“The best time to buy real estate is five years ago.”

- Anonymous

"A pessimist sees difficulty in every opportunity; an optimist sees the opportunity in every difficulty."

-Winston Churchill

As a stickler when it comes to protocol, please allow me – on behalf of the entire Clear Capital team – to comply with the Style Guide for Fourth Quarter Investor Newsletters, by passing along our best wishes for the coming year. I hope that the holiday season was a joyous one for you and your families. Last year was a record-breaking one for the firm and our entire team remains profoundly grateful for your support.

With introductory pleasantries aside and 2021 behind us, our attention turns to 2022 and what it might bring in terms of the economy, financial markets, and multifamily investment opportunities. In short, I believe this year will be challenging, with lingering uncertainties surrounding COVID (I, like many others, am recently recovered from a breakthrough case, despite my three jabs), higher interest rates and inflation, moderating economic growth, geopolitical question marks (e.g., China, Russia), and the midterm elections later this fall. I suppose one could categorize the 2022 uncertainties as either the five C’s (COVID, costs, consumers, China, and Congress), or perhaps the four C’s and two I’s (COVID, consumers, China, Congress, inflation, and interest rates).

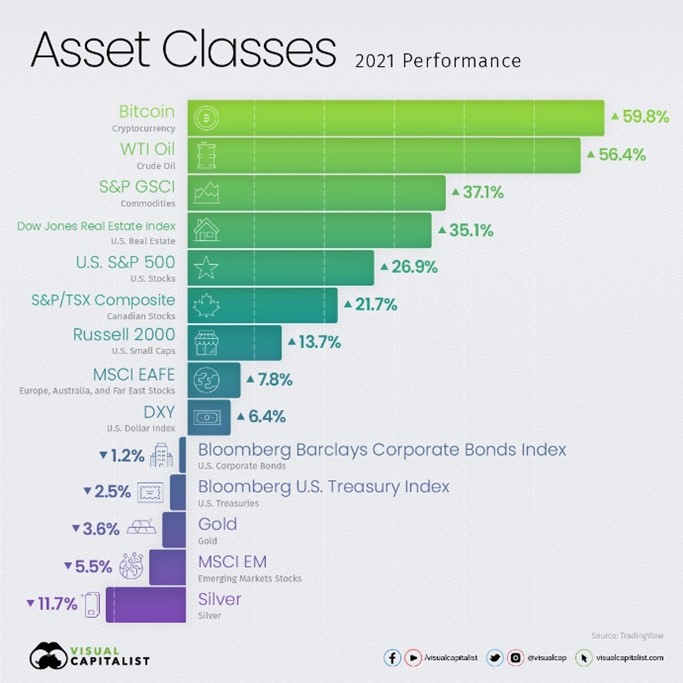

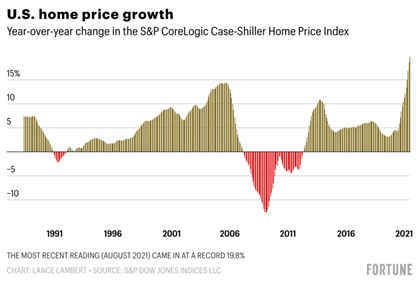

Financial markets face measurable headwinds, if just because recent performance has been so strong. Home sales volume and prices hit 15-year highs last year, up 8.5% and 16.9%, respectively. The S&P 500 was up a whopping 27%. Oil prices were up 56.4% and most other commodities (aluminum, nickel, zinc) were up more than 20%. Heck, even Bitcoin was up nearly 60%. In the face of higher interest rates, the Bloomberg Barclay’s Corporate Bond Index was only down a modest 1.2%, despite much higher 10-year Treasury yields.

One of the other macro-level concerns is whether the air that has been recently let out of the riskier, if not, speculative asset balloon, will prove contagious. The NASDAQ has already “corrected” nearly 12.0% this year. The ARK Innovation Fund (ARKK), which holds a basket of what I would consider the riskiest of the riskiest equities, and Bitcoin are both down about 25%. SPACs (Special Purpose Acquisition Companies) as a group are down over 15% year to date. Netflix, Peloton, Robinhood, and fill-in-the-blank with your favorite highflying meme stock, are trading at 52-week lows, with Peloton and Robinhood trading below their initial public offering prices. One quote from Saturday’s Wall Street Journal seemed especially apropos, if not a tad scary: “SPACs seemed, briefly, like a way to earn easy money. Now, the hype is giving way to reality.”

“Easy money?” Phrases like that, along with Jim Cramer shouting “Booyah” on CNBC’s “Mad Money” (not to be confused with another CNBC favorite, “Fast Money”), as he provides a painstakingly detailed and thorough 30-second analysis on some fast-growing, gravity-defying stock, give me the heebie jeebies…whatever those are (I believe they are closely related to the “willies”).

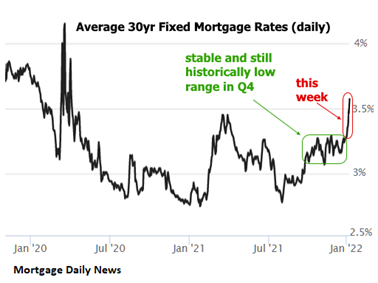

Meanwhile 10-year treasury yields have increased from 1.51% to 1.75% and 30-year mortgage rates from around 3.1%, to 3.5%. All in about three weeks. The financial market captain has illuminated the “Fasten Seat Belt” sign, and suggests you stay seated for the remainder of the flight.

That is not to say that the increased volatility and uncertainty will not present investment opportunities, a perspective Sir Churchill would endorse (see quote above), as they always do. But I am not so naïve as not to recognize and appreciate certain realities. That is, in part, what is required of us, as fiduciaries and stewards of capital. However, so much about this coming year depends on how markets respond to the Fed’s less accommodative monetary policies and whether Omicron marks the end of the pandemic or just another Greek letter in the worst fraternity ever.

