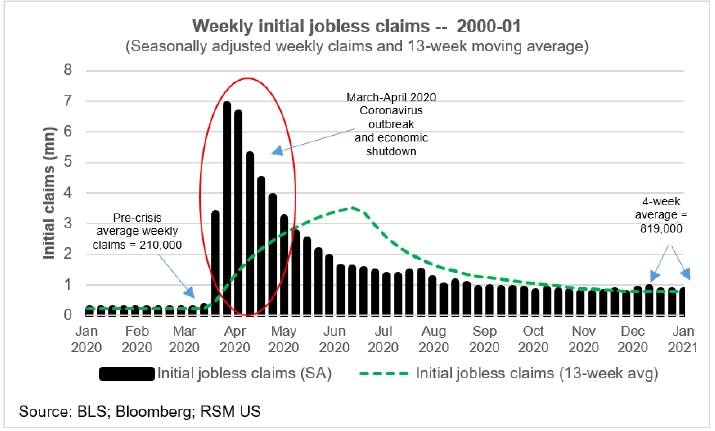

Clearly, we need to watch the job market very closely to gauge the strength and sustainability of any economic recovery

In the absence of government stimulus, a resurgence in COVID cases (including a more contagious variant), and the fractious discourse voiced from certain politicians and their supporters, the job recovery has stalled. Employers cut 140,000 jobs last month, the first net decline in employment since last spring, and initial claims for state unemployment claims exceeded one million during the second week of January, a figure last seen in July.

Until we reach herd immunity from COVID and the Biden Administration settles in, I don’t think we will see marked improvement in the unemployment rate, which remains at 6.7%. The job losses have been especially hard on people of color and the younger demographic. In fact, as of the end of September, some 25 million young adults were living with their parents, two of whom happen to be cohabitating with yours truly. The silver lining is that these young adults will likely become renters in short order.

Overheated equity markets may represent the greatest economic risk beyond COVID-19

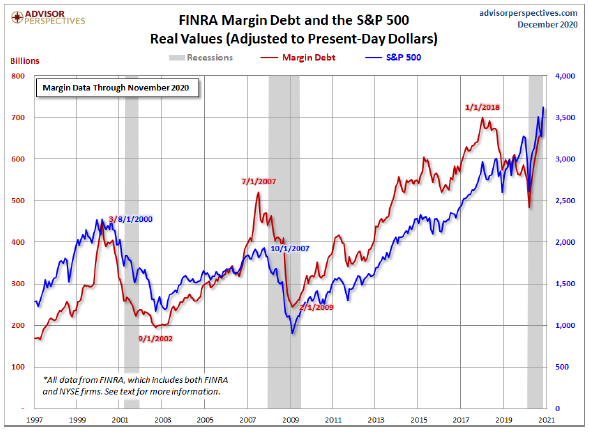

While calling market tops in the stock market may be a fool’s errand, recognizing when equity values become detached from underlying fundamentals is not. Having lived through a few market cycles, I am concerned by the recent flurry of initial public offerings, which have soared on their trading debuts, the widespread issuance of unique securities (e.g., SPACS, cryptocurrencies), increased speculation by retail investors (welcome to Robinhood), and substantial growth in margin debt. As I have stated before, significant liquidity and near-zero interest rates can create serious fuel for financial dislocations.

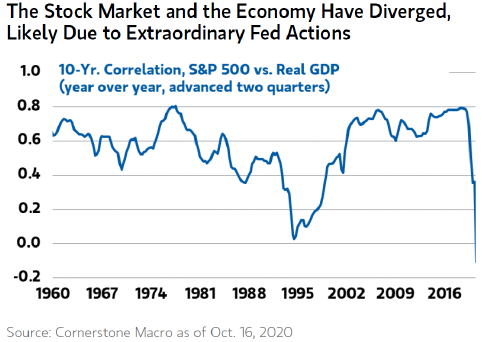

If a picture tells a thousand words, equity market returns have diverged from changes in real GDP in recent years, especially in 2020.

Meanwhile, “zombie” company debt is at an all-time high, exceeding $1.3 trillion. These are firms whose interest expense exceeds their operating income, whose survival depends on financing (and refinancing) with cheap debt. These firms comprise some 19% of the Russell 3000 Index, or 571 companies, employing more than 800,000 people. While recessions generally act – in Darwinian fashion – to restrict these companies and their operations, a combination of cheap and readily available debt and equity capital, along with government largesse (e.g., PPP loans), have allowed these firms to continue operating.

And margin debt? It recently hit an all-time in November 2020, a record $722.1 billion, topping the previous high of $668.9 billion and representing a 28% increase from the prior year, according to the Financial Industry Regulatory Authority (FINRA). I would note that March 2000 and July 2007 represented prior near-term highs in margin debt. Perhaps “this time is different” because interest rates are so low, but color me a cynic.