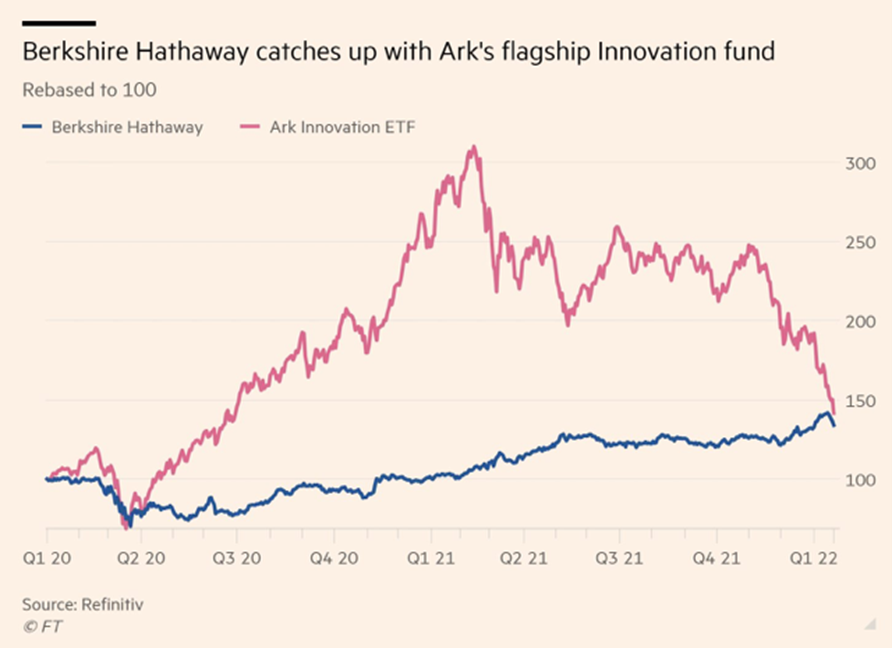

Over the last decade, growth-related investments have significantly outperformed value-oriented ones, but I sense the tide may finally be turning. According to Morningstar, value-based funds outperformed growth funds in 2021 for the first time since 2016, and it has been a rough decade for value-oriented investors. Businesses with more predictable and stable cash flows ought to be relative outperformers in markets such as these, and over time, you know, the kind of investments where making money isn’t “easy” or a “Booyah” doesn’t quite capture the fundamental analysis required to assess an opportunity. Perhaps this simple picture comparing recent relative performance of Berkshire Hathaway to ARKK is telling. Value investing may finally be having its day…or year…or…

While I know this will shock nary a single reader as I have a habit of beating the same proverbial drum, but I would include multifamily residential properties in the mix of stable, cash-flow producing assets that ought to perform relatively well in these volatile markets. While I don’t anticipate multifamily or other commercial real estate prices (i.e., industrial warehouses) to repeat the stellar performances they have experienced in recent years, assets with reasonably stable and predictable cash flows, combined with modest leverage, should be a valuable combination in markets such as these. Regardless, careful underwriting, asset selection, and market analysis will be especially important.

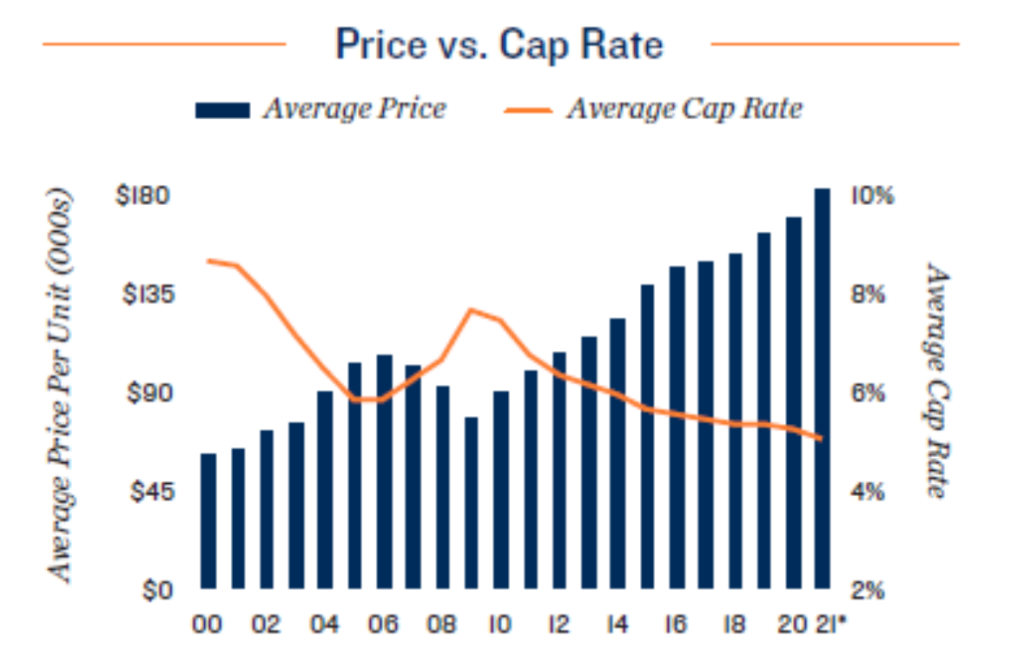

While this final picture paints quite a compelling picture and describes what has happened with multifamily pricing and cap rates over the last decade plus, I don’t anticipate the slope of either average prices paid per apartment unit or average cap rates to continue so linearly looking forward. It may not be that returns always revert to their long-term averages, but rather that trees don’t grow to the sky (and the corollary, roots don’t grow to the center of the earth).

However, if one remarkable tailwind remains, it is all the dry powder out there. The Blackstone Property Fund, a non-traded Real Estate Investment Trust, surpassed $50 billion in assets last month and has been raising $2 billion per month from retail investors since the middle of 2020. $2 billion a month! Not sure that kind of inflow qualifies as “easy money,” but it is certainly a lot of capital to deploy. Meantime, M2 money supply (cash, checking and savings accounts, money market funds, time deposits), all earning negative real returns (after inflation), approximated $21.5 trillion at the end of 2021, another all-time high, and a decent chunk of those funds will likely end up being invested in riskier assets at some point. The only question is when and where these assets go.

In conclusion, I could really use a Ouija Board and some tea leaves to forecast 2022 with so much depending on what is challenging to predict or know: the pandemic and what happens post-Omicron, politics, the impact of changing Fed policy, inflation, interest and mortgage rates, and the employment picture. As an information junkie, it should be a very interesting year, and I will do my best to try and make sense of it all and hope you will stay tuned alongside me and the rest of the Clear Capital team as we endeavor to do so.

While the fundamentals for multifamily residential assets remain strong, we cannot ignore the impact that higher interest rates, slower economic growth, challenging collections, protective tenant policies, the changing employment market, and other uncertainties may have on rents and values

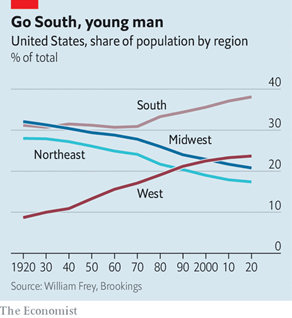

As alluded to above, I am often (and very appropriately) accused of repeating the same theme and beating the same drum every quarter, the “Gospel of Multifamily Investing.”™ I won’t plead the Fifth, but willingly admit guilt. For the last 20 years and more, I have preached that the future of housing in the U.S. is higher-density, multifamily housing, and that housing affordability would lead to increased relative demand for apartments, domestic migration (Manifest Destiny, in reverse, so to speak, as elaborated upon below), and multiple generations living under a single roof. These trends have come to pass, and I cannot see any reason as to why these macro-level realities will change any time soon, if ever.

However, to simply purchase assets indiscriminately, ignoring cycles, macroeconomic data, and geographic particulars (distinctions between various markets and submarkets), is not something we are ever going to do. The key is to recognize, appreciate, and evaluate the data, exercising even greater care and attention to detail while underwriting any potential investment opportunity. Obviously, we are not always right, but I believe our long-term track record speaks for itself.

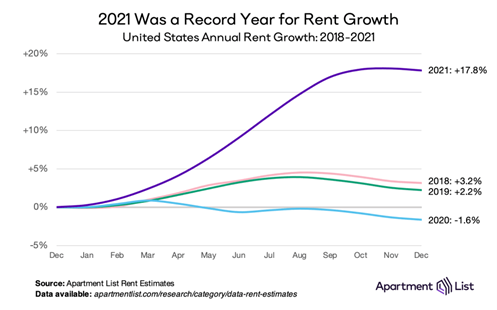

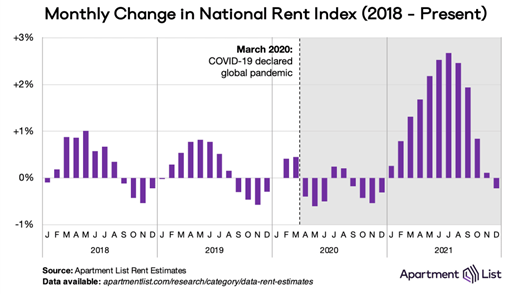

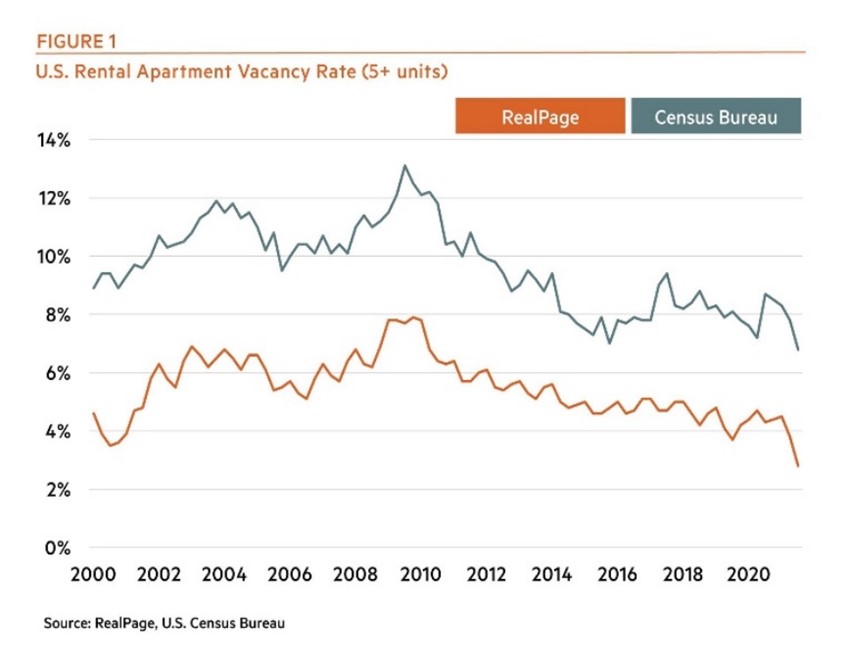

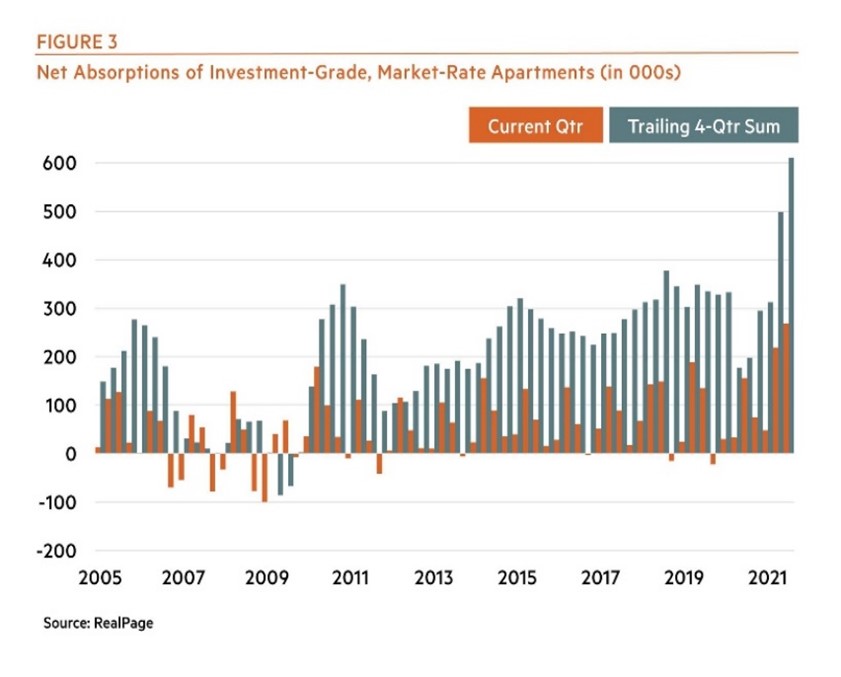

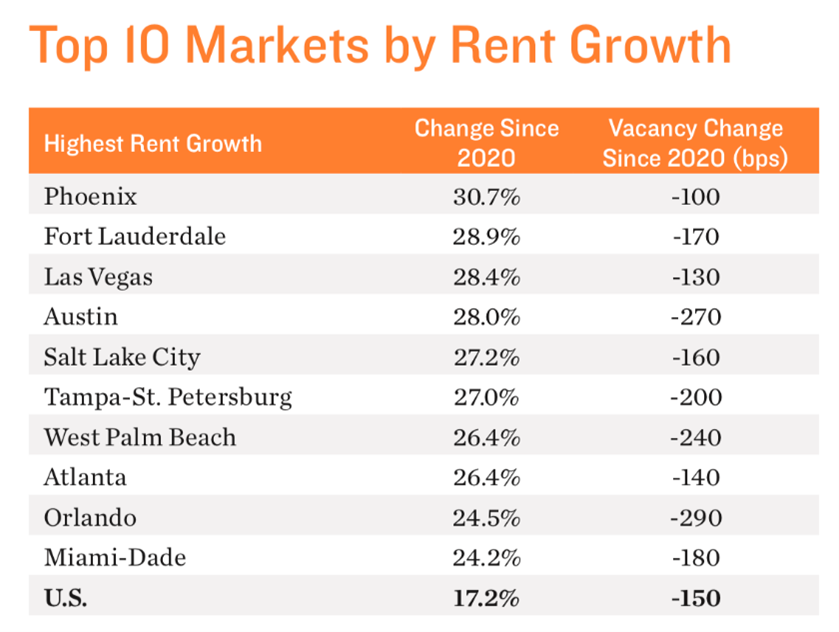

Let’s start with some data from 2021 and the first part of 2022, which essentially tell the broad multifamily story. Rents and net absorption of units (net units rented) increased sharply during the year. Vacancies declined. In all markets. While the first graph is certainly eye-popping, the second may be more telling. Rents increased in every month of 2021 except December, when they declined ever so slightly. But the trend between the end of summer and year-end was telling, as rental growth moderated substantially during the latter half of the year. That is no surprise and was bound to happen, but is probative when thinking about 2022, when I expect rental growth to return to more normal levels, like those experienced prior to the pandemic.