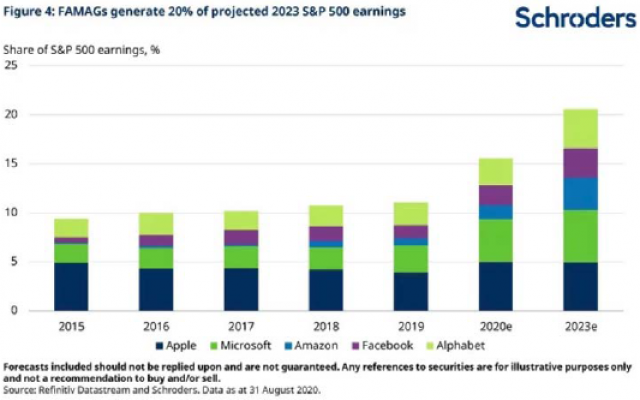

Finally, I should not neglect to mention the significant concentration in equity valuation, represented by large-cap technology companies. At the start of 2020, Alphabet (Google), Amazon, Apple, FB, and Microsoft were worth approximately $5 trillion, collectively, and comprised about 17.5% of the S&P 500. Fast forward to today and the figures are $7 trillion and 22%, respectively. While these firms are truly outstanding, and anything but zombies, this amount of market concentration simply makes me a tad uneasy.

And, as usual, if you will indulge me, there are always additional tidbits I think are worthy of discussion

- Private Sector Assuming Public Sector’s Failures re: Affordable Housing: In a recent WSJ article, Amazon indicated that it would commit $2 billion to “create and preserve affordable housing in three of its employment hubs: Seattle, Arlington, and Nashville.” You may recall that I described in prior memos how Alphabet/Google, Apple, and Microsoft had previously made similar pledges of $1 billion, $2.5 billion, and $750million, respectively. Therefore, in sum, four of the largest tech companies I just described as representing such a substantial percentage of our equity markets, have committed $6.25billion to affordable housing. However, it is not clear how these “commitments” will translate into actual housing given broader market realities I describe elsewhere. Regardless, $6.5 billion is not really impactful, either to these firm’s bottom lines or overall housing affordability. However, these actions reflect how the private sector is trying to assume responsibilities normally tasked to the public one.

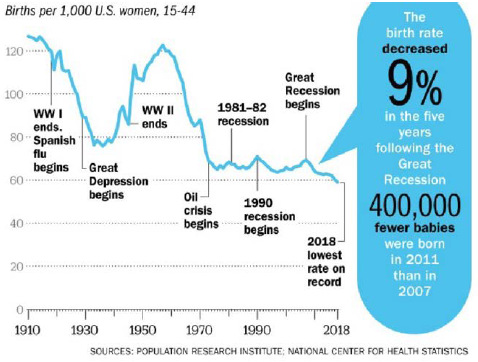

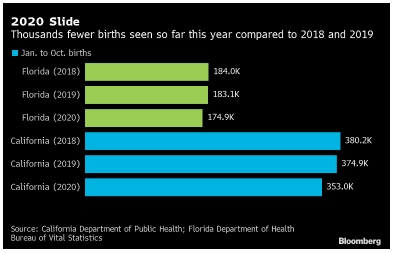

- The Baby Bust Continues: Contrary to many predictions that quarantining and isolation might lead to a “baby boom” (one can only watch so much Queen’s Gambit, I suppose),analysts now expect up to half a million fewer babies in 2021 (3.3 million) versus 2019 (3.8million). My sense is that concerns about the economy are the principal driver, though COVID and the worries it has brought are not exactly aphrodisiacal.

Here is the upshot. The U.S. population is approximately 330 million today and growing only 0.5% per year, between sharp drops in fertility rates and immigration. Therefore, the country is likely within 10% of its peak population and may never reach 400 million residents. While there is a growing number of seniors living to 85 and beyond due to healthcare advances, the number of people in the U.S. under 60 is decreasing every day. Therefore, many metros will see no changes in their populations for the foreseeable future. Others will see population declines. These demographic shifts do not bode well for future economic growth (see Japan).

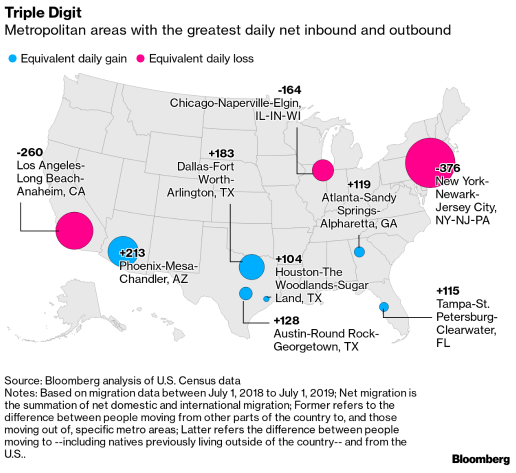

So follow the Baby Boomers, the growing cohort of those over 65, who are affluent and tend to favor cities in the South and Southwest, such as Phoenix, Vegas, Tampa, Orlando, Austin, Dallas, Nashville, Charlotte, and Raleigh-Durham. These markets ought to fare relatively well, while Millennials flock to some of these same cities, but also to Denver, Seattle, and Portland.