To witness this sort of rental growth and a decline in the overall vacancy rate is quite remarkable, reflecting the economic and employment recovery, sharply higher single-family home prices, and moderating construction starts and units brought to market due to supply chain disruptions and a shortage of construction workers.

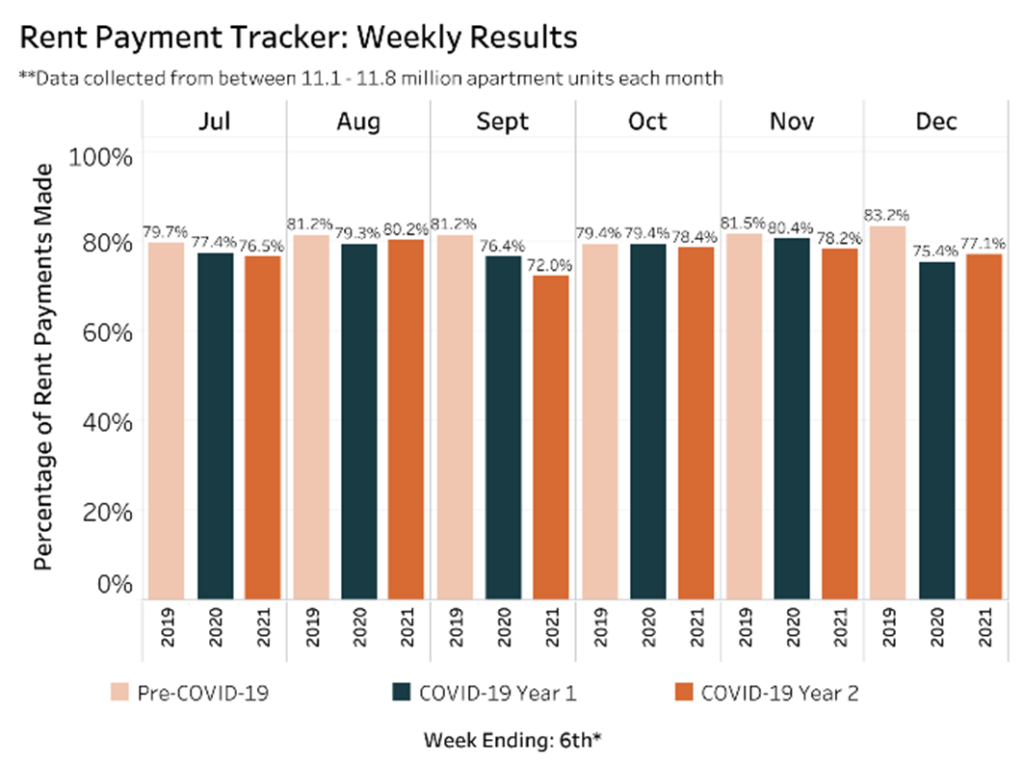

But it isn’t all peaches and cream, and higher rents, occupancies, and unit absorption can be deceiving, because all neglect to capture whether landlords are actually collecting the higher rents or whether tenants are moving and relocating as one would expect in a “normal” market. This is where the impact of the pandemic is clearly seen and skews the data. Collecting scheduled rents and evicting delinquent tenants remain challenges, even as eviction moratoriums burn off. In most jurisdictions, the courts are unable to process the backlog of unlawful detainer actions.

So, it is this sort of MMA battle between competing forces, as I so often describe. Demand is trickier to forecast because it depends on so many unknowns: changes in GDP and employment (which in turn are driven by everything from COVID to the future of remote work), the equity markets, interest rates, consumer sentiment, and household formation. There is no question that higher interest rates and elevated single-family home prices will increase demand for apartment units, all else equal. Otherwise, more precise demand forecasts are challenging.

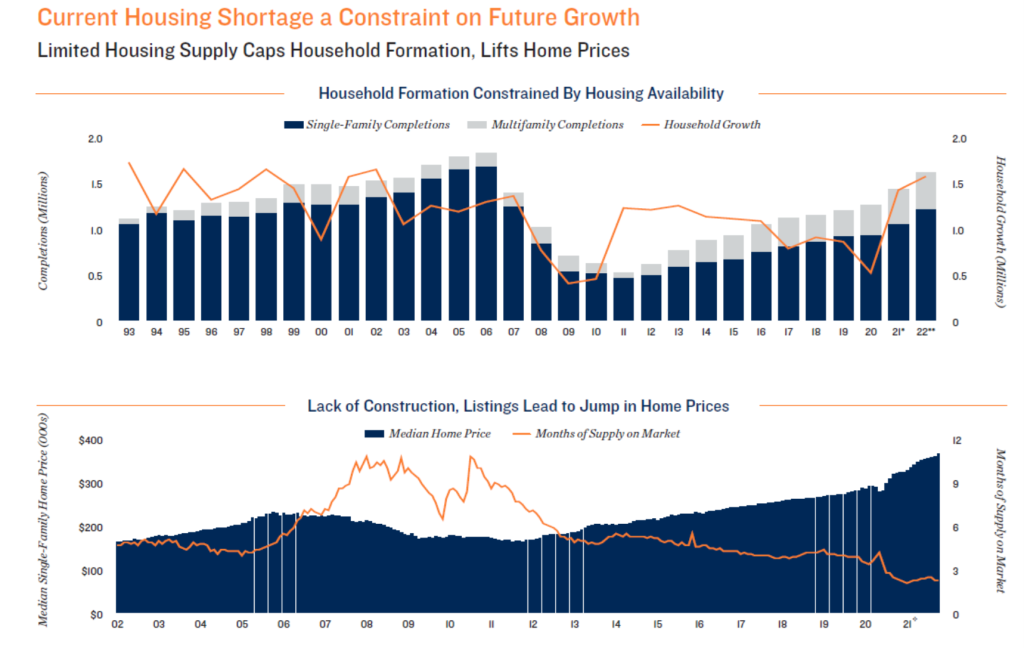

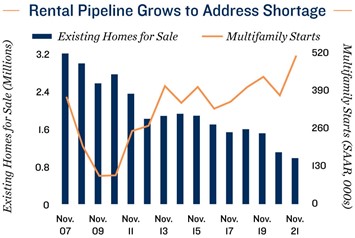

Supply is a bit easier to forecast, if just because the amount of land available for development is essentially fixed and new housing units in the pipeline, whether single- or multifamily, can be quantified, at least to some degree. From my perspective, this has been and will continue to be the housing rub. We cannot construct enough units to catch up and keep up, and I cannot foresee that changing anytime soon, even with recent increases in multifamily starts. Besides, new units coming to market are virtually all “Class A,” focused on the higher end of the market, as opposed to workforce housing, the sort of assets that Clear Capital seeks to acquire.

In summary, multifamily fundamentals remain solid and should benefit from an improving economy, labor market, higher interest rates (reducing housing affordability), and excess liquidity on the sidelines. But rental growth nationally this year will likely be quite modest, more like what occurred before the pandemic and during the latter half of 2021, while cap rates remain flat or even expand modestly.

So, what housing markets look best for 2022 and beyond? Where are potential apartment renters headed?

Location, location, location. Some may believe this platitude is the real estate equivalent of “Booyah,” but I don’t think so. It may be overly trite and simplistic, but we can all agree that there is a lot of truth to it. Not surprisingly, we spend a lot of time thinking about which markets in which we want to pursue opportunities, and then, in those markets we find attractive, the specific submarkets on which to focus. Consider our projects in Colorado Springs or Lakewood, both outside of Denver, or those in Gresham, Oregon City, or Eugene, Oregon, all essentially exurbs of Portland.

As we have discussed at length in previous quarterly updates, the U.S. population, like a fidgety child on a long car ride, has never sat still. For those of you are willing to head back to high school history for a moment (don’t worry, just a moment), we may remember being taught “Manifest Destiny,” the 19th century doctrine or belief that the expansion of the U.S. throughout the American continents was inevitable and justified. Perhaps not politically correct today, but the phrase “Go West, young man,” concerning our expansion westward, relates to Manifest Destiny.

Following World War II, as automobiles and highways became omnipresent, and so westward and southbound we went. To the suburbs we moved. To warmer locales, we flocked. My father did exactly that, moving from New York City (yes, the East Bronx for those of you interested in such things), to New Orleans for medical school, and then to Southern California for the opportunities it presented (thanks, Dad), including the opportunity to meet attractive and intelligent co-eds attending UCLA (thanks, Mom).

Fast forward to today, when we seem to have Manifest Destiny in reverse, at least in part. People are leaving the coasts, its high cost of housing, higher taxes, and crime, and heading to lower-cost states in the South, Southwest, Southeast, and parts of the Northwest. Data is a bit hard to come by, but according to the Federal Reserve Bank of Cleveland, about 1.1 million people moved from high-cost metro and coastal areas to either mid-size cities or rural areas since the start of the pandemic.

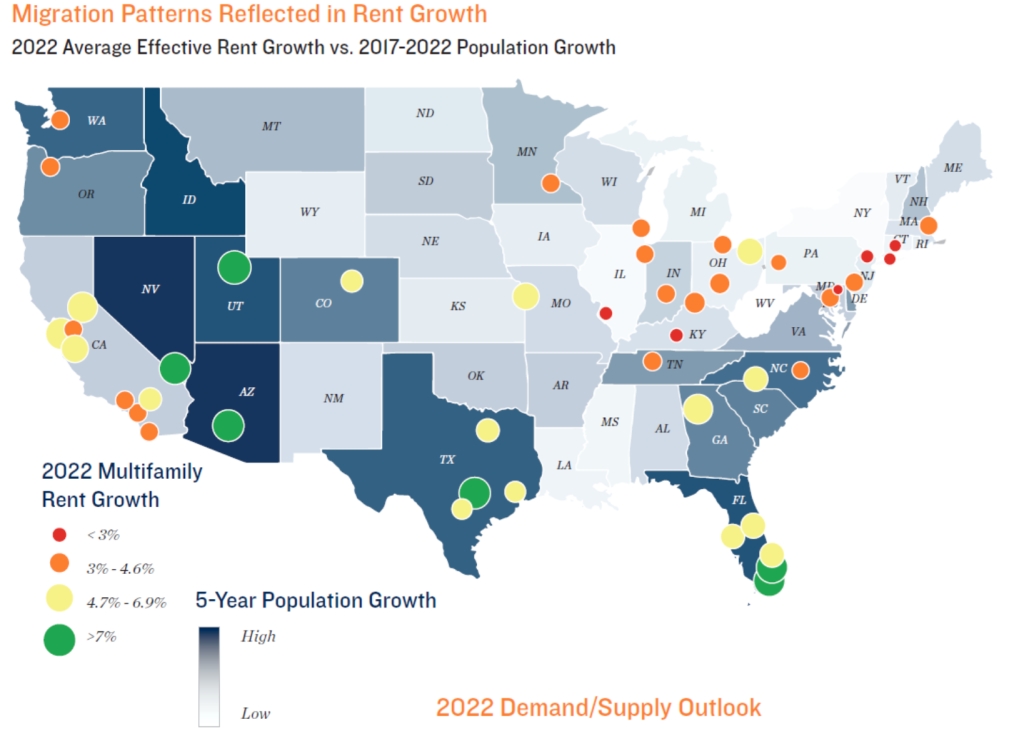

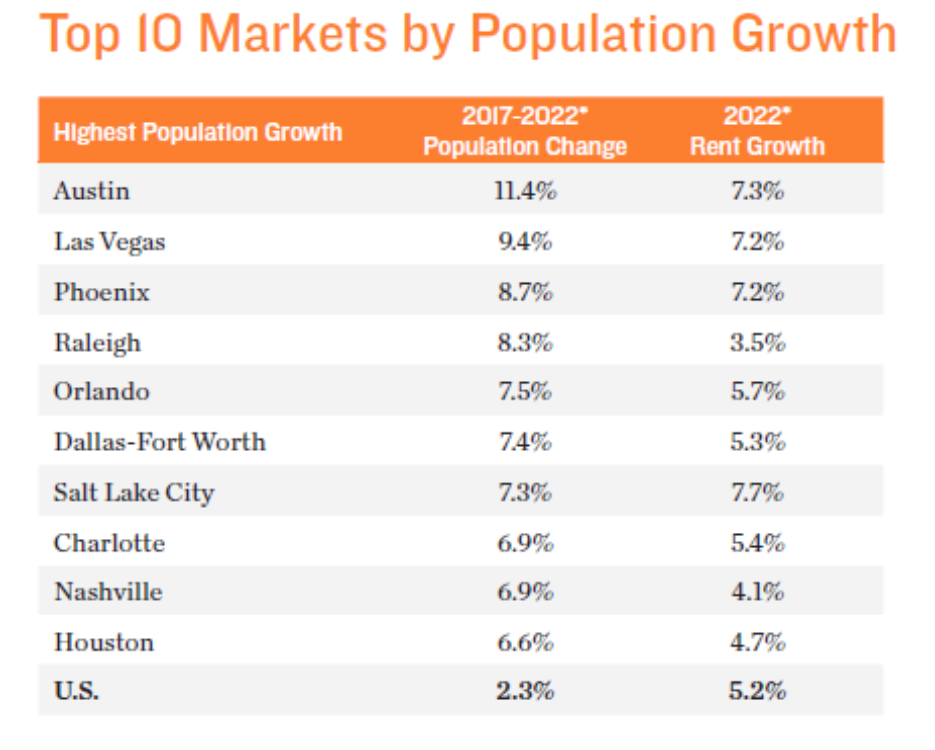

Texas, Arizona, Florida, Colorado, Montana, Oregon, and North Carolina all gained population according to the most recent census, while California and New York have lost residents. Not surprisingly, these population trends inform projections for rental growth in 2022 and beyond.