- Domestic Migration Continues: Over the past several years, I have written extensively about domestic migration, how California, for example, has experienced population declines every single year between 2010 and 2019, a trend most certainly continuing into 2020 and beyond. New York City lost 376 residents each day in 2019. Previously these population outflows were offset by international arrivals and domestic migration. Not any longer. In some cases, the wealthy are moving to more tax-favored states (e.g., Nevada, Texas, and Washington). In others, corporate residents (and presumably a large number of their employees) are relocating. Oracle, HP Enterprises, and CBRE recently announced that they were moving their headquarters out of California to Texas. COVID has clearly accelerated the trend, as 18 of the 30 largest US cities saw more renters leaving compared to 2019. It should come as no surprise that we are mostly underwriting and evaluating investment opportunities in these “destination markets.”

- 2020 Was, Unfortunately, a Banner Year for Bankruptcy Lawyers: As the economic repercussions from the COVID pandemic continued to unfold, corporate bankruptcies piled up. According to S&P Global Market Intelligence, 630 companies declared bankruptcy during the year, their worst levels since 2010 when 900 companies did so. By comparison, 578 and 513 companies declared bankruptcy in 2019 and 2018, respectively. High-profile bankruptcies included Neiman Marcus, J. C. Penney, Ascena Retail Group, Tailored Brands, and Chesapeake Energy. Some 23 companies sought bankruptcy protection during just the last two weeks of 2020.

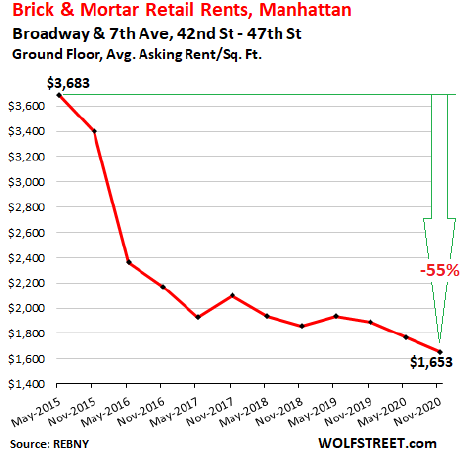

As COVID forced lockdowns across the country, many retailers suffered terribly. According to Coresight research, retailers shuttered 8,400 locations through the third quarter of 2020, putting the year on track to surpass 2019’s record of 9,302 closures. Nearly 20% of all restaurants closed permanently last year. If a single graph indicates just how bad the retail apocalypse is in some locales, take a look at what has happened to asking retail rents in Midtown Manhattan. I think a 55% drop in rents qualifies as something between brutal and ugly. Amazingly enough, even with these far reduced rents, vacant storefronts still lurk on every block.

In closing, while the first half of 2021 will be challenging, I am optimistic the latter half of the year will represent a significant turning point and that the economy in 2022 will strengthen considerably

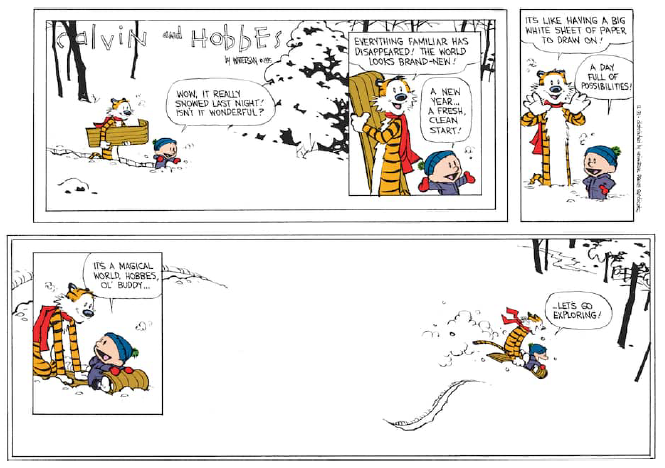

When I find myself with downtime (something of a rarity), I often reach for one of my favorite books, the “Complete Works of Calvin & Hobbes.” In fact, I believe that fictional “Calvin” is among my three favorite philosophers (as opposed to John Calvin, the 16th Century theologian). And if you are wondering, the other two are Yogi Berra and Dilbert. Anyhow, the very last published Calvin & Hobbes strip, released on December 31, 1995, made me think about 2021, and its message of hope, optimism, and the future:

We have been through an awful lot this past year, and perhaps it is darkest before dawn. With recent events in D.C. and sobering data and news on COVID, it can be hard to muster optimism, but I am certain that brighter days lay ahead, and with adversity and uncertainty, always comes opportunity.

The entire Clear Capital team wishes you and yours a healthy and prosperous 2021, and we look forward to sharing both our thoughts and investment opportunities with you throughout the year. For those of you who participated in our recent offerings in Carrollton, Texas, and Victorville, California, thank you. We appreciate your collective support of our firm and its endeavors.

Best,

Eric Sussman

Founding Partner