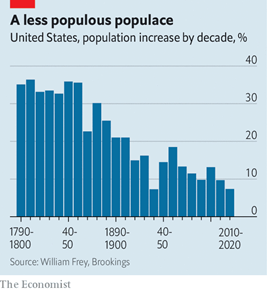

It is no surprise that the Sunbelt will likely see the greatest population growth in 2022, perhaps 250,000 new households. However, I am less sanguine about all these rosy rental growth forecasts, due to the uncertainties I have already discussed. As many of you know, we sold most of our Texas portfolio late last year because we were unable to achieve the sort of rental growth that we had predicted, in part because supply was able to mostly keep up with demand. In any event, many of the same locales that have been popular destinations in recent years from Phoenix to Vegas to Tampa to Atlanta to Sacramento will continue to be popular according to Freddie Mac. On a more macro-level, growth in the U.S. population continues to decline, a trend I have discussed for some time now, continually confirmed by new data.

This reality will have longer-term growth implications to be sure, perhaps another reason I don’t think Elon Musk has to worry too, too much about the need to colonize Mars, although I imagine numerous value-add investment opportunities await us there and elsewhere.

And single-family home prices in 2021? Wowza! But 2022 will likely look a whole lot different…

2021 was simply a remarkable year for the single-family residential market, with every single state realizing higher home prices. Just imagine that home prices in Arizona, Florida, and Idaho, rose 28.6%, 25.8%, and 25.5% in one year, respectively. “Wowza” really is the right word. One almost feels sorry for poor Alaska, which only experienced a 7.5% rise in home prices. The single-family market benefitted from an almost perfect storm of price drivers: record-low interest rates, increased household savings during the pandemic, a rising stock market, remote work, millennials entering homebuying years, institutional buyers loaded with capital, and reduced inventory and new supply.

However, these sorts of increases are not sustainable, and in the face of higher inflation and mortgage rates, slowing economic growth, the lingering pandemic, and broad uncertainty – economic and political –home prices are likely to remain flat this year, best I can foresee.

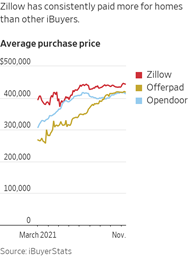

One impetus for higher home prices in 2021 was Wall Street and all the institutional i-buyers (e.g., Zillow, OpenDoor, and OfferPad) which were scooping up homes left, right, and center before they began to suffer some serious acquisition-related indigestion. Mark one in the “I got it right” column, as I have consistenly expressed pessimism about their strategies, basing purchase prices and home values on mathematical algorithms, while they forewent due diligence and purchased homes willy-nilly, for all cash and with quick closes. As though buying a home is like buying bubblegum at Walgreen’s. Even if their mathematical models were accurate, I could not detect a sustainable, scalable business model, especially in an economic downturn. It is equally likely that their models were a bit of GIGO, “garbage in, garbage out.”

Exhibit A for this colossal mess is Zillow, which announced a complete exit from the home-flipping business and is now offloading some 7,000 houses for $2.8 billion, on which it is expected to take a meaningful bath. Keep in mind that about 5.6 million single-family homes are sold in an entire year in the U.S. (plus about 700,000 condominiums). Whether their selling activity will depress prices in certain markets remains to be seen, but can we be surprised that they appear to have bought the most homes in Phoenix? From what I understand, a New York based investment firm has agreed to buy 2,000 of the homes from Zillow, so perhaps it depends on what this firm decides to do with them.

And sure enough, Zillow is not alone, as their competition is also starting to sell. Economics 100 tell us that this increased supply will negatively impact pricing, at least on the margin.

Meanwhile, more favorable longer-term trends in the single-family market persist, including a lack of buildable lots. Back in 2004 to 2005, homebuilders collectively generated new home sales of about one million units. And today? About 800,000. Will Rogers quote about “buying land because they are not making any more of it” was prescient. In a recent survey, about three-quarters of developers described the number of buildable lots in their markets as “low” or “very low”.

Meantime, supply chain and labor woes have provided and will continue to provide some downside buffers to single-family home prices. The cost to build a home is up about 20% over the past year, and most developments are at least two months behind schedule. I am sure more than a few of you have been experienced the supply chain challenges first-hand, perhaps a delay in the delivery of a washer and dryer or some other home appliance. We have. How long it takes for supply chains to return to normal is anyone’s guess, but given my penchant for cynicism, I am betting it will take more time than less.

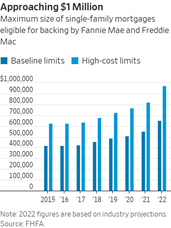

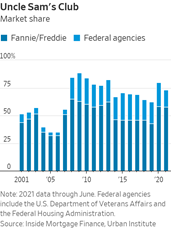

In other single-family housing news, I recently read that Fannie Mae is going to increase the size of home mortgages that it is willing to back, to nearly seven figures, reflecting the obvious, that its previous ceilings were impractical in the face of higher home prices. As of now, the maximum loan limit is $647,200, so whether they follow through remains to be seen. Given that some 60% of single-family homes purchased in the U.S. are financed through Fannie, the change would be impactful.

Regardless, I believe home prices will be mostly flat this year or will trade in a modest range (up or down a couple of percent). I certainly don’t see a repeat of 2021, but on the other hand, I don’t see any impending collapse. The banks have been more prudent in their lending standards, supply remains low, and even with their recent rise, mortgage rates relatively low by historical standards.

Location, location, location? More like inflation, inflation, inflation….

Unless, you have been living under a rock (if you have, I hope it is not in the Sunbelt as it would get awfully toasty under there), rising prices and inflation have been on every consumer, investor, and policy maker’s mind of late, as we have recently witnessed inflation rates not seen for some 40 years. Consumer prices rose 7.0% in December, as compared to the prior year, even higher than November’s 6.8% rise, and levels not seen since 1982. One picture tells 1,000 words, and it’s not pretty:

Here’s the thing. After a year of brushing off these higher prices as “transitory,” it is proving anything but, and can we really be shocked? The Fed has printed money for over a decade like they would never run out of toner. Does anyone think that the bubbles we have witnessed in speculative assets (see November Clear Insights newsletter) and higher assets generally (including, yes, real estate prices) have strictly been based on fundamentals? Sure, those have been highly influential, too, but let’s not pretend that the accommodative Fed has not played its part.

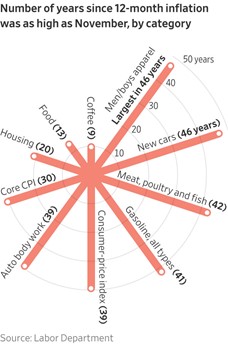

Here are another couple of interesting pictures which tell the inflation story, and in ways that I found unique and interesting. The first summarizes – across various categories (i.e., housing, food, gasoline, new cars, wages) – just how many years it has been since inflation rates were as high as what we have recently witnessed. Let’s just say that it has been…a while.

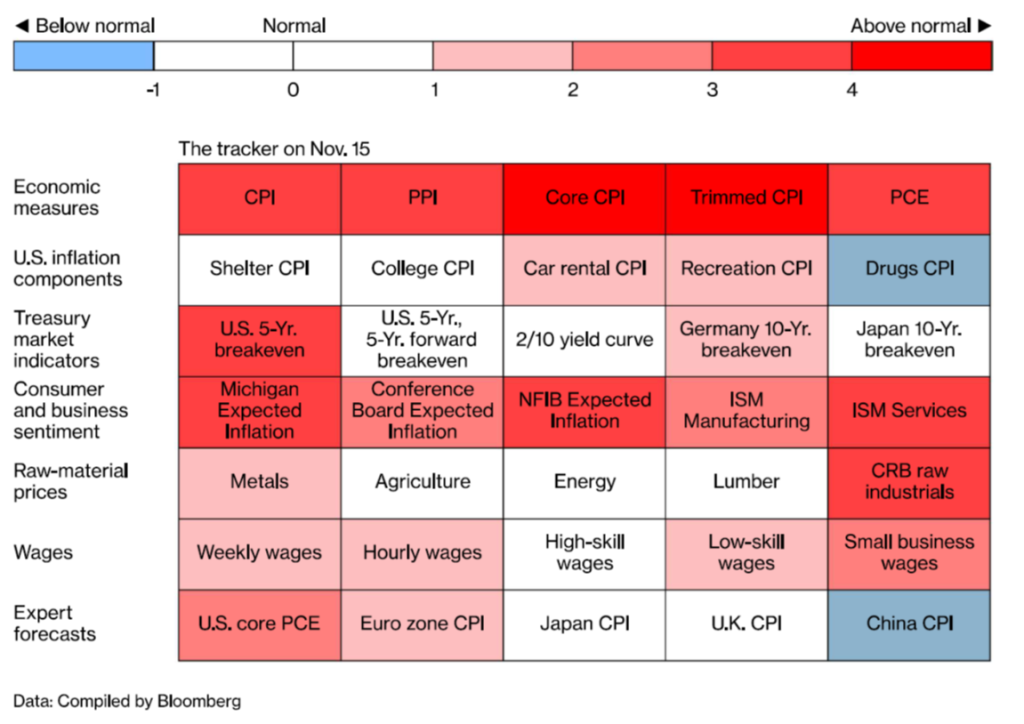

The second presents similar data, in a different way, but with the same conclusion. Prices, wages, raw material prices, etc. are all experiencing well above normal price or rate increases.

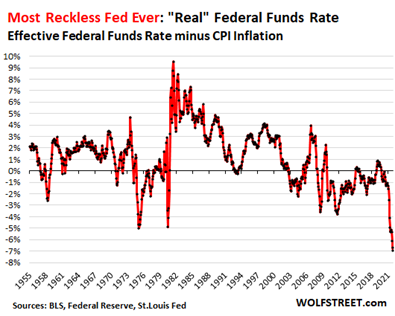

Perhaps the Fed mandate to promote maximum employment, stable prices, and moderate long-term interest rates is asking too much, as Jerome Powell and his predecessors are not Houdinis, and 2022 is most certainly not 1982, when the Fed Funds rate was 14.2% (that is not a typo), and “Quantitative Easing” (significant asset buying) was not in the lexicon. Today we have this unique situation where the Fed Funds rate is something like 0.08% and the Consumer Price Index over 7.0%, resulting in an inflation-adjusted, effective Fed Funds Rate of negative 6.96%, something never seen previously.

So, what is the Fed to do? Somewhere in the back of my mind, I am now hearing the Naked Eyes song from 1983 (no coincidence, perhaps), “Promises, Promises,” because just last week, the Fed announced that they will “tighten monetary policy” at a much faster pace than thought a month ago. Median forecasts are for the Fed to raise interest rates three times in 2022, starting in March, to 0.75-1.00% by year end, up from the two hikes forecast in December. We shall see.

What is interesting is that when the Fed made its last announcement and plans for two rate hikes in 2022, the markets essentially yawned. But not this time. If I have one other concern is if inflation, like everything else these days, becomes “politicized,” and blame for higher prices is placed on “greedy” corporations or “rigged” markets, instead of other obvious factors, like supply chain disruptions, pent-up demand, and the Fed’s money-printing ways. We should all be very wary of those calling for “price controls” as a policy response, because we must remember our economic history, like President Nixon’s predictably ill-fated efforts to freeze wages and prices back in the early 1970’s.

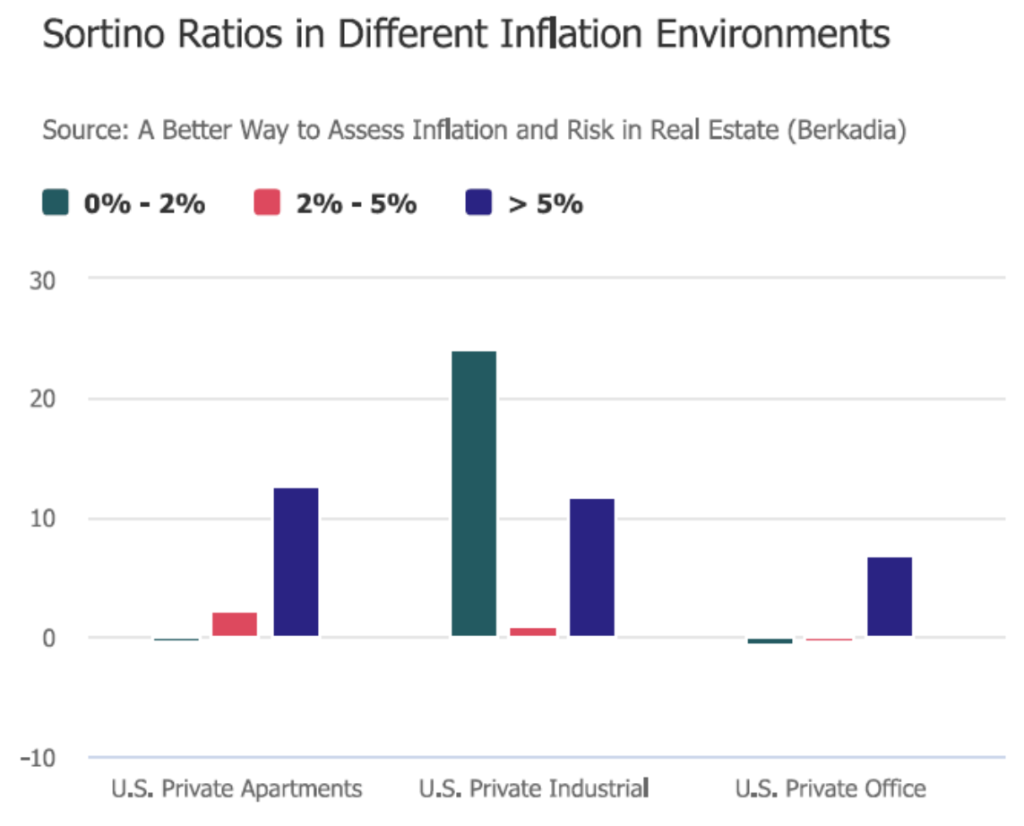

Because all this inflation talk can be fear-invoking and sobering, I would like to put one positive spin on the data, relating it back to what we do for a living. Thankfully, real estate has historically proven to be a good inflation hedge, something I wrote at length about in the August edition of our Clear Insights newsletter. Perhaps not surprisingly, those classes of real estate assets in which landlords are able to adjust rental rates more quickly in response to inflationary pressures do well. Historical data indicates that multifamily and industrial assets fare best in these environments, perhaps explaining, in part, their outsized performance in recent years.

In any event, higher inflation rates and a less accommodative Fed will act as significant headwinds to financial markets this year, and while multifamily investments will benefit from higher mortgage rates, making homes less affordable, these higher rates will impact asset underwriting and both purchase and projected exit cap rates.

While the employment picture has certainly brightened, folks are quitting their jobs in record numbers and who can blame them?

In one week, I read several articles which really captured what is happening in the job market. One was “The Great Resignation,” describing the record number of people, especially the young, leaving in their jobs due to everything from low wages, poor treatment, COVID, and new professional or personal opportunitites (e.g., education, cryptocurrency/NFT trading). As of year end, there were some 12 million job openings (including several openings at Clear Capital), as compared to about 7.5 million unemployed. In 2021, some 4.4 million left the workforce.

Another article that crossed my desk (or desktop) was “Companies Plan Hefty Raises for Workers.” While labor strikes at John Deere and Kelloggs were settled in November, the settlement terms spoke volumes. The Illinois manufacturer’s United Auto Workers voted in favor a new six-year agreement that included an $8,500 signing bonus and a ten percent wage increase, along with enhanced retirement and performance benefits. And then in following weeks, I read about strikes involving the Seattle Carpenter’s union, certain Denver-area grocery store workers, and some 17,000 BNSF Railroad employees. From Wall Street to Main Street, from London to Berlin to Los Angeles, wages are headed higher.

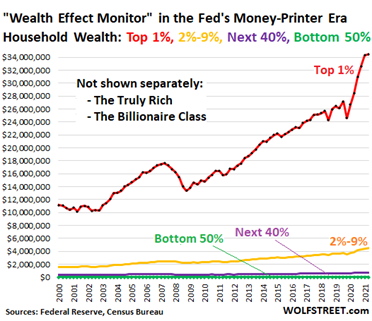

In the face of increases in food, energy, and housing prices, it is a necessity, and from my view, about time. I have long written about expanding wealth inequality and its perverse consequences. The graph below tells the story, and how we need to return to something more balanced when it comes to household wealth.

On the public policy front, there are just a couple newsworthy items from the fourth quarter

Somehow, some way, politicians here and everywhere provide fodder for these quarterly diatribes, usually suggesting, proposing, or implementing harebrained or shortsighted salves to address longer-term systemic issues. Here are a couple from the fourth quarter that fit the description:

- For all units subject to rent control (about 650,000 units, three quarters of housing stock), the city of Los Angeles decided to freeze residential rents until 2023. Yes, you read that right. No rent increases until 2023, decided upon at the end of 2021. How can this be sound economic policy, let alone Constitutional? Perhaps it was this story juxtaposed against another that broke on the same day that really got my goat, where a local anti-growth group is seeking to block a separate proposed housing plan by the city, which would allow for greater housing density and potentially add 500,000 units to the rental stock. What developer in their right mind would want to develop units in a city which is incessantly trying to rein in higher rents through price controls?

- From Los Angeles to the White House, from New Zealand to Ireland, politicians are mulling or implementing restrictions on who can purchase a home or adding taxes and fees to address housing affordability. Los Angeles City Council is supposedly considering a proposal that would not allow entities (e.g., corporations, limited liability companies) to purchase single-family homes, a completely impractical, if not unconstitutional policy. During the fourth quarter, New Zealand passed legislation eliminating certain tax breaks for property owners and investors and Ireland implemented a 10% tax on bulk buying of homes, which represent less than two percent of transactions.

None of these policies will meaningfully impact housing prices or rents. In this prediction, I feel pretty darn confident.

And despite this memo’s length, I will end with just a couple quick tidbits from the quarter that I found interesting or noteworthy

- By admission, I am always a late adopter when it comes to technology, and while I have an iPhone, I won’t tell you which model I own other than it is a few iterations behind. Anyhow, during the quarter, I read that Ukraine (of all places), may allow for Non-Fungible Tokens (NFTs) to signal proof ownership for certain financial assets or transactions, including the exchange of real property deeds, bypassing traditional intermediaries. I have always found title insurance and the entire recording process for deeds and real estate ownership to be inefficient, cumbersome, and excessively costly. I don’t know whether technology and real estate will finally meet, as they have been reluctant bedfellows. We shall see.

- In response to supply chain bottlenecks, CEOs are rethinking their global production playbooks, which could result in greater onshoring of manufacturing and distribution activities. If such comes to pass, the industrial market will receive another shot in the arm. Industrial rental rates have already doubled in the last 24 months.

In closing, I can’t say I am altogether unhappy to see 2021 in the rearview mirror, though the way 2022 has started, I am already longing for the good old days…all the way back to December. While I am a perpetual optimist, I am not one to simply don rose-colored glasses because my VSP insurance covers their cost. 2022 will likely present challenges, if just because higher inflation, a less accommodative Fed, the lingering pandemic, and the midterm elections increase uncertainty and present tailwinds. And let’s be candid. Financial and real estate markets have performed so well for so long, more modest expectations and returns ought to be in the cards regarldess.

What this means for Clear Capital is simple. We will have to be especially mindful and critical when underwriting potential acquisitions, stress-testing key assumptions and what-if scenarios. We will likely monetize certain assets in certain markets, where we have realized projected returns and see limited upside, perhaps entering new markets as we remember hockey great Wayne Gretzky’s simple message, that success is figuring out where the puck is going and not where it has been.

Finally, and as always, thank you. Thank you to our investors, partners, vendors, employees, friends, and the entire Clear Capital and Clarion Management teams for their support and extraordinary efforts during a challenging year. I remain grateful and feel very fortunate to work alongside such a talented and dedicated group of individuals.

Best,

Eric Sussman